The signing ceremony for the revised Trans-Pacific Partnership (TPP), a free trade agreement of 11 Asia-Pacific countries excluding the United States, is set to take place in Chile on March 8, 2018. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or the TPP 11 will likely help Japanese companies boost trade and investment. Meanwhile, U.S. President Donald Trump recently expressed his intention to consider rejoining the TPP subject to renegotiations of the agreement, but the future course of U.S. trade policy remains unclear.

Companies' expectations on free trade agreements (FTAs)

In a bid to grasp the current state of business activities, outlooks for the future, and the influence of economic and industrial policy interventions on corporate business prospects amid the growing uncertainty of the world economy, RIETI conducted a survey of Japanese companies from October through November 2017 regarding their business plans and forecasts (Note 1).

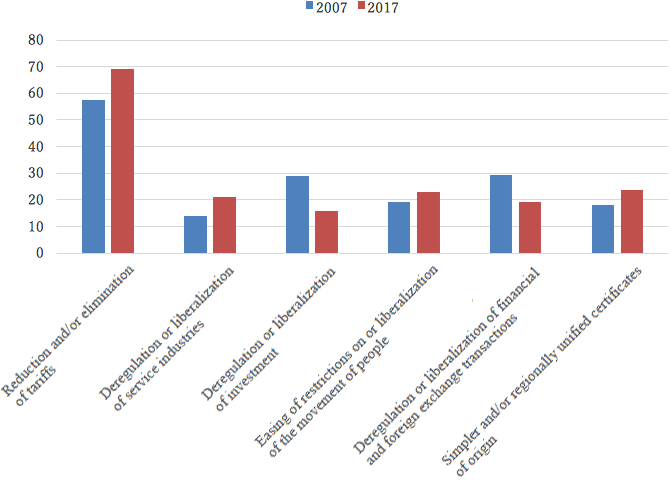

Figure 1 shows the responses to the question asking what respondents expect from the FTAs (including the TPP) currently under negotiation (Note 2). "Reduction and/or elimination of tariffs" topped the list of expectations, chosen by 69% of the respondents (57% in the Survey on Overseas Business Activities conducted by METI in 2008; hereafter the same). This was followed by "simpler and/or regionally unified certificates of origin" selected by 24% (18%), "easing of restrictions on or liberalization of the movement of people" by 23% (19%), "deregulation or liberalization of service industries" by 21% (14%), "deregulation or liberalization of financial and foreign exchange transactions" by 19% (29%), and "deregulation or liberalization of investment" by 16% (29%).

A rigorous comparison between the two surveys cannot be made as their target populations are different. However, larger proportions of companies selected "reduction and/or elimination of tariffs," "simpler and/or regionally unified certificates of origins," "deregulation or liberalization of service industries" in the 2017 survey than in the 2008 survey. Companies sampled for the 2008 survey are multinationals having overseas affiliates, and thus on average are larger in size than those sampled for the 2017 survey. Multinational companies typically provide goods to foreign markets by means of local production. However, many of those sampled for the 2017 survey are purely domestic players, i.e., those with no overseas affiliates and no exports. For those companies seeking to capture overseas demand, aspects that would reduce the overall cost of trading—such as lower tariffs and cheaper costs incurred for obtaining certificates of origin—are the greatest concern.

A closer look at the results of the 2017 survey reveals that expectations on the "reduction and/or elimination of tariffs" are high, cited by 76% of respondents from the manufacturing sector and 63% of those from the non-manufacturing sector. The proportion of respondents that selected "deregulation or liberalization of service industries" and "easing of restrictions on or liberalization of the movement of people" was higher in the non-manufacturing sectors at 31% and 25%, respectively, compared to 12% and 22% in the manufacturing sector. Meanwhile, 28% of respondents from the manufacturing sector expressed expectations of "simpler and/or regionally unified certificates of origin," compared to 19% in the non-manufacturing sector.

Reduce uncertainty over trade policy

In recent years, there has been a great deal of trade policy uncertainty. For instance, it is uncertain whether and how soon the TPP can be concluded, when and to what extent tariff rates will be lowered, and what will be the rules for electronic commerce and intellectual property (as was the case for the Japan-European Union Economic Partnership Agreement concluded in December 2017) (Note 3). In our survey, 21% of Japanese companies said that the prospects of trade policy affect their business plans and forecasts for sales, capital investment, and so forth. Approximately 30% of Japanese companies said that Trump's economic policy has a significant impact on their business plans.

Focusing on the timing of the conclusion of an FTA and uncertainty associated with the reduction and/or elimination of tariffs, recent studies have shown that a significant reduction in trade policy uncertainty leads to a significant increase in business investment and exports. According to the study by University of Michigan Assistant Professor Kyle Handley and University of Maryland Professor Nuno Limão, Portugal's accession to the European Community (EC) in 1986 and China's accession to the World Trade Organization (WTO) in 2001 removed future uncertainty about preferential tariffs. They found that such reduction in future uncertainty prompted many of those companies belonging to industries or manufacturing products subjected to a significant tariff reduction to advance into overseas markets, resulting in a significant increase in exports from the two countries. They estimated that more than 30% of the increase in China's exports to the United States between 2000 and 2005 is attributable to the reduction of trade policy uncertainty resulting from China's accession to the WTO.

If the planned signing of the TPP 11 is followed by its entry into force in 2019 and the reduction of uncertainty in overseas markets as hoped for, it will make it easier for Japanese companies to make medium- to long-term business decisions and plans such as those concerning capital investment, research and development, and expansion into overseas markets. This, combined with companies' expectations about the future, would make it possible to bring out the economic effects of the TPP (Note 4). In order to reduce trade policy uncertainty, what is of foremost importance is for the 11 member countries to sign the agreement in March and proceed with their respective domestic procedures in accordance with the provisions and schedules set forth therein.

Promote the utilization of the TPP

At the same time as seeking to pave the way at early date for bringing the TPP 11 into force in 2019, the Japanese government needs to create an environment to facilitate the utilization of FTAs at the working level. It has been pointed out that the ratio of Japanese companies taking advantage of FTAs (FTA utilization rate) remains low (Note 5). In 2016, Thomson Reuters surveyed more than 1,700 trade professionals from 30 countries to find out the current state of international trade activities including the utilization of FTAs (Note 6). The survey found that only 23% of the respondents claimed to be fully utilizing all FTAs available to their countries and applicable to their products, indicating that the underutilization of FTAs is an international issue. However, the ratio among Japanese companies is extremely low at 21%, compared to 60% for South Korea. The survey found that the complexity of rules of origin, challenges in gathering required documentation, and a lack of internal expertise are the biggest reasons for not utilizing FTAs. In addition, global trade processes around import and export activities are found to be predominantly manual and take more time than necessary. The survey showed that companies recognize the need to automate the processes but continue to face challenges in securing necessary funds and support.

It also found that some 45% of Japanese companies surveyed are considering ways to utilize the TPP in preparation for its ratification. In order to spur the utilization of the TPP or FTAs in general, it is imperative for the government to create an environment for enabling the facilitation and automation of customs clearance procedures including those under the rules of origin. The use of technology can help automate the standard tasks, making it easier to complete the procedures involved in the use of FTAs. The procedures for the use of FTAs such as acquisition of certificates of origin pose greater challenges for small and medium-sized enterprises (SMEs), which are typically limited in resources compared to globally operating large companies such as multinationals. Thus, the government should implement support measures focused on exporting companies as well as SMEs considering exporting.