As the largest developing country, China is experiencing an aging society at a rate faster than that of developed countries such as Japan. The shortage of labor force and rising labor costs are pushing Chinese firms to adopt industrial robots and automation technologies (Note 1). This trend is further accelerated by the spread of the COVID-19 pandemic. For China, Japan has both important experience on aging society and advanced technologies in robotics. It is believed that the rise of robots in China will create great potential for trade and investment for Japanese firms. This column aims to document some facts on the adoption of robots in China and to predict the potential for growth in trade and investment of robots between China and Japan.

The rise of robots in China

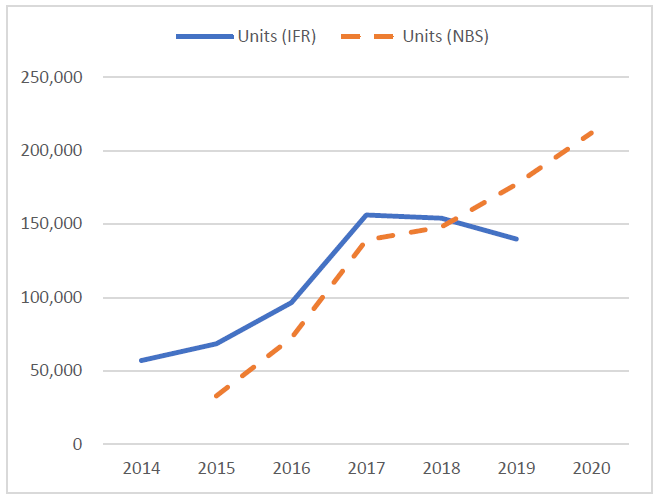

China is the world's largest user and strongest market for industrial robots. China accounts for around 40 percent of the global market. Figure 1 shows the annual installations of industrial robots in China. According to the International Federation of Robotics (IFR), sales of new robots in China reached 140,500 units in 2019 and it was more than double the numbers sold in 2014 (57,000 units) (Note 2). Though China was hit hard by the COVID-19 in Q1 2020, the Chinese economy recovered quickly from Q2 2020. Despite of the pandemic, the number of new robots in China increased by 20.7 percent in 2020 according to the National Bureau of Statistics of China (NBSC) (Note 3).

Furthermore, China exceeded Japan and became the country with the largest operational stock of industrial robots in 2016. China reached about 783,000 units in 2019, which is more than double the number of the second largest adopter, Japan (355,000 units) (Note 4). It is worth noting, however, that the robot density in the Chinese manufacturing industry is still quite low. In 2019, the number of robots installed per 10,000 workers in China was 187. By contrast, the robot density was 364 in Japan and 855 in the Republic of Korea, respectively. Therefore, there is still large potential for the adoption of robots and automation in China.

