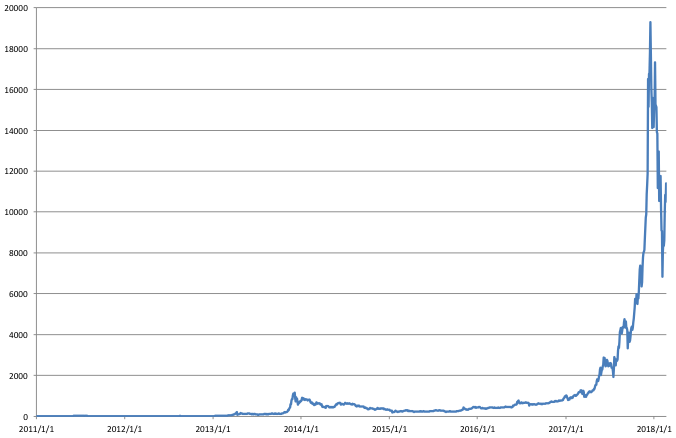

Bitcoin bubble and burst

Cryptocurrencies or virtual currencies such as Bitcoin are at the center of a scandal. Bitcoin's exchange rate against the U.S. dollar, which stood at 997.73 USD/BTC at the beginning of 2017, made an uninterrupted climb and peaked at 19,289.79 on December 17, 2017, rising 19-fold over a period of 11.5 months. From that day onward, Bitcoin trended downward, plunging to 6,838.82, roughly one-third of its peak value, on February 5, 2018. In the midst of this collapse came the Coincheck incident in January. Coincheck, an exchange for virtual currencies including NEM, was robbed of 58 billion yen worth of NEM belonging to its customers, prompting the Financial Services Agency (FSA) to conduct an onsite inspection into the company as well as other virtual currency exchange operators. Also, we all remember another related scandal, in which Mt. Gox, a Tokyo-based Bitcoin exchange, had to halt all Bitcoin withdrawals.

As shown in the below Figure, Bitcoin's exchange rate against the U.S. dollar has changed drastically over the years, having undergone two bubble-and-burst episodes. Bitcoin's exchange rate against the U.S. dollar surged more than 11-fold over a 3.5-month period, from 100 in mid-August 2013 to 1,151, the peak value at the time, on December 4, 2013. However, Bitcoin tumbled shortly afterward, falling below 500 at the end of March 2014 with half of its value lost in 3.5 months. Then came the 19-fold elevation and the subsequent free fall in 2017. Such a rapid and continuous escalation followed by a sudden free fall are nothing but the creation and collapse of a speculative bubble, and this process has been repeated over time.

Virtual currencies as real currency

Virtual currencies such as Bitcoin, which are based on blockchain technology and used as a means of settlement in a decentralized manner without any centralized control, have been attracting a great deal of attention as the poster child of fintech. The application of blockchains as a means of settlement will likely contribute significantly to the evolution of settlement systems in the coming years and the development of economic transactions and international trade related thereto. However, questions have been raised as to whether virtual currencies can operate as real currency comparable to existing ones such as the U.S. dollar and the Japanese yen. Some even say that it was a mistake to have named them "currencies."

Yermack (2015) examined and questioned the viability of Bitcoin as a real currency from the perspective of economics. What makes a currency, which may just be a piece of paper, a real currency is the fulfillment of the three functions of money, namely: 1) unit of account (or measure of value), 2) medium of exchange, and 3) store of value (Ogawa 2016). Bitcoin satisfies the second of the three functions as a medium of exchange, secured by blockchain mining. However, its functionality as a store of value is highly questionable.

Ever since the end of the Bretton Woods system, the U.S. dollar—a currency whose value has been trending downward over the years—has been serving as the de facto world currency, maintaining its dominance as a reserve and transaction currency in the existing international monetary system that has no internationally agreed upon rules governing any global currency system. This fact seems to suggest that a currency's function as a medium of exchange is more important than its function as a store of value. This is because a currency's function as a medium of exchange relies on the general acceptability of the currency based on its credibility and the network externalities that are present. A currency that has acquired the dominant share in the world as a settlement currency for economic transactions has its status sustained by forces on the demand side. This is a phenomenon called the law of inertia of a dominant currency. Ogawa and Muto (2017a, b) empirically showed that the U.S. dollar's status as the world's key currency relies heavily on its liquidity. Given these observations, it will be difficult for any virtual currency, which has suddenly come into being, to operate as a medium of exchange comparable to existing currencies.

