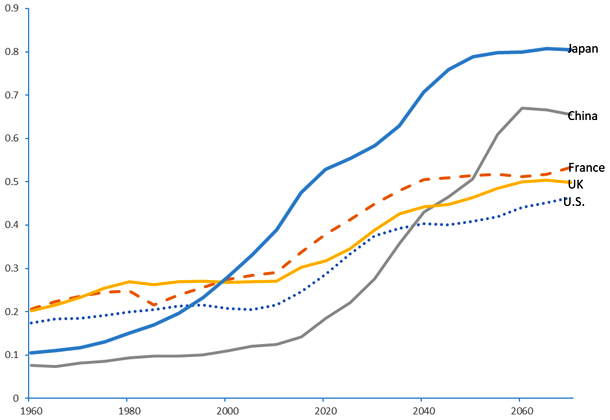

The fiscal tightening resulting from the low birthrate and the aging population and the steady increase in social security spending will continue for several decades and has become an issue that needs to be addressed from a long-term vision. Detailed inspections of government spending and review of tax items at the yearly fiscal soundness discussions are extremely important. However, such discussions are clearly not keeping up with the massive scale and the rapid speed of the aging of the population (See Figure). The key to regaining fiscal discipline will be the increase in household income underpinned by improved productivity and social security reforms that will reinforce such channels. This article will discuss policies to ensure medium- to long-term growth and fiscal soundness.

♦ ♦ ♦

While the eligibility age (65 years old) for national pension benefits in Japan has not changed since the universal pension was first adopted in 1961, the average duration of receiving benefits has increased from three years to approximately 20 years in conjunction with the continuing rise in average life expectancy. The burden of continuing the national pension plan continues to grow, and employee pension premiums on earnings, which are paid equally by employers and employees, rose from 3.5% in 1961 to 18.3%. With the addition of medical and nursing care expenses, there is little room for the working population to bear any additional fiscal burden.

One alternative would be to gradually raise the standard benefits eligibility age to 70, and to provide an option for beneficiaries to wait until age 75 to 80 to receive benefits. At the same time, discriminatory employment practices based on age including the institution of mandatory retirement would be prohibited and reforms to encourage employment mobility should be promoted. This is not a discussion about the amount of benefits paid to existing retirees but a recommendation about the future of social security and the employment environment facing the young and future generations.

The important thing is to promptly indicate a clear path and provide individuals and companies with ample time for preparation and adjustments. For example, let us assume that the eligibility age will be raised in stages over 10 to 15 years from 2020. The pros and cons of such a policy change should be determined by the generation that will face the trade-off, i.e., the working population and the younger generation who will actually be subject to changes in their eligibility ages. According to various surveys, the working population is doubtful about the sustainability of the pension plan and incorporates the reduction in the amount of benefits. By indicating a clear path, uncertainty will be alleviated, which, in turn, will lead to appropriate consumption and investment plans.

At the core of economic activities is the trade-off surrounding limited resources, and without clarifying this, any discussion on policy would be futile and fundamentally wrong. We should present the whole picture, i.e., by raising the eligibility age to Y in year X, the net burden for each generation will increase/decrease by Z, and the macroeconomic environment will change in such a way. And then ask the people to make a choice.

In my research, I have found that the level of satisfaction of future generations will rise through improved productivity and the mitigation of distributions in economic activities through the reduction of long-term burden. Raising the pension benefits eligibility age has also been shown to enhance the elderly's willingness to work.

On the other hand, whether income can be secured until the pension eligibility age is also crucial. It makes a world of difference if you are able to work comfortably until the eligibility age of 70 and transition into a pensioner, or if you have no employment prospects after retirement and are forced to whittle away at your savings. We must ensure the availability of employment opportunities while carrying out reforms. Reforms to build an employment environment that will allow the elderly to be self-reliant and to eliminate factors that could discourage their willingness to work will be indispensable. Otherwise, benefits could swell to even greater proportions in the form of welfare and other transfer payments.

♦ ♦ ♦

Not only increasing the number of employed but also maximizing the skills of each worker is essential. Getting a right job that aligns with the changes in one's life stage, health, and preferences will enhance productivity and make effective use of precious labor resources.

