Industry-Specific Nominal and Real Effective Exchange Rates of 25 Countries Worldwide

Overview

RIETI started publishing the novel dataset of the industry-specific nominal effective exchange rate (I-NEER) and the industry-specific real effective exchange rate (I-REER) in May 2011 in cooperation with the Center for Economic and Social Studies in Asia (CESSA) of the Department of Economics at Yokohama National University (YNU).

RIETI began releasing the daily and monthly series of I-NEER and I-REER for nine Asian economies from March 2015, and the data for 18 countries started to be published from April 2016 including nine more countries from Europe, North America, and Oceania. Since February 2018, the database availability has been extended to 25 economies worldwide by including additional seven countries from Europe and Oceania.

Asia (nine countries)

Europe, North America and Oceania (nine countries)

Europe and Oceania (seven countries)

* Click on the figures to enlarge

Monthly data: Updated at the beginning of each month

Daily data: Updated every day

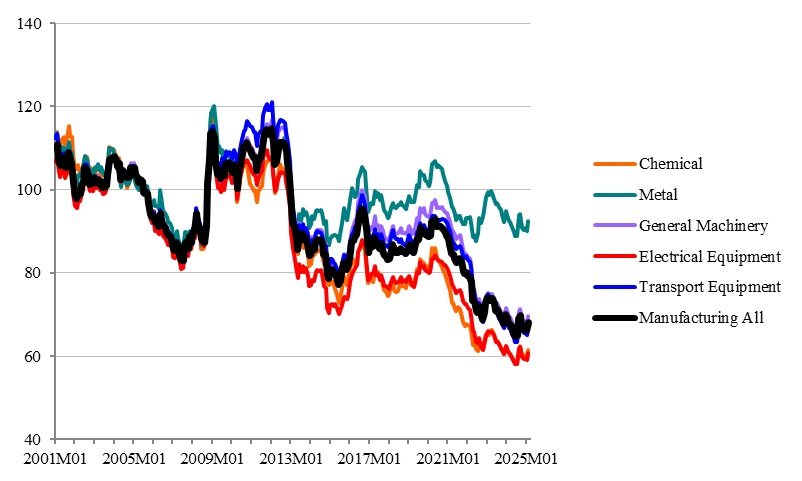

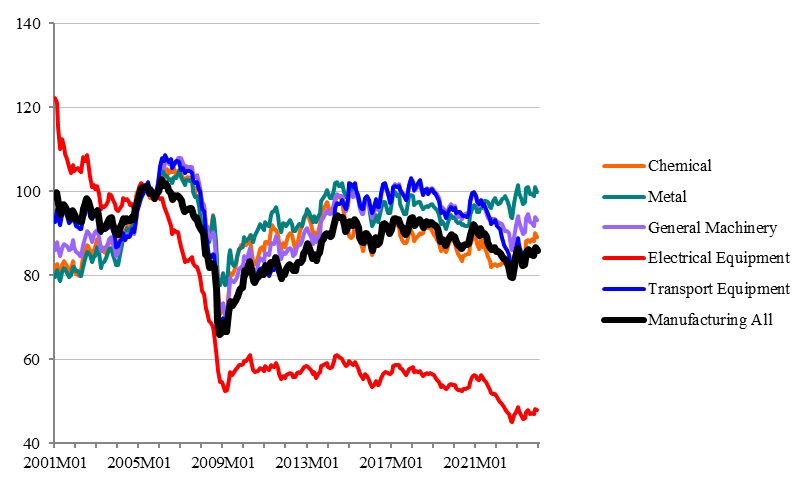

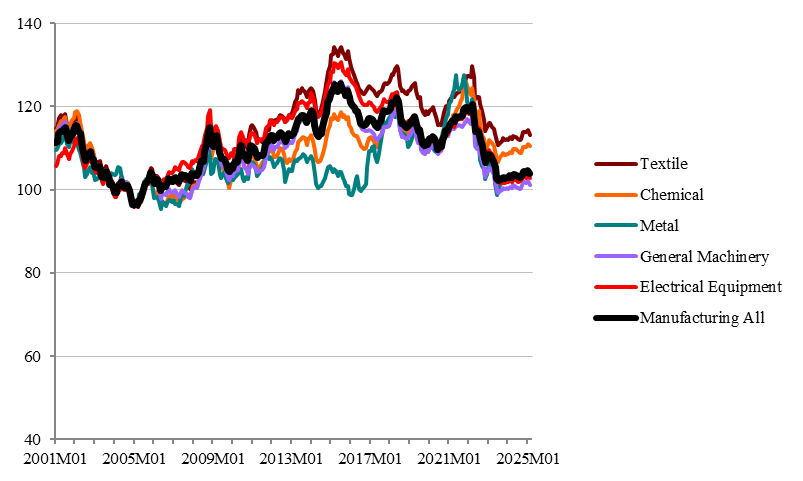

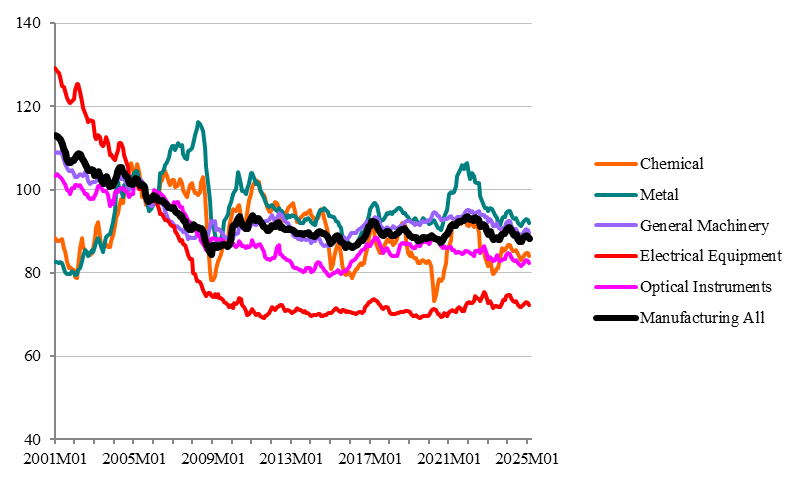

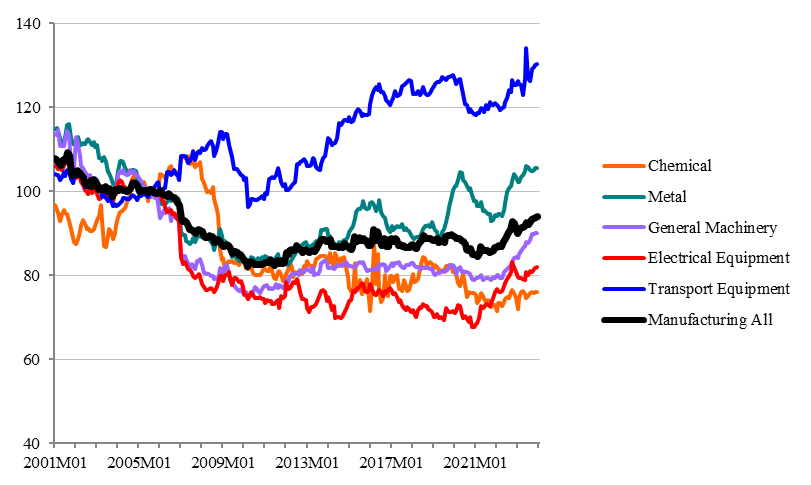