Obviously, virtual currencies such as Bitcoin are significantly limited in their usability as a medium of exchange compared to existing currencies such as the U.S. dollar and the Japanese yen. A virtual currency accepted only within a specific closed world where it is used as a means of settlement cannot be defined as a currency functioning properly as a medium of exchange, though it would be a different story should the time come when we receive salaries and pension benefits in bitcoins and all purchases are payable in bitcoins.

Virtual currencies' functionality as a store of value

In order to examine the functionality of Bitcoin as a store of value, I calculated the daily percentage changes (difference of logarithms) in its market price, using data on its exchange rate against the U.S. dollar. Then, I calculated the mean and standard deviation of daily percentage changes for the sampled period as measures of Bitcoin market returns and volatility. For comparison, the mean and standard deviation of daily percentage changes in the yen/dollar exchange rate are also included in the Table below.

| Bitcoin's Exchange Rate against the U.S. Dollar (USD/BTC) |

Yen/Dollar Exchange Rate (JPY/USD) |

|||

|---|---|---|---|---|

| Period | Mean | Standard deviation | Mean | Standard deviation |

| 2011 | 0.33% | 2.80% | -0.01% | 0.25% |

| 2012 | 0.12% | 1.11% | 0.02% | 0.20% |

| 2013 | 0.48% | 1.60% | 0.03% | 0.33% |

| 2014 | -0.10% | 1.10% | 0.02% | 0.23% |

| 2015 | 0.04% | 1.20% | 0.00% | 0.22% |

| 2016 | 0.09% | 0.77% | 0.00% | 0.34% |

| 2017 | 0.32% | 1.52% | -0.01% | 0.23% |

| 2018/1/1-2018/2/20 | -0.18% | 2.54% | -0.06% | 0.21% |

| Total period | 0.18% | 1.76% | 0.00% | 0.27% |

| Data: Calculated by the author based on data from Blockchain (https://blockchain.info/) and Datastream. Total period: 2011/1/1-2018/2/20 |

||||

As for Bitcoin's exchange rate against the U.S. dollar, the mean average and volatility of daily percentage changes for the entire sampled period from January 1, 2011 through February 20, 2018 were 0.18% and 1.76% respectively, while that for the yen/dollar exchange rate for the same period were 0.00% and 0.27% respectively. The volatility of Bitcoin is 6.5 times higher than that of the yen/dollar exchange rate. I also calculated their average daily percentage changes and volatility for each year in the sampled period, and the results show that the volatility of Bitcoin was several times higher that of the yen/dollar exchange rate in all of these sub-periods.

Speculation has been the primary cause of such high volatility of Bitcoin. Along the way, Bitcoin's value has deviated from fundamentals, with speculation creating a bubble and driving the price up and down. Virtual currencies, which are subject to such drastic changes in value, may be a good vehicle for speculation, but they function very poorly as a store of value. It may have been the case that growing interest in virtual currencies as a vehicle for speculation prompted many people to use them more extensively in an attempt to increase their liquidity. However, this is a double-edged sword in that increasing the liquidity of virtual currencies by means of speculation on the one hand undermines their function as a store of value on the other.

Virtual currencies versus blockchains

Although their function as a medium of exchange is secured by blockchain technology, virtual currencies are limited in the scope of transactions for which they can be used as a means of settlement. Also, their function as a store of value is extremely poor because they are subject to speculation, characterized by high volatility in value, and prone to be affected by the formation and burst of bubbles. Furthermore, although this is not a problem with virtual currencies per se, a decline in the credibility of virtual currency exchanges is having a negative impact on the credibility of virtual currencies. However, we must make a clear distinction between virtual currencies and their underlying technology, i.e., blockchains, which provide an excellent means of settlement and deserves appreciation. It is hoped that blockchain technology will be applied to the settlement of payments, not in virtual currencies, but in real currency.