The employment style which begins with the mass hiring of new graduates and proceeds with a rigid wage structure under the seniority system, where workers remain until retirement followed by a long retirement life living off of one's pension, is incongruous with changes in the demographic structure, the technological environment, and the fiscal situation. Companies responsible for paying wages that do not necessarily match productivity on the grounds of seniority will lose their competitiveness. By abolishing the mandatory retirement system while simultaneously raising the benefits eligibility age, companies will be able to secure human resources with appropriate skills in a timely fashion, and establish a wage structure commensurate with productivity.

Even when corporate profits increase, a company will think twice about raising wages under a rigid wage structure because there is no guarantee of how long the high profits will last. Since there is much at stake for an employee to step away from lifetime employment, companies are able to retain employees even under a serious labor shortage without raising wages, and there is little rationale for companies to raise wages. Under Japan's traditional employment system, there is no efficient labor market, which is a prerequisite for raising wages through economic stimulus measures and improvements in the economy.

Workers are also not motivated to seek employment that suits their skills or aptitude and loses opportunities for growth. Rather than remaining at an unsuitable job until retirement, workers would enjoy increased lifetime wages by quitting when still young and learning a new skill.

We cannot hope for macroeconomic growth without productivity growth for each individual. While technological advances and high value-added skills change constantly, unless the improvement in the productivity of each worker leads to greater employment opportunities and higher wages, workers could be discouraged from further growth.

In an employment market heavily biased toward new graduates, a worker with enhanced skills can neither measure the market value of his or her productivity nor seek appropriate compensation for his or her labor. The reason for Japan's low rate of entrepreneurship and low level of challenges in new fields compared to other countries may have something to do with the difficulty of seeking an exit when challenges fail under a rigid labor market. If companies were no longer required to commit to (be involved with) employees until retirement, it would make it easier to hire employees based on experience and aptitude, and employment opportunities for a broad range of age groups, including middle-age and older, would expand.

♦ ♦ ♦

Japan's period of rapid economic growth, in which the ratio of the elderly and social insurance contributions were unbelievably low and the labor force continued to grow year after year, is a thing of the past. The 20-64 age group, which was approximately 80 million in 2000, will be halved by 2070. We must stop praying for a re-enactment of the post-war miraculous growth, but instead change the standards by which we measure growth and engage in major structural reforms.

Pre-modern factors that impede efficient allocation of workers and improvement of productivity are also found in the social security system as well. The "standard" household that consists of a husband who works under lifetime employment and a stay-at-home wife with two children is no longer a "standard" household. The rationale and the legitimacy of a system, under which women become a dependent on one's spouse by retiring at marriage or childbirth or by cutting back on working hours and income (category 3 insured person) in order to eliminate the burden of pension, medical insurance, and nursing care insurance premiums, no longer exist.

The government must promptly revise policies that discourage women with skills and willingness to work from working to their heart's content. Even if the bottom of the "M-shaped curve" on a graph of the female labor force participation rate, which appears as a result of women in their 30s refraining from work, has been raised somewhat, the number of regular employees is still in a reverse V-shape.

In a joint study, I simulated fiscal imbalances through the end of the current century under various assumptions. If the female labor participation rate reaches levels comparable to that of men, the decrease in net expenditures will be 2.5% of the gross domestic product (GDP) as of 2040. If the distribution of employment styles including regular and non-regular employees and wages also reach comparable levels, further decreases of 2.7% and 2.5%, respectively, in net expenditures can be expected. In addition to the increase in the GDP and consumption and income tax revenue through increased employment, and the cutting back of government debt and interest payment, the changes are also expected to contribute to pension, medical insurance, and nursing care insurance in accordance with income.

A system in which all workers, regardless of age, employment type, or marital/dependent status, pays a uniform social insurance premium and support the finance by contributing according to their income is a fair and efficient system. Administrative costs would be reduced, while productivity and the portability of social security benefits would raise the labor market mobility and reduce distortions to the incentives to work. In the very long-term, funding social insurance premiums through individual accounts will lead to the development of a robust social security system that would not be affected by changes in demographics and lead to the formation of long-term capital.

All eyes are on Japan, a nation that has aged and will continue to do so ahead of others, on how it faces and tackles fiscal problems and how it aims to achieve the happiness of its people and growth as a nation.

I am not overly pessimistic, as Japan still has room for improvement in terms of household income, productivity, and fiscal discipline. Meanwhile, growth is not being fully backed by government policies. Based on a long-term vision, the government must remove policies that hinder growth and promptly embark on bold structural reforms to enhance productivity.

* Translated by RIETI.

June 14, 2018 Nihon Keizai Shimbun