PDF version [PDF:396KB]

Asia as a Global Growth Center

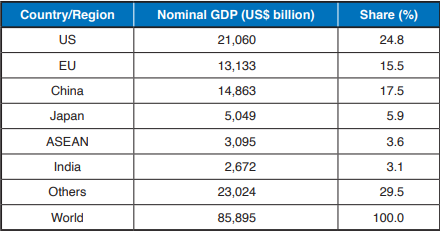

Japan and Asia’s newly industrialized economies (NIEs) – South Korea, Taiwan, Hong Kong, and Singapore – achieved remarkable industrialization and economic take-off after World War II. The World Bank represented it as the “East Asian Miracle”. This was followed by the successful catchup in industrialization by the advanced ASEAN member states (AMS) – Indonesia, Malaysia, the Philippines, and Thailand. These AMS reoriented their policies in the latter half of the 1980s from import substitution to attraction of foreign direct investments and promotion of exports. Today, Asia is the driver of the world economy, with people calling it the “global growth center”. Statistics shows that China, Japan, India, and ASEAN account for roughly 30% of global GDP (Table). It is almost certain that the global economic center of gravity will further shift to Asia in the future.

Source: International Monetary Fund, World Economic Outlook Databases, 7 April 2023

Challenges Faced by Asia

However, Asia is facing increasingly powerful challenges. First, we have yet to witness the end of the Covid-19 pandemic that was first reported in China in December 2019 and dragged the global economy into recession in 2020 and 2021. This pandemic also caused expanding gaps between developed and developing countries, as well as within countries (upper and lower-income classes, urban and rural regions).

Second, uncertainty is growing in the global economy. In addition to complications from the pandemic, the war between Russia and Ukraine that broke out in February 2022 has created a focus on great geopolitical risks. Geopolitical instability is giving rise to fears of cost-push inflation due to resource shortages and logistics disruptions, and rising interest rates implemented by central banks such as the US Federal Reserve Board.

Third, the economic security issue has been debated recently amid heightened geopolitical risks. The US-China economic war has not only generated political tension between these two countries, but also has accelerated decoupling of their economies. The United States and some countries in the Asia-Pacific region have started serious discussions to maintain economic security: that is, how to secure scarce resources, reconstruct global production networks, and protect their critical technologies. This is likely to heavily affect developing countries in Asia, particularly AMS, that depend on trade and investments from both the US and China.

Fourth, dramatic advances in digital technology such as artificial intelligence, big data processing, and robotics are causing a broader technological transformation, a process accelerated by the pandemic. Digital technology creates the need to reskill workers that were replaced by automation and nurture entrepreneurship that encourages business challengers to leverage these technological opportunities.

Fifth, there are the more long-term challenges such as the broader destruction of our environment and climate change, and Asia not only must decarbonize by conserving energy and using renewable energy sources but also manage climate disasters appropriately. Transitioning to a circular economy that is focused on recycling is also necessary, a challenge whose urgency is highlighted by marine plastic waste.

There are also many other challenges that Asia must resolve. Many of these challenges are laid out straightforwardly in the Sustainable Development Goals (SDGs) adopted by the United Nations in 2015. The SDGs cover a wide range of social, economic, and environmental goals in 17 areas including poverty, health and well-being, industry and innovation, and climate and life below water with the aim of achieving them by 2030. These are inescapable issues if Asia is to become the center of the global economy. In fact, these are not challenges limited only to typical developed countries. Developing countries in Asia have already reached the stage where they must pursue high-quality sustainable economic development and avoid stagnations represented by the middle-income trap.

Growing Global Interest in Industrial Policy

Before discussing in detail how Asia should pursue sustainable economic development, we will review the theoretical and empirical aspects of public policy. Particularly, industrial policy has great relevancy to the government’s role in development strategies. However, the debate on industrial policy has been terribly controversial.

While the debate over the effectiveness of industrial policy began with the experience of postwar Japan and East Asia, the rise of neoliberalism produced the “Washington Consensus” in the 1980s. It pursued deregulation and small government under market liberalization and was applied to developing countries. During the Asian financial crisis in 1997-1998, market-oriented economic and structural reforms based on recommendations from international organizations were imposed on South Korea, Indonesia, and Thailand. Around this crisis, industrial policy was met with global indifference for a long while. However, the spotlight turned once again on industrial policy along with the global financial crisis in 2008, when governments took measures to expand domestic demand in specific sectors (e.g., support for eco-cars) and rescue private business companies (e.g., General Motors). Expectations have been increasingly growing, on the policy forefront and in academia, toward industrial policy.