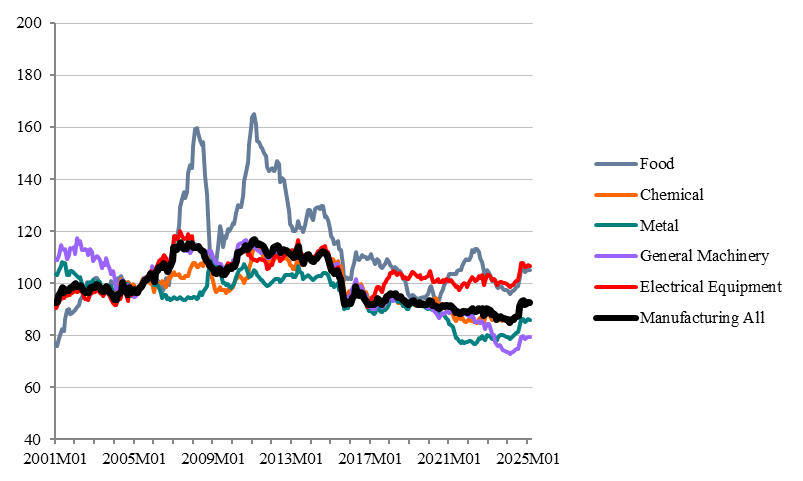

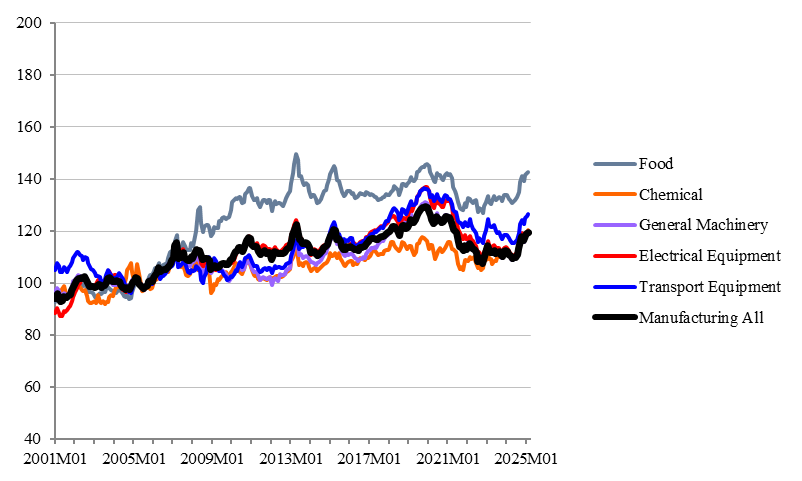

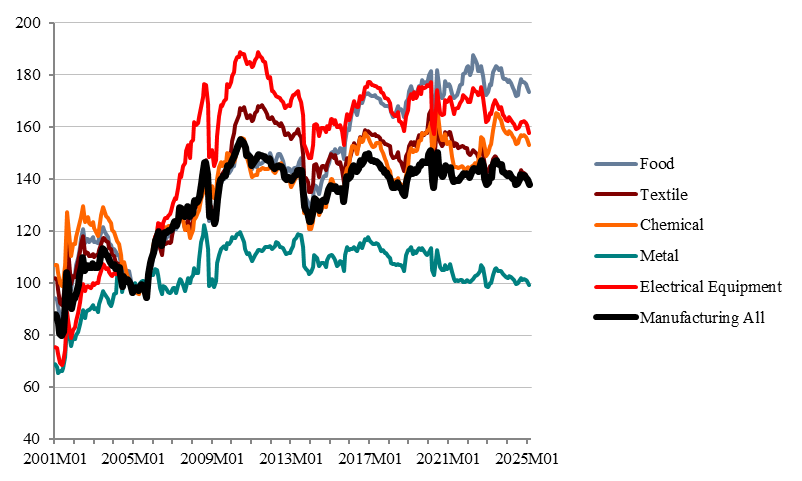

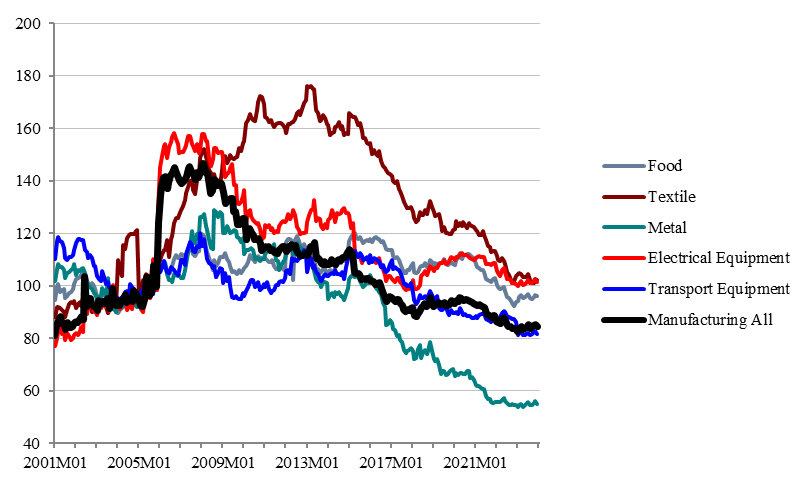

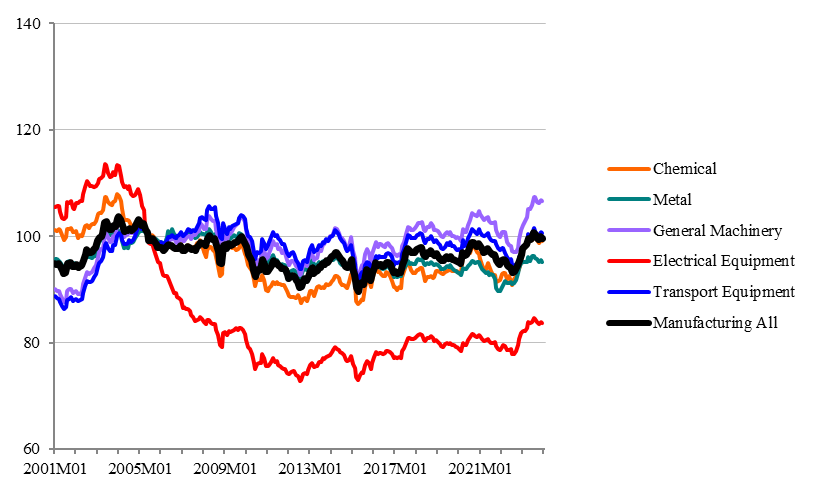

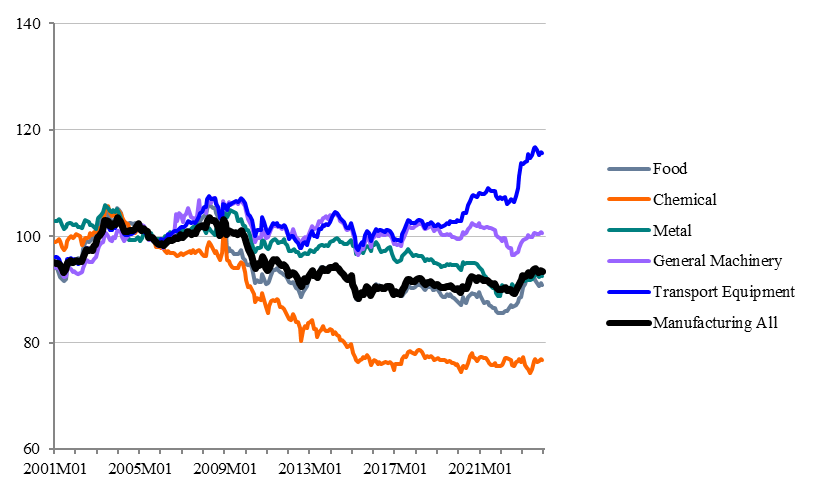

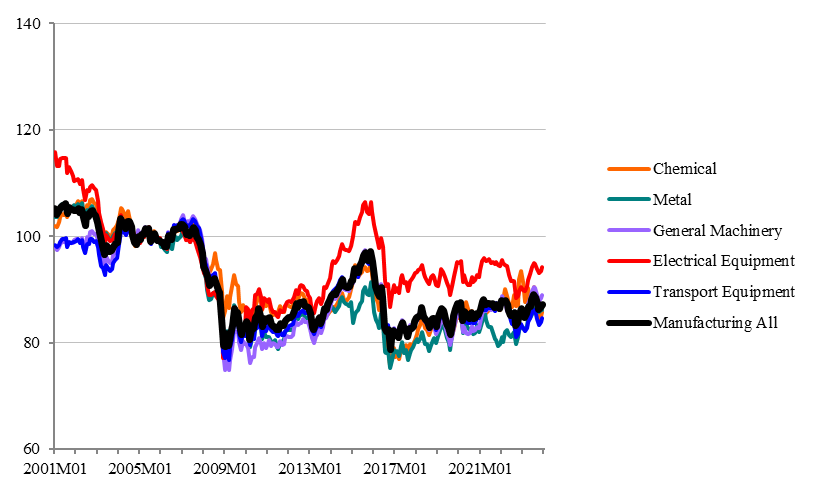

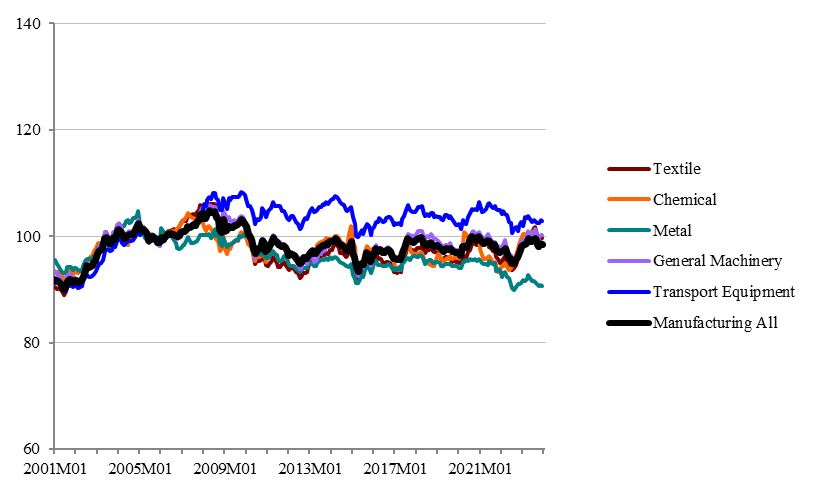

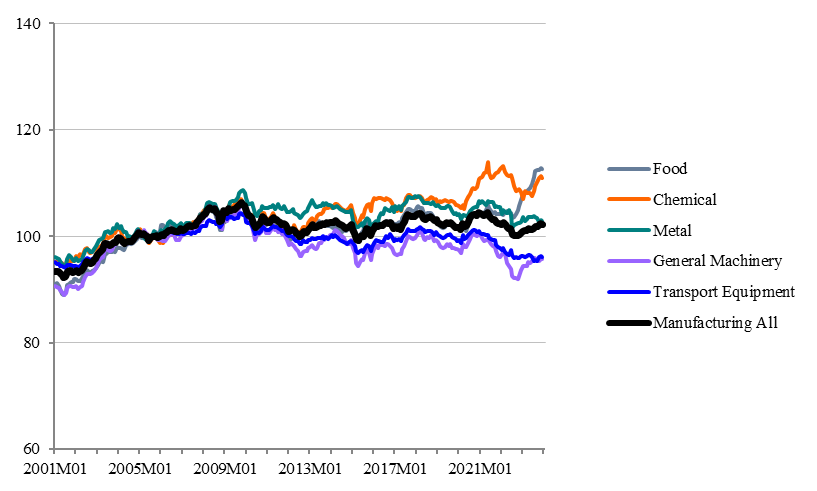

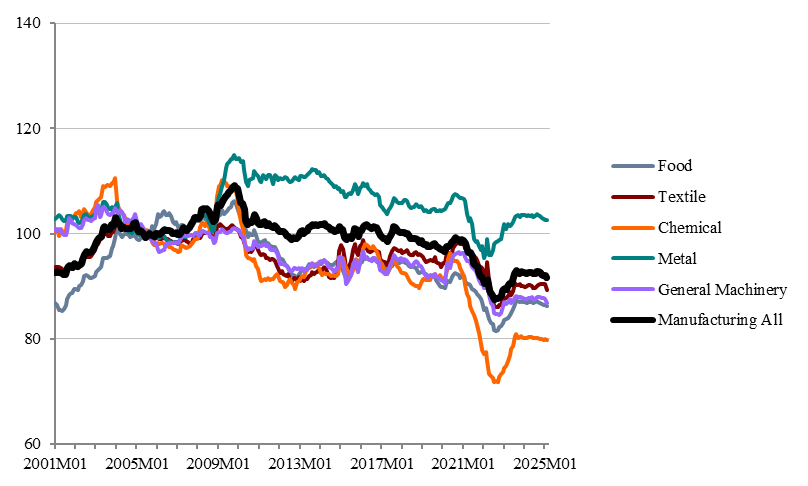

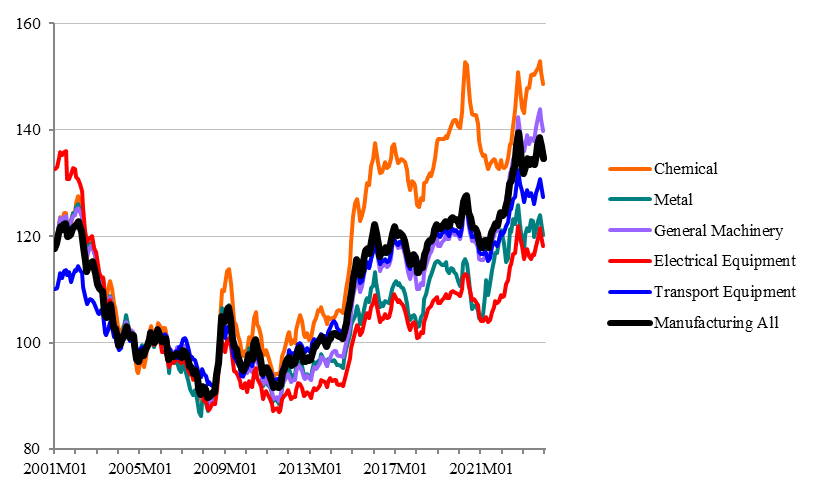

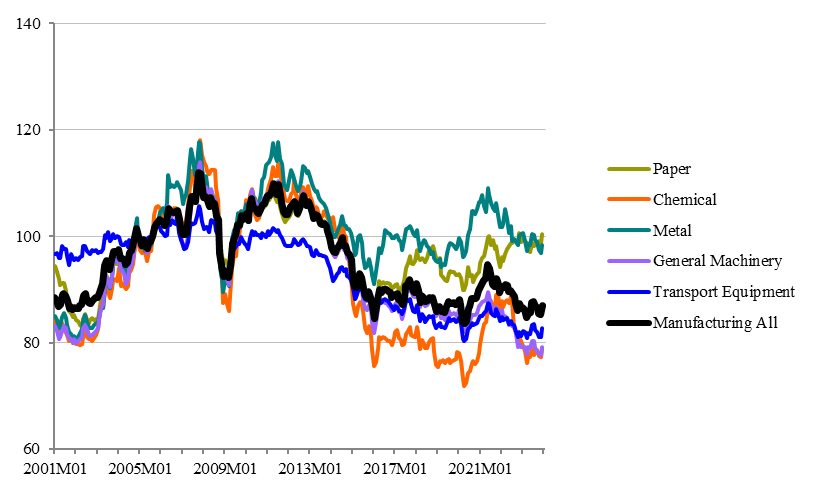

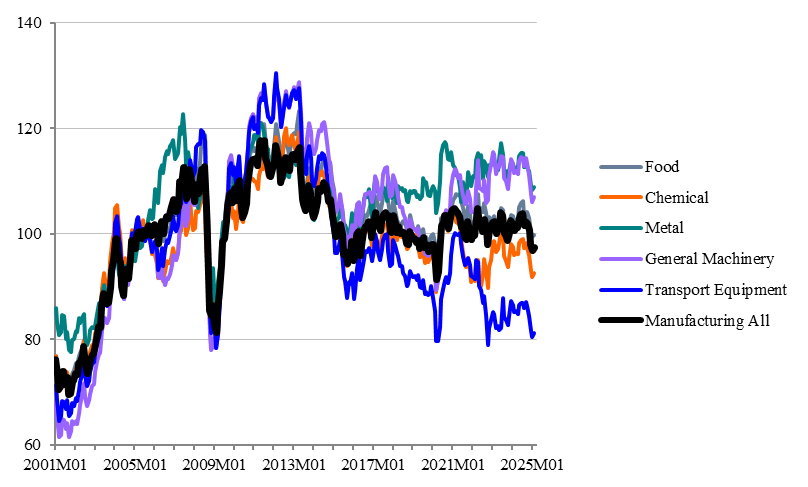

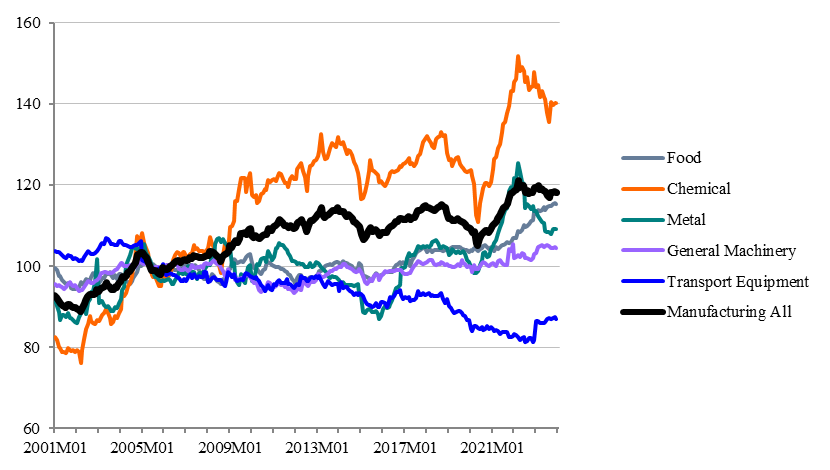

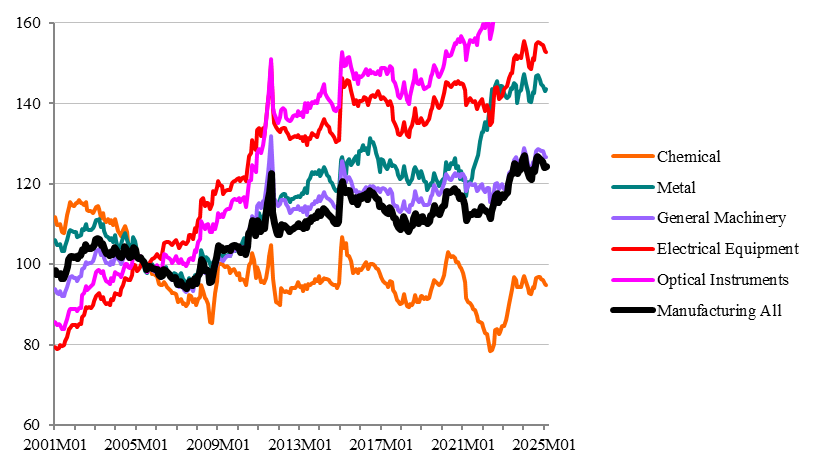