Japan-China trade in robots

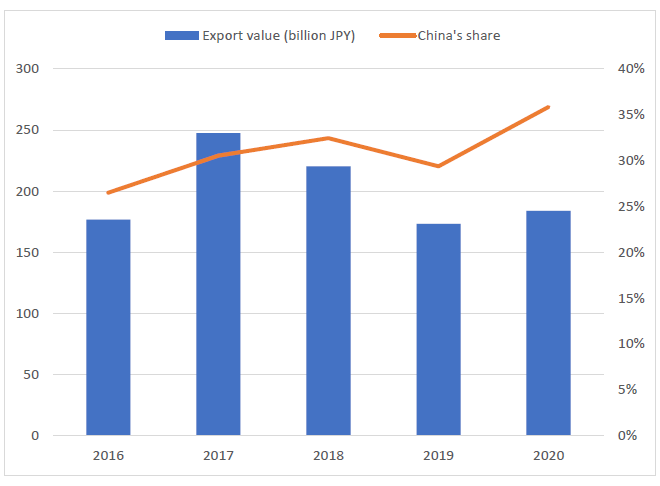

The adoption of robots by Chinese firms relies heavily on imports. In 2019, about 71 percent of new robots in China was imported from foreign suppliers. China is the largest export destination for Japan's industrial robots in recent years. Figure 2 shows Japan's total export value of industrial robots to the world and the export share to China. Japan's total export value is approximately 200 billion JPY per year. Importantly, China's share increased from 27 percent in 2016 to 36 percent in 2020. In terms of quantity, Japan exported 54,545 robot units to China in 2020, which account for 43 percent of Japan's total exports of industrial robots (Note 5). This is more than double the numbers of robots exported to the United States. However, relative to the exports to the United States and other developed countries, exported robots to China have lower unit value. Specifically, at the disaggregated Harmonized System (HS) 6-digit product-level, the unit value of exported robots to China is only 0.65 if the unit value to the United States is normalized to 1. It suggests that China imports relatively low-quality industrial robots from Japan. Another possibility is that China and the United States import quite different types of robots but it is not clear due to the availability of data.

Similar to developed countries, the automotive industry is the largest user of industrial robots in China. Accompanied by the rapid spread of automatization in various sectors including electric vehicles, electronics, machinery, and pharmaceuticals, it is expected that China will increase the imports of high-quality industrial robots from Japan in the coming 3-5 years.

Japan's investment in China

Unsurprisingly, China's soaring demand is attracting foreign investment from Japanese technology companies. It is reported that Japanese industrial robot manufacturers have decided to undertake large scale investment in China. Yaskawa Electric now produces 18,000 industrial robots annually in Jiangsu Province and plans to invest another 4-5 billion Japanese yen to build a new plant. The production of motors and parts for industrial robots is expected to start from fiscal year 2022 (Note 6). Furthermore, Funuc, which holds largest market share of industrial robots in China, will make its largest investment of 26 billion JPY in 2021 to expand the size of its robot plant in Shanghai fivefold (Note 7). These projects will substantially increase production capacity in China.

International trade theory predicts that foreign direct investment may substitute export. It means that the expansion of local production by Japanese firms in China may decrease China's imports from Japan. However, in the case of trade in robots between Japan and China, it is more likely that the high-quality products, main parts and components will continue to be produced domestically in Japan and exported to China. Meanwhile, the relatively low-quality products will be produced locally in China. Given that China is the largest market in the world, both exports and local production of Japanese companies are expected to expand in the next 3 to 5 years.

Government policy

The Chinese government has aggressively promoted the production and use of industrial robots in recent years. For example, the "Made in China 2025" program (launched in 2015) set the national goals of producing 100,000 industrial robots annually and achieving a density of 150 robots per 10,000 workers by 2020. As mentioned previously, China achieved these goals in 2019. In addition, to encourage foreign firms to participate in the "Made in China 2025" program, the Chinese government has also amended the Catalogue of the Guidance of Foreign Investment Industries in 2015 and 2017. Such government industrial policies provide incentives for both production and adoption of robots and automation technologies by Chinese firms.

Based on a survey of 1,115 of China's manufacturers in 2016, Cheng, Jia, Li, and Li (2019) reports that among 96 robot-using firms, 15 percent received government subsidies for robot adoption. Based on my own calculations using the China listed firms database, the number of subsidized projects for the R&D and adoption of robots increased from 47 in 2015 to 139 in 2019. It is estimated that the total amount of robotics-related government subsidies to listed firms increased from 4.6 billion RMB in 2015 to 15.4 billion RMB in 2019. It suggests that government policy may have contributed to the R&D, production, and adoption of robots by Chinese firms.

Though the Chinese government is subsidizing the R&D and production of robots by domestic firms, at this stage, Chinese robot manufacturers are not likely to replace Japanese and other foreign manufactures in the short term. Chinese manufacturers are gaining increasing market share but they still mainly serve the domestic market. However, in the middle and long term, Chinese manufacturers will catch up and gain increasing shares of both domestic and international markets, as seen in other manufacturing sectors.

There are potential concerns that national security concerns over key sectors and key products in both China and Japan may affect trade and investment in robots between the two countries. Under the Dual Circulation Strategy, the Chinese government continues to encourage domestic firms to produce robots by providing subsidies and tax incentives. On the other hand, the Japanese government is reenforcing export control on advanced technologies and equipment. In my opinion, the contents and scope of national security should be well defined. Trade and investment should not be restricted and disrupted for reasons related to "national security." I hope to address these questions by continuing to follow the trend and polices related to robots in China and Japan.