Let us first look at the policy forefront. In the case of the US, the administration of President Joe Biden announced the “American Jobs Plan” in March 2021 against the background of friction between the US and China over trade, technology, and economic security issues. The plan has a strong element of industrial policy, as it consists of infrastructure investment, R&D investment in science and technology, and support for domestic manufacturing and small businesses. In August 2022, the US Congress passed the “CHIPS and Science Act” and the “Inflation Reduction Act”. The former provides new funding to boost the US semiconductor industry, while the latter intends to facilitate energy security as well as tame high inflation.

Meanwhile, China had already announced “Made in China 2025” in May 2015 with the goal of becoming a world manufacturing power. It designates 20 industries in 10 important leading-edge sectors (e.g., energy-saving and new-energy vehicles) and aims to increase the domestic production of key items from 60% to 80% by 2025. China also proposed a “Dual Circulation Strategy”, which includes both domestic and global circulation, to strengthen resilient supply chains and increase domestic consumption and production, as well as promote exports. Being inspired by the US and China, the Ministry of Economy, Trade and Industry (METI) of Japan proposed its “Innovation to Economic and Industrial Policy” in June 2021 to tackle challenging economic and social issues. This proposal advocated a “mission-oriented” industrial policy that is different from conventional industrial protections and simple structural reform approaches.

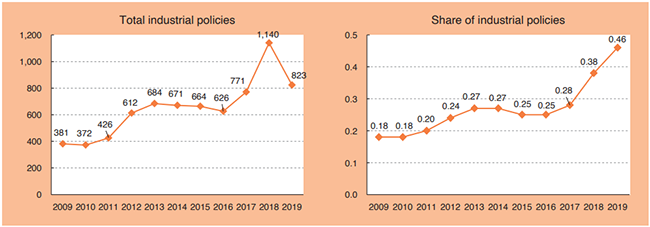

Then, one question arises: are measures called industrial policy growing in number? The answer is “yes”. Applying machine learning methods to policy-related texts that appeared in the Global Trade Alert database in 2009-2020 demonstrates approximately 25% of the texts concern industrial policy, and their proportion has grown since 2010 (Juhász et al., 2022) (Note 1) (Chart 1). It is also shown that subsidies and export promotion measures have been replacing import duties, and more notably, that high-income countries are more likely to use industrial policy than low-income countries, which goes against our expectations.

[Click to enlarge]

Source: Juhász et al (2022) (Note 1).

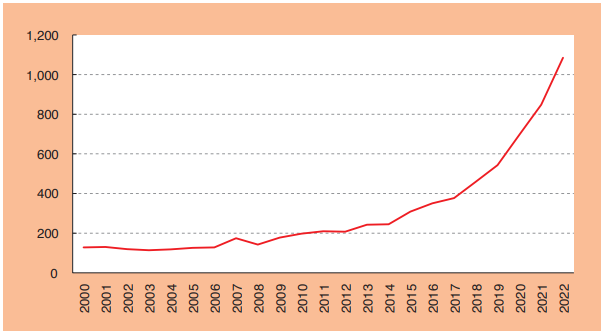

Revival of Industrial Policy in Academia

Next, we shall probe the worldwide academic interest in industrial policy. A search based on Dimensions (the scientific research data platform) reveals that the number of English academic papers on industrial policy has increased significantly since the 2010s (Chart 2). Taking account of the fact that the overall number of papers on economics is growing as well, the data shows that the ratio of hits to all papers on economics grew from 0.7% in 2000 to 1.5% in 2022. It reveals how industrial policy is being used more frequently at the policy forefront and how academic interest in the subject is also growing.

Source: Authors, using Dimensions of Digital Science

There are, broadly speaking, two academic approaches to industrial policy. One approach is provided by mainstream neoclassical economists (Stiglitz, et al., 2013) (Note 2). In their view, state intervention is practically justified to correct inefficiencies in the market allocation of resources caused by “market failures” concerning economies of scale, public goods, externalities, market imperfection, information asymmetry, coordination failure, etc. The role of industrial policy consists mainly of altering the relative prices of goods and services to shape the appropriate incentives of consumers and firms so that economic activities further increase social welfare.

The second approach, standing in strong contrast to the former, is the “developmental state” perspective. Japan, South Korea, Taiwan, and others that achieved economic development after World War II are cited as powerful examples of states that implemented industrial policy (Johnson, 1982 (Note 3); Amsden, 1989 (Note 4)). The developmentalists believe that the state has an essential role beyond the mere resolution of market failures toward the achievement of the greater goals of economic development, poverty reduction, and sustainability. Some developmentalists currently maintain that the state is expected to play a more extensive and critical role toward the goals. Specifically, they point to the “mission-oriented economy” in which the state should take the lead in innovation as an “entrepreneurial state” that takes the risk of innovation (Mazzucato, 2013 (Note 5); 2021 (Note 6)).