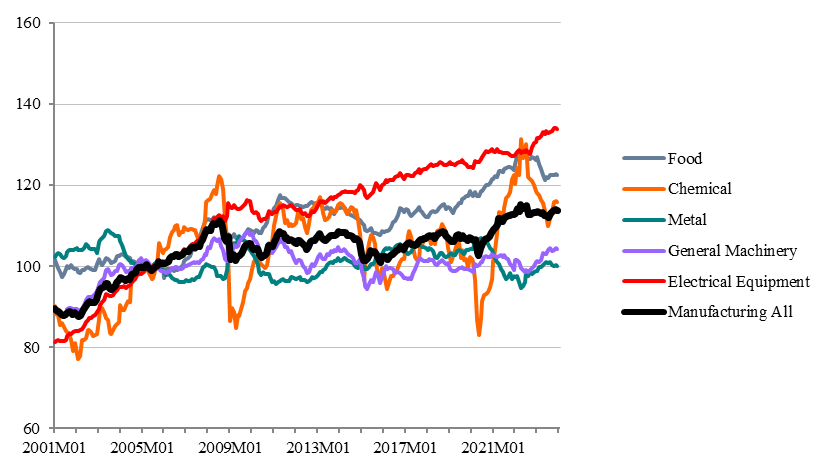

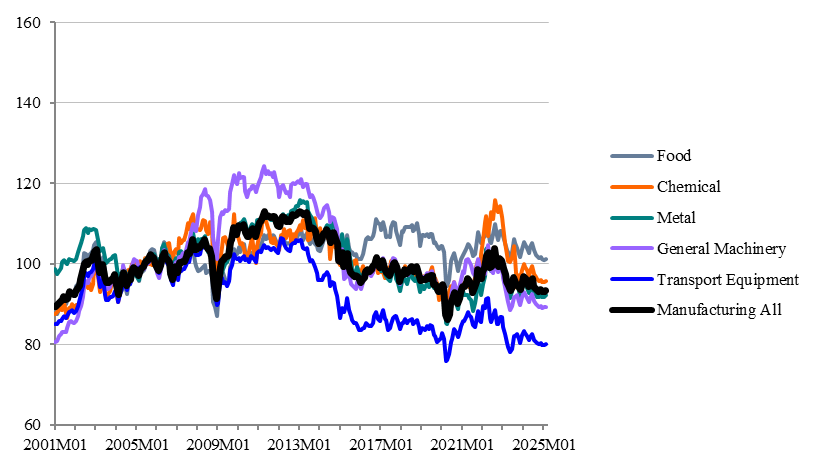

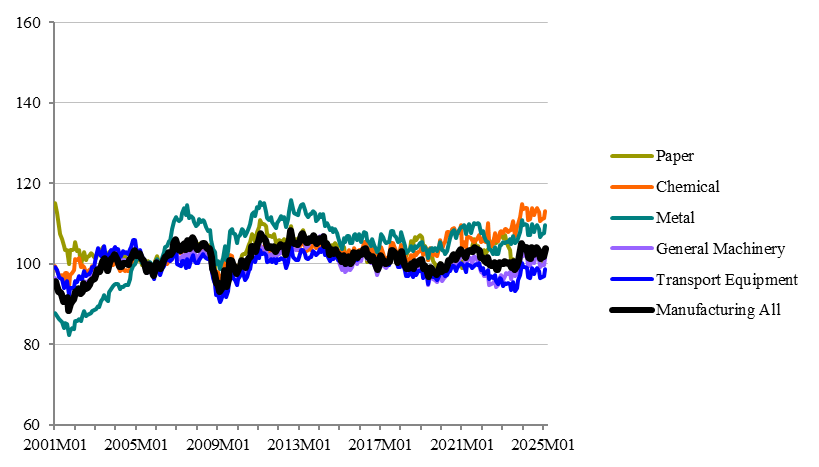

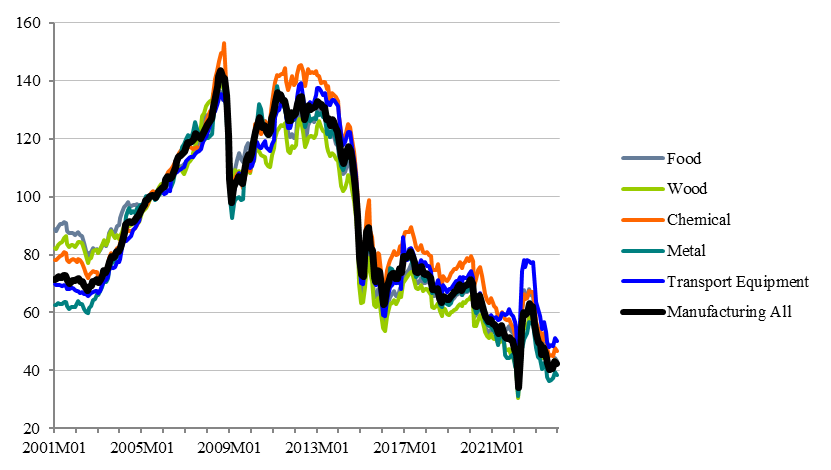

Data Description

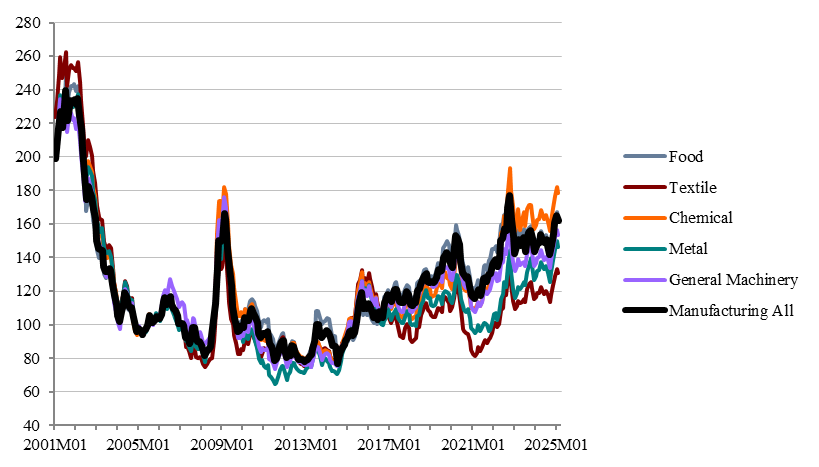

The novelty of this database is to construct the I-REER using the industry-specific producer price indices of major economies in Asia, North America, Europe, and Oceania. The real effective exchange rate (REER) is typically used as a good measurement for the export price competitiveness of the country in question, however, the export price competitiveness can differ across industries. For