The United States is accelerating its restrictions on imports. On March 23, 2018, the Donald Trump administration imposed a 25% tariff on steel imports and a 10% tariff on aluminum imports. On the same day, it announced its policy to slap a 25% tariff on the more than 1,300 imports from China in response to China's alleged violation of intellectual property rights and mandatory technology transfer.

The restrictions on steel and aluminum imports are based on Section 232 of the Trade Expansion Act, which claims that the decline in the steel and aluminum industries as a result of increased imports could threaten national security, and thus such imports should be restricted.

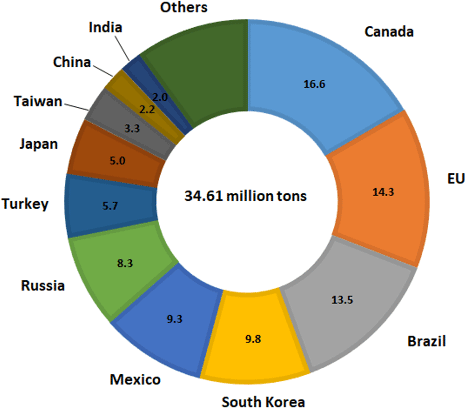

Initially, it was announced that the restriction would apply to imports from all countries but eventually Canada, Mexico, South Korea, the European Union (EU), Brazil, Australia, and Argentina were temporarily exempted. Steel imports from the above countries and the regions account for more than 60% of all steel imports, and aluminum imports from those countries and the regions account for roughly half of all aluminum imports, casting doubts on the integrity of the claim of imposing import restriction for the sake of national security (See Figure 1).

It is presumed that Canada, Mexico, and South Korea are exempted because they were in the process of renegotiating a free trade agreement (FTA), as well as the EU due to resuming FTA negotiations. This is because the United States is expected to play this as a negotiating card. In fact, South Korea was subsequently exempted from tariffs by setting quotas on steel exports to the United States and making concessions in the import of U.S. automobiles and the export of South Korean pickup trucks.

Furthermore, since his inauguration, Trump has been strongly concerned with bilateral trade deficits. It has been pointed out that Brazil, Australia, and Argentina have been exempted from the import restrictions because the United States has a trade surplus against these countries.

It makes sense to talk about overall trade and current balance surpluses and deficits, but discussing bilateral surpluses and deficits is nonsense from an economics perspective. Trump is trying to get the upper hand in the negotiations through misleading the public by labeling "trade surplus as good and trade deficit as bad."

Import restrictions in response to China's violation of intellectual property rights and mandatory technology transfer are based on Section 301 of the Trade Act. Under Section 301, the president may unilaterally impose trade sanctions such as raising tariffs if a country is found to be engaging in unfair trade practices. Trump seems to be using this as an excuse to drag China into bilateral negotiations, reduce the U.S. trade deficit with China, and expand U.S. exports of automobiles and semiconductors to China.

♦ ♦ ♦

Import duties are said to have a detrimental impact on the economy. In the following, I will consider the effects of import tariffs.

When import duties are imposed, the import volume of goods decreases, and domestic prices rise, which, in turn, leads to increased domestic production and decreased domestic consumption. As a result, domestic producers will gain, but domestic consumers will lose. Meanwhile, the government will obtain tariff revenue.

Ultimately, the effects of tariffs on a nation's economic welfare, in other words, whether a nation will gain or lose from tariffs, will vary according to the nation's scale of economies (small or large). For small economies, the consumer's loss will exceed the producer's and government's gains and will result in the entire nation incurring a loss. For large economies, as long as the tariff is not too large, the country as a whole will benefit.

This difference depends on whether the tariff impacts the international prices of the imported goods. For small economies, even if imports decrease due to the tariff, the decrease will be negligible from the perspective of global demand, and the international prices will not be affected. For large economies, the decrease in imports resulting from the tariff will considerably reduce global demand and lower the international prices of the imported goods. For the importing country, this means an improvement in the terms of trade and will increase economic welfare. Therefore, for large economies, there is a positive tariff that maximizes economic welfare, which is called optimal tariff. For small economies, the optimal tariff is zero.