As pointed out above, there is no uniformly accepted definition of industrial policy, given the variety of ways in which the role of industrial policy is understood. But some researchers belonging to international organizations try to draw a general definition of industrial policy, such as “(industrial policy) encompasses all types of instruments that intend to structurally improve the performance of the domestic business sector” (Criscuolo et al, 2022) (Note 7). It should be noted that, under this broad definition, policies not being literally demarcated as industrial policy can be covered if they contribute to improving the business sector (e.g., tax credits to promote firms’ investments, human resource development for industrial workforce). In this sense, industrial policy should not be monopolized by developed countries. Rather, developing countries particularly in Asia should make positive use of industrial policy to achieve sustainable economic development through strengthening their industrial competitiveness globally.

Significance of Industrial Policy & Its Measures

There has been plenty of debate over the pros and cons of industrial policy. While some economists have cast serious doubts on its effectiveness, neoclassical economics supporting industrial policy considers a wide range of the above-mentioned market failures. Thus, government interventions are justified to correct such market failures and to achieve more efficient resource allocations, given that countries engage in de facto industrial policy.

In the beginning, infant industry protection is a controversial and typical measure of industrial policy that developing countries, including Asian countries, aggressively employed in their initial development stages. It assumes that, in the transition stage of industrial development, trade protection which temporarily restricts imports through tariff barriers and import restrictions is effective until technology is sufficiently advanced to enable economies of scale and targeted industries to generate positive externalities to the others. However, objections have been raised against this kind of industrial policy. The criticism is that it would favor industries lacking comparative advantages, discourage sound competition, and exacerbate productivity improvement and innovation. Government protection frequently leads to “picking losers” and rent-seeking by protected incumbent industries. Asian countries sought to industrialize by developing their heavy and chemical industries through protections before the 1980s, but the general assessment is that they fell far short of complete success with some exceptions.

Technology development policy is also implemented as an important part of industrial policy by both developed and developing countries. Technology development has positive externalities in the form of spillover effects on other firms that do not undertake it. This means that the private return on investment in technology development will be lower than the social return on investment, resulting in a lower level of investment than the socially optimal level. This positive externality mechanism is regarded as justifying government support for technology development. Especially for developing countries, such measures as foreign direct investments of multinational corporations (MNCs) and industrial hubs have been used to accelerate technology transfer and spillovers to domestic private business sectors. On the other hand, while the measures of R&D support and reinforcement of intellectual property right systems are popular in developed countries, they should get more attention from policymakers in developing countries in Asia as well, given the small amount of their R&D investment (Ambashi, 2019) (Note 8).

There is also the industrial dynamics argument, advocated by a famous economist, Joseph Schumpeter, that the entry of new efficient firms achieving innovation and productivity improvement can push the exit of inefficient existing ones. This “creative destruction” signifies the role of industrial policy in facilitating the appropriate shift of resource allocation. Therefore, the “crony capitalism” prevalent in Asian economies should be controlled in view of industrial dynamics. Moreover, information asymmetry hinders efficient resource allocation in credit provision to private enterprises, particularly micro, small and medium enterprises (MSMEs). When financial institutions are not as familiar with business projects as the private firms themselves because of the asymmetry of information in the financial market, a borrower firm may not be able to secure funds even for a promising project. Since it is observed that financial markets in developing countries are generally incomplete, it will be desirable for their governments to provide financial support through public financial institutions.

There can be situations in which coordination failure may be alleviated through government intervention. In a sector where there is a fixed cost and uncertainty, firms may not enter the market at all. Then, government interventions can resolve this difficulty of firms and accelerate new entries. In addition, industrial policy can be useful when there are externalities to manufacturing activities connected through supply chains. Therefore, Asian countries still need to design effective industrial policies to fully exploit international production networks and global value chains, which have been reinforced in the Asian region.

Finally, there are several things to keep in mind when policymakers implement industrial policy in addition to the harmful effects raised regarding infant industry protection. Industrial policy may have the potential to discourage new entries because of its strong tendency to support specific incumbents. Among other things, policies that support a small number of specific firms may not raise the productivity of the industry or the overall economy. This means that it is necessary to combine industrial policy with competition policy as much as possible so as not to lose industrial dynamism.

