For Japan, where the government's debt is growing progressively, the events in Greece are not a "fire on the other side of the river" as its fiscal health could take a direct hit from an increase in the interest rates on Japanese government bonds (JGBs). At the moment, however, JGB interest rates are stabilizing at low levels. This is largely attributable to the effects of the Bank of Japan (BOJ)'s massive quantitative and qualitative easing (QQE).

Specifically, the BOJ has been purchasing long-term government bonds from the private sector to expand the monetary base by 80 trillion yen per year with an aim to achieve its inflation target of 2%. The monetary base can be measured in terms of the quantity of (narrowly defined) money supplied by the BOJ to the market. Currently, the BOJ is issuing money at a rapid pace.

Thus, we can see the QQE as a scheme that brings financial gain to the government and the BOJ in two ways. In addition to suppressing a rise in the debt servicing costs by lowering interest rates, certain financial gain can be realized by increasing the money supply. The latter is called "seigniorage." Some people argue that the government can rebuild its finances by using seigniorage. Is this possible? To conclude first, it is quite difficult to make it happen without causing pain.

♦ ♦ ♦

A simple way to understand seigniorage is to see it as the quantity of newly issued money. In this case, it is defined as an increase in the monetary base (Definition (1)).

We can also see it in a different way. When a central bank issues money, it purchases assets such as government bonds with the proceeds. Such purchased assets generate revenue typically in the form of interest income, but the monetary base does not. Since the central bank is capable of procuring interest-free funds (printing money), any amount saved by not paying the cost of financing--i.e., prevailing interest rate × monetary base (Definition (2))--can be considered as seigniorage. This is the definition used by the BOJ. Accordingly, any financial gain from seigniorage, whether in the form of interest income or else, is transferred to the government coffers.

How can we consider those two different definitions? One way to understand this is to attribute the difference in the definitions to the variation in the timing of recognition of such financial gain as revenue.

For instance, suppose that the central bank issued money with a total value of 10 billion yen and purchased an equal amount worth of government bonds. If the yield on the government bonds is 1%, the central bank will receive one million yen in interest income for the current year and continue to do so for each subsequent year. Although I do not give detailed calculations here, the amount of increase in the monetary base is actually equal to the present value of future interest income. Based on this line of thinking, the difference between Definitions (1) and (2) boils down to the question of whether the financial gain from an increase in the monetary base is to be recognized immediately as revenue for the current year (Definition (1)) or incrementally over the period of the time to maturity (Definition (2)).

Another way to understand the difference between the two definitions is to attribute it to how we define the "scope" of government debt. If we take the stance that a central bank is part of the government in an ultimate sense, there should be a consolidated balance sheet of the "integrated government" that combines the government (as generally defined) and the BOJ. If we consider the money issued by the central bank as its liability (government debt) to the private sector, the liabilities section of the integrated government's balance sheet is composed mainly of JGBs held by the private sector and the monetary base.

Here, if the central bank increases the monetary base and buys government bonds from the private sector, the amount of government bonds (held by the private sector) recorded in the liabilities section can be reduced. In this case, the government bonds are an interest-bearing liability whereas the monetary base is a non-interest-bearing liability, hence, the amount of seigniorage is that which is saved by not paying the cost of financing (Definition (2)). On the other hand, if we consider the monetary base not as a liability but as something that does not need to be repaid (reduced), the amount of increase in the monetary base (Definition (1)) is the amount of seigniorage.

A notion similar to seigniorage is "inflation tax," which is financial gain to the government resulting from inflation and calculated as: inflation rate × monetary base (Definition (3)). Liabilities are recognized at nominal value, which does not take into account inflation. Thus, when inflation occurs and liabilities are reduced in real value terms, the amount of decrease is financial gain to the government.

Let us now consider the BOJ's current QQE in terms of its seigniorage effect. If we take Definition (1), the amount that should be recognized as revenue from seigniorage is 80 trillion yen. However, the BOJ will eventually have to implement an exit strategy from the QQE. At some point in the future, it will halt and reverse the expansion of the monetary base by selling government bonds or having them redeemed. In this case, the amount recognized as revenue from seigniorage should be based on Definition (2).

Even if the BOJ were to follow Definition (1) and recognize 80 trillion yen as revenue from seigniorge for the current fiscal year, it would have to recognize losses somewhere down the road when it executes an exit strategy and reduces the monetary base. We must keep in mind that not all of the increase in the monetary base is revenue to the government because the monetary base is, at least in part, a liability in nature.

