Global environment issues, public debt crises, and other persistent problems of human society must be considered in the long term, and thus are not conducive to thinking under a market time frame. These problems must be considered as intergenerational problems. This article will take up the two perspectives used when addressing intergenerational problems in economic theory: the problem of time inconsistency and intergenerational altruism.

♦ ♦ ♦

One of the difficulties inherent in intergenerational problems is the inevitability of the problem of time inconsistency, i.e., promises made in youth are not honored in old age. However, it is also a fact that intergenerational problems, which are repeated from one generation to the next, can be solved using the "repeated games" structure.

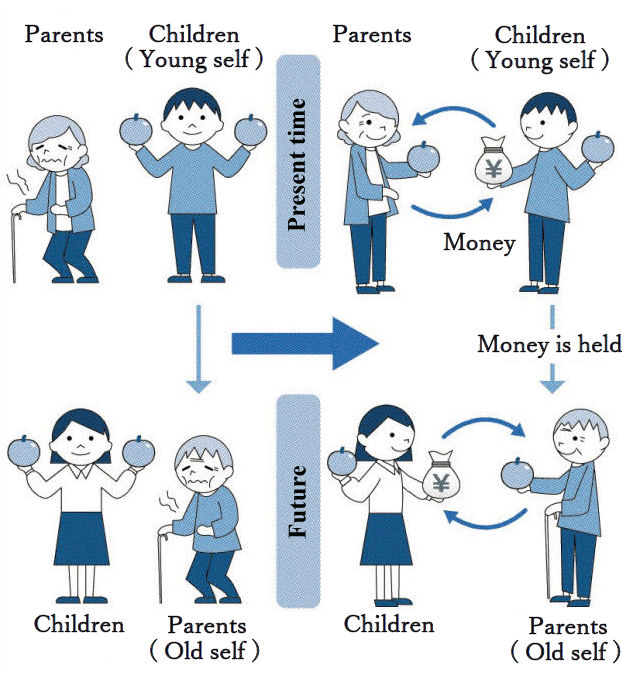

A typical intergenerational problem with a repeating structure is the problem of whether adult children will support their parents. Supporting one's parents cost money, and self-centered children will not want to do so. However, when they grow older, they will want to be supported by their own children. In a natural society with no developed social systems, the younger generation will not support its parents, and the elderly can only expect a miserable life in their old age.

U.S. economist Paul Samuelson, in his 1958 paper, argued that through the issuance of money as an implicit social contract, each generation has come to voluntarily support its parents. The parent generation pays the money, which it acquired, to the offspring generation as consideration for being supported in old age. The offspring generation receives such money and pays it to successive generations as consideration for being supported when it grows old. Support of the elderly is ensured by transferring money from one generation to the next (See Figure). Modern society actually follows this mechanism.

As a theory that generalizes Samuelson's money, Boston University Professor Laurence J. Kotlikoff and Swedish economists Torsten Persson and Lars E.O. Svensson, in their 1988 paper, claimed that even without money, by transferring certain social contracts as assets from one generation to another, the problem of time inconsistency could be solved.

This is a social contract which ensures that each generation will not break the (taxation policy) promise which it made in its youth when it grows older. The social contract has the value Q: if the elderly honors the promise, he/she will receive consideration Q from the young generation. The elderly will honor the promise because if it is not honored, the social contract would collapse and the value Q would be lost. And this social contract continues throughout successive generations.

♦ ♦ ♦

The overlapping generation model made up of self-serving individuals may solve intergenerational repeated games, but it cannot solve one-time problems. Unprecedented environmental problems and financial collapses are one-time intergenerational problems and thus cannot be prevented by implicit intergenerational contracts.

To solve one-time problems, intergenerational altruism (parental altruism toward one's offspring) must be viewed in macroeconomic models. With intergenerational altruism, the current generation's utility enters the next generation's utility, which will then enter the following generation's utility. Therefore, the macroeconomic model is the same as an infinite duration model comprising a never-ending lineage. While individuals only live for a limited time, economic activities of an altruistic individual who acts while thinking about his/her offspring is equivalent to those of a human being who will live forever.