Horizontal & Vertical (Targeting) Policies

In the implementation of the above-mentioned industrial policies, policymakers and scholars often argue over which kind of industrial policy it is desirable to implement, that is, “horizontal” or “vertical” policy. The term “targeting policy” is sometimes used to represent vertical policy. Economists who fear “government failure” have argued in favor of horizontal policies, in which institutional environments are developed through market facilitation and regulatory reforms. Horizontal policies are applied across the board to firms and sectors, instead of fostering them to be specified. However, some economists have also been speaking out in favor of vertical industrial policies that target specific firms and sectors (Aghion et al., 2021) (Note 9). One justification is the existence of “path dependency”. Selective development of specific firms and sectors under government initiative is vindicated when superior technology (e.g., clean decarbonizing technology) will not necessarily be adopted because of inertia from the past.

It also seems obsolete to naively divide industrial policy into horizontal and vertical policy and then recognize one to the exclusion of the other. Industrial policy can be roughly divided into three instruments (Criscuolo et al., 2022) (Note 7): (i) “firm instruments” that directly affect individual firm performance (e.g., subsidies, finance loans, knowledge transfers, infrastructure development), (ii) “framework instruments” that affect industry dynamics (e.g., developing capital markets, facilitating labor mobility, trade and investment policy), and (iii) “demand-side instruments” that affect goods and services (e.g., product regulation, public procurement). The key is to select appropriate instruments or combinations thereof according to the objective.

Evidence-Based Policymaking (EBPM)

We shall take a brief look at a subject that has been receiving recent attention: evidence-based policymaking (EBPM). While progress in research on EBPM in economics and its incorporation into real policy has been conspicuous, powerful arguments have been made in favor of practically applying it to industrial policy. Briefly speaking, EBPM is a recent revolution in policymaking, in which policy tools are selected based on “evidence”. The definition of evidence is, in general terms, the empirically verified “causal effects” of a policy. Given the increasingly broader application of EBPM to policy fields, it is strongly recommended that appropriate policy tools be chosen by applying evidence to economic and social issues that public policy should address.

Causal inference based on the statistical and econometrical methods that have developed around economics is often used for this empirical demonstration in the policy field. In causal inference, there is a strict distinction made between causation and correlation. It is required to prove causal relationships in measuring the effects of policy intervention. Among other things, evidence produced by a randomized controlled trial (RCT) is considered the highest quality. In RCT, the subjects of the policy are randomly assigned to a treatment group or a control group. Since the two groups have on average identical characteristics except for the policy intervention, the difference between the average of the outcome variable can be measured as the causal effect of the policy intervention.

However, while RCT is a powerful methodology to verify policy impacts, it is ethically and practically difficult to randomly assign targeted subjects (sectors, firms, workers, etc.), given the typical nature of industrial policy. Assigned treatment groups via industrial policy are frequently subject to “sample selection”, in which more motivated firms and workers tend to apply to policy programs. For this reason, much research has been conducted through “natural experiments” based on ex post observational data, structural estimation, and dynamic macroeconomic general equilibrium models. These empirical methods overturn correlational results of some past research studying industrial policy, finding out new positive views based on firm-level panel data, historical episodes, and selective place-based policy variations. Furthermore, although we stressed the necessity of EBPM as described above, it is unrealistic to implement policies only when there is robust evidence. The point is that economists and policymakers should cooperatively integrate the essence of EBPM into industrial policy and development strategy in Asia going forward.

Review of Empirical Studies on Industrial Policy

There has been much research on industrial policy in recent years with a variety of data and methods being used from the EBPM perspective. However, the aim of this article is not to review all empirical studies on industrial policy, so we will confine our focus to empirical evidence of vertical and horizontal industrial policies that is relevant for developing countries.

First, some research has analyzed the effects of targeted subsidies for specific industries as a vertical policy. While targeted subsidies tend to be more effective for young, small firms than for large firms and MNCs, problems have been identified such as negative effects on downstream firms in the supply chain and inefficiencies in international industrial allocations. In any case, the effectiveness of industry protection or promotion policy is still controversial, although some research using exogenous historical events finds a positive result from such a policy. This piecemeal evidence suggests that, at least, erroneous technological bias must be avoided and that the whole industrial ecosystem in the country and the world should be taken into consideration when policymakers design targeted subsidies.

Second, aside from subsidies and tax credits targeted for investment (particularly R&D), horizontal industrial policies include (i) competition and regulatory reform policy and (ii) international trade and investment policy to improve the business environment in developing countries. The first type of industrial policy is important channels for structural changes that expedite the entry (exit) of highly productive (unproductive) firms. It would encourage the adoption of new technology and innovation through fierce competitive pressures while facilitating efficient resource allocations. For these reasons, it is undesirable to indiscriminately shield domestic firms and industries from competition, and thus it is essential to harmonize industrial policy with competition policy. Existing studies conducted in China show that when subsidies and other forms of industrial policy are implemented in a manner that targets competitive sectors or promotes competition within sectors, for example, by targeting new, highly productive firms, the productivity of firms rises.