instance, the export price competitiveness of the electric machinery industry (e.g., electronic components) clearly differs from that of the transport equipment industry (e.g., automobiles). Sato, Shimizu, Shrestha and Zhang (2013) analyzed the I-REER of Japan and Korea to compare the export price competitiveness of the above two industries between both countries.

Moreover, the weighted average of I-REERs (henceforth, Avg-I-REER) is also a useful measurement for the export price competitiveness of the country in question. Sato, Shimizu, Shrestha and Zhang (2015) examined how Avg-I-REER moves differently from the REER published by Bank for International Settlements (BIS). It is found that in five out of nine Asian economies, the Avg-I-REER exhibits very different movements from the BIS-REER. The result of panel estimation also shows that the appreciation of Avg-I-REER has negative and significant effect on real exports, while the appreciation of BIS-REER does not cause a significantly negative impact on real exports.

In addition, the yen-U.S. dollar exchange rate often appreciates or depreciates to a large extent only within several days. The monthly series of the exchange rate data cannot show such a short-run change within a month. Given that Japanese exporting firms face severe competition in the global markets, it has become increasingly important to monitor the daily fluctuations of the yen even on an effective basis. Thus, both monthly and daily series of I-NEER and I-REER figures are published on this website.

The database is constructed by Professor Kiyotaka Sato (YNU), Professor Junko Shimizu (Gakushuin University), Associate Professor Nagendra Shrestha (YNU), and Dr. Shajuan Zhang (YNU).

The details of the data construction and other necessary information are presented and discussed in Sato, Shimizu, Shrestha and Zhang (2013, 2015). Also, see supplementary information [PDF:635KB] for industry weights and industry-specific partner country's trade weights. When using this database, please cite both the RIETI website as the data source and the following two papers for acknowledgement.

- Sato, Kiyotaka, Junko Shimizu, Nagendra Shrestha and Shajuan Zhang, 2013, "Industry-specific Real Effective Exchange Rates and Export Price Competitiveness: The Cases of Japan, China and Korea," Asian Economic Policy Review, 8(2), pp.298-321.

- Sato, Kiyotaka, Junko Shimizu, Nagendra Shrestha and Shajuan Zhang, 2015, "Industry-specific Real Effective Exchange Rates in Asia," RIETI Discussion Paper, 15-E-036.