If this is the case, then the equivalence proposition that fiscal policies and the accumulation of public debt do not impact a country's economy whatsoever will hold true. In other words, even if government debt continues to increase, the current generation with intergenerational altruism, knowing that such debt will be repaid by future generations through tax hikes, will increase their savings, and try to leave an inheritance for their offspring who will be subject to increased taxes. For this reason, even if the government were to carry out fiscal policies to increase debt, it would not have the effect of improving the economy. This is known as the Ricardian equivalence proposition put forth by Robert J. Barro of Harvard University.

However, this applies only when people can leave behind an inheritance. In reality, a gap exists between the rich and the poor, and many people will not be able to leave behind a sufficient inheritance and the adverse effects of ballooning government debt will not be eliminated. Therefore, in reality, fiscal policies and government debt cannot be said to be neutral in terms of the economy.

The problem of endogenous altruism, which claims that intergenerational altruism is determined by an individual's experience (e.g., education, child rearing), was taken up in a 1997 work of University of Chicago Professor Casey B. Mulligan. While Mulligan's main purpose was to explain the widening economic inequality between families, a 2003 paper by Paris School of Economics Professor Hillel Rapoport and Jean-Pierre Vidal of the European Central Bank, which applied Mulligan's theory to the theory of economic growth, demonstrated that parental altruism toward a child was largely impacted by economic growth.

In economies where capital wealth has yet to be accumulated such as pre-Industrial Revolution Europe, the level of intergenerational altruism was low, and the development of endogenous altruism was non-existent. With economic growth and the accumulation of a certain level of wealth, people began to prefer behavior which enhanced altruism, and, as a result, the level of altruism grew significantly nationwide. As altruism directed toward one's offspring grew, it further accelerated the accumulation of capital and enhanced economic growth.

♦ ♦ ♦

These theories assume that people choose their own types of altruism when they grow up. However, in the real world, it is generally a case of adults molding the children's altruism into a form, which they have determined, through the education of children by adults such as parents and teachers.

The model of education by adults changing children's preferences is commonly seen in family economics. A 2017 paper by Northwestern University Professor Matthias Doepke and Yale University Professor Fabrizio Zilibotti claims that parenting styles such as authoritarian and permissive impact a child's preference. In countries with greater economic inequality, there is a prevalence of authoritarian parents, and in countries with low inequity, a prevalence of more permissive parents.

However, in this study, there is no analysis of changes in the children's intergenerational altruism. The movements in the economy when an endogenous nature is recognized, i.e., when the parent determines a child's intergenerational altruism, is expected to become a crucial research theme going forward.

In Rapoport's model, there is only one channel for economic growth, which is a product of the model's structure in which the amount of inheritance one leaves behind determines one's utility. However, if we assume the type of altruism in which the child's utility becomes a part of the parent's utility, the economy will have two types of equilibria (good equilibrium and bad equilibrium) and which way it will go will be determined by expectations.

In a good equilibrium, the prosperity of one's offspring is expected to give rise to activities that enhance altruism, and a high level of altruism and high economic growth are realized. Meanwhile, in a bad equilibrium, the utility level of one's offspring is expected to be low, reducing investments in activities that nurture altruism, and, as a result, a low level of altruism and low economic growth will ensue. Whether the equilibrium will be beneficial or adverse is determined by future expectations and the initial value of altruism. Because we have the freedom to hold future expectations, we have the freedom to determine our future.

Policies to nurture endogenous altruism are crucial for solving one-time intergenerational problems. If immense costs are expected in the future due to environmental and fiscal crises, the amount of resources to leave behind to our offspring to deal with such crises is determined by the size of the altruism and such altruism is determined by our imagination regarding the future.

* Translated by RIETI.

June 18, 2018 Nihon Keizai Shimbun