The second type of industrial policy is more relevant for developing countries that intend to nurture strong industrial sectors. Many studies reveal that simple protective trade measures are ineffective as industrial policy in terms of productivity. In fact, studies using firm-level data conclude that the promotion of free trade and foreign direct investment results in efficient resource allocations, productivity improvement, and innovation through such factors as import competition, lower prices of intermediate goods, knowledge spillovers, and learning by local firms. Specifically, there is also a view that dynamic gains from trade through cross-border knowledge spillovers are significantly greater than the static gains from comparative advantage both within developed countries and between developed and emerging economies. In the sense that international trade and investment policy (e.g., economic partnership agreements) readily enhances business sectors, it would continue to play a central role in the industrial policy of developing countries in Asia.

Macroeconomic Assessment of Industrial Policy During the Postwar Boom in Japan

The macroeconomic literature on resource allocations has discussed the effects of industrial policy. It generally shows that total factor productivity (TFP), the core element of economic growth, remains low because of inefficient resource allocations. Some research concludes that the inefficient resource allocation dragging TFP down is the outcome of industrial policy.

The multisector growth model calibrated by macroeconomic data successfully quantifies the effect of industrial policy during the postwar economic boom of Japan. The research, through conducting counterfactual simulations, demonstrates that these policy effects were minimal. It focuses on the distortion that industrial policy creates in resource allocations, casting doubt on its efficacy. However, it is also argued that the key to Japan’s high postwar growth was to eliminate the imperfections in the labor market. This observation arguably indicates the importance of industrial policy that promotes the free movement of domestic labor forces through transportation infrastructures (e.g., roads, high-speed railways), urban housing, and regional industrial clusters.

Existing Development Strategies in ASEAN & Concern over the Middle-Income Trap

As the endogenous growth theory suggests, the dramatic accumulation of physical and human capital in Japan and Asian NIEs served as a part of the background for the economic development in the postwar period, which was driven mainly by industrialization and export expansion. The developed AMS such as Indonesia, Malaysia, the Philippines, and Thailand followed this successful economic development, the historical pattern of which is called the “flying-geese model”. Let us take a closer look at the development process of these AMS.

In retrospect, the AMS experienced downturns in their growth rates in the 1960s and 1970s under the protective “import substitution industrialization strategy”, which encouraged domestic production by restricting imports. But subsequently, realizing the limitation of this strategy, these countries adopted a “foreign capital-dependence, export-oriented industrialization strategy” as the foundation for their development policy. Since the 1990s, they have deepened economic integration through trade and investment liberalization (e.g., ASEAN Free Trade Agreement, ASEAN Comprehensive Investment Agreement), and the ASEAN Economic Community was finally established at the end of 2015, with the continuing process of further deepening its economic integration.

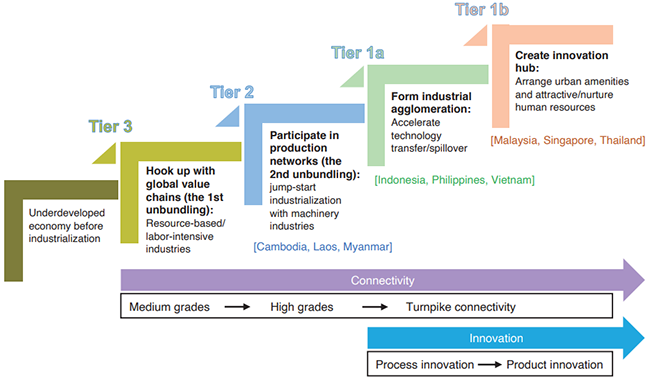

Specifically, ASEAN’s recent industrial development strategy is based on the regional specialization of manufacturing, represented by the automobile and electrical machinery industries. As economic integration has deepened, the international division of labor between manufacturing processes and tasks has also progressed with involvement by MNCs, which accompanied active trade in intermediate and final goods. The deepest international production network in the world has been exploited according to respective AMS development stages, while infrastructures and investment environments have been aggressively improved (Chart 3). Consequently, individual AMS have achieved extraordinary economic growth, poverty reduction, and the expansion of a thick middle-income class (ERIA, 2015) (Note 10).