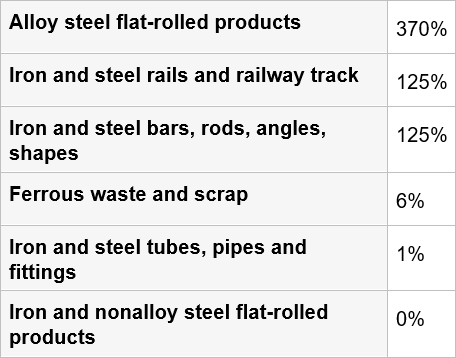

In the case of the United States, how much is the optimal tariff of steel? According to the University of California at Davis Professors Robert C. Feenstra and Alan M. Taylor, there are a number of steel products and the amounts of their optimal tariffs also vary widely (See Figure 2). Imposing a tariff of 25% on certain products would have the effect of raising a nation's economic welfare, but the overall effects are not clear.

Moreover, the improvement in the terms of trade of the United States signifies the deterioration of the terms of trade of the exporting countries as well as the deterioration of their economic welfare. Furthermore, if an exporting country retaliates and starts a trade war, it will become a loss for both countries.

♦ ♦ ♦

As retaliation against the import restrictions on steel and aluminum, on April 2, 2018, China imposed a maximum 25% tariff on 128 items. It is also ready to take even stronger measures if the import restrictions go into effect on account of intellectual property rights violations and the mandatory transfer of technology. Strictly speaking, if a country retaliates without resorting to the dispute settlement procedures of the World Trade Organization (WTO), the country itself could be charged with breach of the WTO agreement.

China interprets the recent U.S. import restriction measures as safeguards. Safeguards are emergency import restriction measures approved by the WTO to be imposed in the event that an unexpected rise in imports is found to cause serious injury to a competing domestic industry. In the case of safeguards, countermeasures may be taken without implementing dispute settlement procedures, but it seems to be a stretch to interpret the current U.S. import restrictions as safeguards.

However, it should also be noted that the WTO's dispute settlement function has been declining. Particularly, as the United States has been blocking the appointment of judges to fill vacancies on the appellate body for dispute settlement, there have been massive delays in the settlement hearings. Even if claims are made to the WTO, considerable delays are expected, and a decision may not even be reached during the Trump administration's tenure.

In the past, President George W. Bush imposed a maximum 30% tariff on steel in March 2002, claiming that the steel industry was being seriously harmed due to the sudden increase in imports. At that time, the dispute settlement system of the WTO functioned swiftly. In November 2003, the WTO determined that the tariff was a breach of WTO agreements, and ruled that the countermeasures by the exporting countries were justified. Subsequently, the EU warned that it would impose a punitive tariff equivalent to $2.2 billion on imports from the United States. In response, the United States abandoned the tariff in December 2003. However, some studies say that, as a result of this tariff, nearly 200,000 people lost their jobs in the United States and the GDP declined.

♦ ♦ ♦

What effects will the U.S. import restrictions have on Japan? In 2016, Japan's steel exports amounted to approximately 2.8 trillion yen, of which exports to the United States accounted for about 6.7%. These imports include products that are only manufactured in Japan. Therefore, the impact may not be as serious in terms of the U.S. market. However, if the international prices of steel fall, Japan's steel industry will also be impacted. Having succeeded with South Korea, Trump is likely to demand concessions, such as opening the agriculture and automobile markets, in exchange for exemption from tariffs in the bilateral negotiations with Japan.

If the import restrictions in response to China's alleged intellectual property rights violations and mandatory technology transfer are actually imposed, there could be repercussions on the global supply chain due to the sheer volume of items subject to the restrictions, and Japan would not be exempt from the adverse effects. If China decides to retaliate once again, a trade war could become inevitable. A trade war could not only have an impact on the flow of actual goods but also have an even greater effect on capital markets. The appreciation of the yen and the decline in stock prices of relevant companies have already begun.

If import restrictions in the name of national security and unilateral measures become widespread due to recent developments, the global economy could fall into utter chaos. We must not repeat the trade wars which were triggered by the U.S.' massive tariff hikes following the Great Depression. To do so, we must make an effort to accurately communicate our knowledge and insight of economics.

Rebuilding the WTO's dispute settlement function is also an urgent issue. The number of dispute cases brought to the WTO has been increasing and any further delays in settlement could threaten the very foundations of the WTO framework. To avoid such a situation, we ask the Japanese government to demonstrate its leadership.

* Translated by RIETI.

April 6, 2018 Nihon Keizai Shimbun