The BOJ posted 579.4 billion yen in revenue from seigniorage for FY2013 (April 2013 through March 2014) and 756.7 billion yen for FY2014. Currently, the BOJ pays a 0.1% rate of interest on reserve balances held by commercial banks in their current accounts at the central bank, meaning that increasing the monetary base incurs a certain amount of cost. Yields on government bonds, which constitute the largest part of assets held by the BOJ, are on a downward trend due to strong demand driven by its massive purchases. As such, the BOJ has nearly used up its capacity for increasing seigniorage through monetary easing.

♦ ♦ ♦

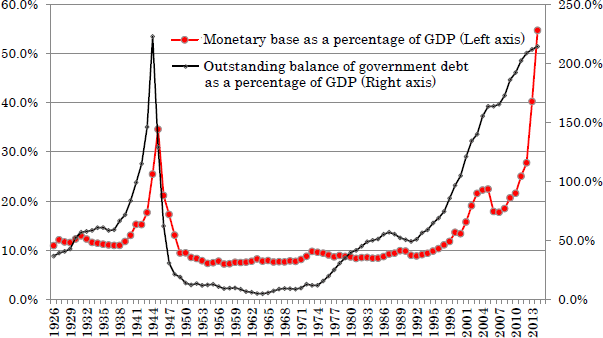

What lessons can we learn from past episodes of excessive monetary easing? Figure 1 shows how the outstanding balance of government debt and the monetary base, measured as a percentage of the gross domestic product (GDP), changed over time. The current situation resembles that during World War II. When we focus on the wartime and postwar periods, we can see that the outstanding balance of government debt dropped sharply after peaking in 1945. Postwar hyperinflation was one big factor behind the plunge. But we can also see it as an indication that massive amounts of seigniorage and inflation tax had been recognized in the period toward the end of the war. With Japan's deficits rising to a critical level, the monetary base was growing rapidly, and it is highly likely that people believed that there would be no reversing that trend.

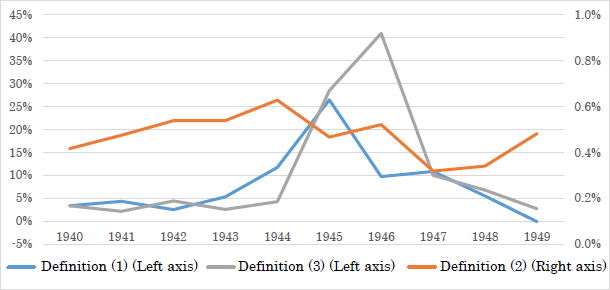

Is it possible to restore fiscal health with seigniorage? Shown in Figure 2 are changes in seigniorage (measured as a percentage of GDP) during the wartime and postwar periods, as estimated by Takahiro Hattori of Nomura Securities Co., Ltd. and myself. First, we should take note that seigniorage based on Definition (2) did not increase. This is mainly due to government interference such as "financial repression," which artificially suppressed nominal rates from rising despite ever-mounting fiscal deficits.

On the other hand, seigniorage based on Definitions (1) and (3) increased significantly. If we assume that the monetary base, once increased, will not be decreased, the entire amount of increase is considered seigniorage. Furthermore, if an increase in the monetary base is accompanied by high inflation, the government's debt will shrink in real terms.

If the government manages to control inflation while increasing the monetary base permanently, the government bonds held by the private sector will decrease in value. However, history shows that a permanent increase in the monetary base combined with mounting government debt is often a recipe for eventual hyperinflation.

According to New York University Professor Thomas J. Sargent, a winner of the 2011 Nobel Prize in Economics, countries that experienced hyperinflation were, in many cases, running huge fiscal deficits. When a government relies on and eventually becomes unable to restrain the issue of banknotes for keeping the public finance going, hyperinflation is on the way.

♦ ♦ ♦

Our estimates shows that in Japan, the cumulative amount of seigniorage for the period 1945-1948 reached 52.5% of GDP based on Definition (1) and 86.2% based on Definition (3). Obviously, the Japanese people at the time were forced to suffer enormous losses in the form of impairment of assets resulting from hyperinflation. Seigniorage or inflation tax might solve the current problem of government debt, but it would be meaningless if such solution comes only at the cost of enormous burdens on the general public.

Fiscal reconstruction by means of seigniorage or inflation tax is just another form of tax-increasing policy, which is unfair to households that are ill-equipped to guard against the impact of sudden hyperinflation. Seigniorage is not a lucky mallet that can tap out anything we ask for. The government and ruling parties must work earnestly and steadfastly to carry out fiscal and social security reform.

* Translated by RIETI.

August 31, 2015 Nihon Keizai Shimbun