[Click to enlarge]

While the AMS and other emerging Asian economies have thus far enjoyed steady economic development, the important issue for them is how to avoid the “middle-income trap”. There are serious concerns in developing and middle-income countries such as Malaysia and Thailand that their economic growth may stall over the long run at the current middle-income level (or per capita GDP) and may not reach the level of developed countries in the future. These countries, as they achieve middle-income country status, face the need to find a new development strategy that is different from the catchup one and foster new, high value-added industries that can realize productivity improvement and innovation.

Potentiality of Digitalization

It is worth noting that digitalization is expected to be an important clue for escaping the middle-income trap. Digitalization encourages the division of labor at the task and human levels, as we have been witnessing in the shift in the international division of labor. This has led to a drastic change in technologies, innovations, and organizations. Among other things, there is a growing shift from “incremental innovation”, which focuses on the incremental improvement of existing goods and services in the industrialization process, to “disruptive innovation”, which aims at achieving the introduction of new goods and services and the creation of new markets. In disruptive innovation based on digitalization, the accumulation of technology and knowledge previously required may not be necessarily significant. Then, “leapfrogging” economic development jumping over presumed immediate development stages would be possible (ERIA, 2022) (Note 11). Digital platform services are one such example. Smartphones, which have been widely adopted in the AMS, open a new business frontier of online shopping, electronic payment, ride-hailing services, etc., which have enriched people’s living standards.

The AMS intend to bring existing industries and digitalization together, that is, digital transformation (DX). For example, in 2011 Malaysia established a special innovation unit under the Prime Minister’s Office to consolidate innovation policy at the national level jointly with the Malaysia Innovation Association. Thailand presented “Thailand 4.0” in 2014, a vision of a 20-year national strategy, for fear of falling into the middle-income trap. Thailand 4.0 has the ambitious objective of transforming Thailand into a developed country. Its economy and society are expected to create high value-added in sectors such as next-generation automotives through innovation, productivity improvement, and services trade and to leapfrog the extant stage of heavy industrialization and foreign capital attraction. Additionally, Indonesia introduced “Making Indonesia 4.0”, a 2018 roadmap to introduce “Industry 4.0”, in which Indonesia’s manufacturing sectors will be revitalized, such as food processing, textiles, and automobiles.

Reconsider the Role of Industrial Policy to Form Effective Development Strategies

To implement these development strategies, policymakers need to incorporate concrete industrial policy tools into development strategy based on evidence as shown in the review of empirical studies. A certain role of industrial policy in the early development stage of developing countries is now accepted given Asia’s remarkable growth experience. More importantly, in the present digitalization age, it is also necessary to demonstrate how industrial policy can be useful in embodying industrial development strategies at higher development stages, such as the above-mentioned Thailand 4.0. Assuming that the cooperation of stakeholders is necessary to develop new industries, in which there are significant knowledge spillovers associated with innovations, we should reconsider the role of industrial policy to form effective development strategies in Asia.

Meanwhile, we still need to note the reason why industrial policy was relatively successful in the Asian NIEs. The reason is that they had desirable features such as outcome-based competition promotion, clear policy objectives, sunset clauses, and transparency with effective implementation mechanisms. Moreover, there were long-term visions and guidelines backing up development strategies, enabled by political leaders with foresight, powerful control towers that can incorporate leaders’ ideas into industrial policies, and competent, meritocratic bureaucracies. The Ministry of Economy, Trade and Industry of Japan, the Economic Planning Board in South Korea, the Economic Planning Unit in Malaysia, the National Economic and Social Development Board in Thailand, and the National Economic Development Authority in the Philippines are considered significant players that implemented the respective national development strategies. The Asian countries should continue to leverage these institutions conducive to effective making and use of industrial policy.

However, conferring excessive powers on the government side would run the risk of creating “elite capture” (i.e., the appropriation of privileges and embezzlement by the elite). Therefore, accountability and transparency, corruption prevention, participation of a wide range of citizens in the debate on industrial policy, and other elements of governance continue to be an issue for developing countries in Asia. Notably, in the case of Japan, the government advisory councils composed of representatives from industry, academia, and civil society helped secure governance in industrial policy through information sharing and mutual reasoning and trust.

Finally, we end this discussion with an important caveat. While we have reviewed the plausible factors that contributed to the success of industrial policy implemented by forerunners in Asia, policymakers should be cautious about indiscriminate applications of industrial policy to their own countries. In general, successful industrial policy seems to be heavily dependent on conditions and environments surrounding the countries. This implies that the industrial policy which achieved a high performance in some countries may not be successful in other countries. Hence, industrial policy should be tailored to fit changing needs of specific countries.

Framework of New Strategies for Sustainable Economic Development

We have conceptually explained the importance of implementing industrial development strategies while using appropriate state interventions of industrial policy. Here we will discuss the framework of new strategies for sustainable economic development in Asia. What follows in this article will exemplify contemporary economic challenges to this end: (i) developing digital startup businesses and (ii) addressing environmental problems and managing natural disasters.

Example 1: Developing Digital Startup Businesses

MSMEs account for the bulk of firms and employees in any country, and in particular, startups are expected to be the engine of economic growth. More precisely, it has been shown that startups force inefficient firms to exit the marketplace by accelerating market competition. Moreover, they are expected to have knowledge spillovers as a creator of innovation, an externality whose impact appears in the enhanced performance of other geographically proximate economic entities. While startups in developed countries have attracted the focus of attention, the progress in digitalization has brought much attention to startups in developing countries from the perspective of economic growth, employment creation, poverty reduction, and inclusiveness.

GAFAM (Google, Apple, Facebook (now Meta), Amazon, and Microsoft) in the US are prime examples of successful digital startups. Some digital startups, even if they do not reach those levels, have already become major flagship corporations of their respective home countries. The success of digital startups is a major trend in Asia as well (see 2022 Global Entrepreneurship Monitor), as Alibaba, Baidoo, Tencent, and other corporations in China have grown from the status of digital startups. The reason is that they do not need initial large-scale R&D investments to get a start. All that is needed is to provide a digital IT service, so-called “creative imitation” of a US first mover, but it is likely to have the potential of disruptive innovation.

For example, Gojek and Grab in the case of Indonesia competing fiercely in rideshare services essentially copy the Uber business model. However, Indonesia’s rideshare services not only enhance consumer welfare by supplementing urban transportation, but also provide wage-earning jobs for many people (many of whom are “gig workers”, though, and this is a problem). Thus, we cannot deny the significant contribution to poverty reduction that digital startups have made through the expansion of employment. Moreover, the lockdowns that accompanied the Covid-19 pandemic have been an unexpected push toward digitalization in national economies and social inclusiveness of digitalization in business transactions and employment.

What we should keep in mind is that digital startups depend on originality and ingenuity of private firms, which is not something that governments can conjure directly overnight. Governments need to focus on both hard and soft infrastructure development and related institutional environments that enable digital startups to conduct their free activities in the marketplace without facing any difficulties. The infrastructure catering for digitalization is sometimes lumped together as “digital connectivity”. Highspeed Internet services such as 5G comprise essential infrastructures to facilitate the adoption of remote technology and the Internet of Things (IoT) on the production line. At the same time, it is necessary to continue to develop physical roads, railways, and other conventional hard infrastructures. Without such hard infrastructures, it is impossible to deliver physical goods to consumers no matter how widely electronic commerce is accepted. Moreover, enhancing the services of digital startups requires promotion policies that develop soft infrastructures such as fintech and e-payment.

Turning our attention to the negative aspects of digitalization, the striking growth of digital startups has raised concern over the use of monopoly power such as tie-in sales. Unfair pricing and sale of goods and services based on monopoly power has the risk of harming consumer welfare. Since data collected by a digital firm may include personal data, this must be managed properly from the perspective of privacy protection so that it will not be misused. In addition, gig workers who work for digital startups are frequently forced to endure unstable incomes and subjected to disadvantageous terms and conditions as workers. If they do not have an employment relationship with the digital firms, they do not generally receive protections under labor law even in developed countries.

These concerns strongly suggest that when promoting digital startups, governments must simultaneously arrange the relevant laws, regulations, and institutional environments from the viewpoint of competition, consumer and labor protection. Furthermore, the taxation of digital firms that conduct business activities globally is an important issue. This taxation problem regarding digital firms is not contained within national borders, and has led to calls for international harmonization. Asian countries should also contribute actively to the debate in the World Trade Organization and other international forums to resolve this problem.

While governments of developing countries have great expectations for digital startups, it is crucial that considering the significant uncertainties attached to digital innovation, they develop relevant infrastructures and institutional environments simultaneously to enable local firms to fully exploit the potential of digitalization. The industrial policy fostering digital startups should be based on the more horizontal approach to give benefits to a wide range of entrepreneurs.

Example 2: Addressing Environmental Problems & Managing Natural Disasters

Environmental problems are a typical case of market failure, in which necessary goods and services are not provided by the market to maximize social welfare. For example, air and water pollution accompanying business activities produces negative externalities by endangering the health of their neighbors. In this case, governments can increase social welfare by restricting excessive business activities by way of subsidies and taxes or direct regulations to reduce pollution. For other environmental problems, there is a social dilemma called the “tragedy of the commons”, in which common resources such as forests and fishing grounds, which can be used by many, are exhausted by excessive use. It is sometimes resolved by government interventions that give the interested parties property rights to that resource to manage it appropriately.

Among environmental problems, there is growing attention today to climate change as well as the natural disasters that it causes. Natural disasters tend to cause greater damage in developing countries because of their weak infrastructures. For example, we still have a vivid memory of the disastrous eruption of Mt. Pinatubo in the Philippines in 1991, the earthquake and tsunami in the Indian Ocean off Sumatra in Indonesia in 2004, and the cyclone Nargis that hit Myanmar in 2008. However, preventing and alleviating natural disasters is frequently disturbed by market failure. Although rising sea levels due to climate change threaten to submerge inlands and coastal areas, it is difficult to provide seawalls, levees, and other infrastructures necessary to reduce the damage through the market alone (i.e., the free-rider problem regarding public goods). When a natural disaster strikes, maintaining and securing lifelines such as electricity and water supply are the pressing tasks to maintain living standards. Responses to natural disasters are traditionally considered the realm of public policy. It is a well-known fact that the private insurance market provides very limited coverage for damage from natural disasters; it seems that the disaster insurance market is very incomplete.

So is industrial policy relevant for environmental problems and disaster management? According to the general definition of industrial policy presented in this article, policies that seek to enhance firms’ international competitiveness through the development of energy conservation technology and renewable energy fall under this category. For this purpose, a mechanism is necessary that incentivizes firms to develop environmental and energy technology and enables that technology to function smoothly in the marketplace.

Given the path dependency of technologies that firms use, it is sometimes necessary to provide powerful incentives to replace a high-carbon, polluting technology with a low-carbon, clean one. In addition to carbon taxation, R&D subsidies, and tax credits, policies are conceivable such as the establishment of intellectual property and financial markets to encourage firms’ clean technology shift. A public procurement policy for clean technology can also be expected to have the effect of bringing in private investments and funds as governments initiate R&D investment (i.e., prime-pumping effects) and encouraging private firms to develop new technology prototypes as a first step to technological innovations.

Providing disaster insurance for firms is another way to aptly utilize the market mechanism to address disaster management. In most developing countries where the financial market is underdeveloped, some government support for the establishment of that insurance is likely to be necessary, particularly in its initial stage. Dealing with environmental problems and natural disasters mainly through private firms by enhancing such underdeveloped markets can be done with an industrial policy through market creation and shaping (Mazzucato, 2013 (Note 4); 2021 (Note 5)).

To conclude, the primary role of government is to directly address market failure in the event of environmental problems and natural disaster management. Be that as it may, developing technology and establishing markets that resolve these challenges are important areas in which governments should consider intervening by using industrial policy. Hence, there seems some room for the vertical industrial policy to be applied to specific markets and technologies that can address these challenges.

Conclusion: Achieving “Asian Development Model 2.0”

We emphasized the importance of setting forth a new strategy toward sustainable economic development in Asia, which has successfully achieved rapid economic growth driven by dramatic industrialization since the previous century. We argued that the role of industrial policy be globally reconsidered in the current trend among policymakers and academic researchers as a tool to strengthen business sectors and transform economic structures. We briefly reviewed empirical knowledge regarding industrial policies and confirmed a large demand for policymaking based on EBPM. We touched upon the history of development strategies in Asia (especially AMS) and how they should evolve going forward using industrial policy. Above all, we focused on how we should incorporate digitalization in development strategies that Asian countries need to illustrate in the days ahead. As examples based upon the discussions above, two challenges and strategies were presented – digital startup business development, and environmental problems and natural disaster management.

To resolve these complicated and difficult challenges, which cut across both economic and social boundaries, developing countries in Asia need to fully mobilize market power and policy power based on the latest empirical findings while not sticking to past experiences. Industrial policies and new development strategies need to take an appropriate balance between the two powers and make a novel application of them to significant development issues. Achieving sustainable economic development while overcoming hard challenges will enable Asia to propose an “Asian Development Model 2.0” to the world. In this article, we presented broad ideas and ingredients to envisage the model. Finally, the important thing for the region’s nations is to steadily accumulate evidence of industrial policies so that they will be able to implement workable development strategies. We hope that the discussion elaborated in this article will help satisfy such expectations to achieve sustainable economic development.

Note: This article is based on research outcomes of the FY 2022 ERIA-JEF joint project, “Study on New Strategies for Recovery from the Pandemic and Sustainable Development in Asia”.

This article first appeared on the November / December 2023 issue of Japan SPOTLIGHT![]() published by Japan Economic Foundation. Reproduced with permission.

published by Japan Economic Foundation. Reproduced with permission.

November / December 2023 Japan SPOTLIGHT