Recently, we have been increasingly seeing the term, "customs union," vis-à-vis Brexit, which refers to the United Kingdom (UK)'s decision to leave the European Union (EU). This column will explain what a customs union is with emphasis on its differences with a free trade agreement (FTA). It should be noted that this column will exclusively deal with tariffs on goods.

1. MFN, FTAs, and customs unions

(1) MFN

There are several patterns in setting the tariff. The most basic pattern is the most-favored nation (MFN) tariff, which sets the same tariff on imports from all nations. The MFN principle is one of the World Trade Organization (WTO)'s basic principles, and it requires that when a member nation of the WTO sets its tariff, it does not set discriminatory tariffs on the same product among the member nations, such as imposing a 3% tariff on Country A, while imposing 10% on Country B.

(2) FTAs and customs unions

Customs unions and FTAs are called regional trade agreements, both of which are based on Article 24 of the General Agreement on Tariffs and Trade (GATT), and both effectively eliminate restrictions on all trade including tariffs among the participating nations. Both customs unions and FTAs violate the MFN, the basic principle of the WTO, and thus, in the past, there have been numerous discussions that voiced anti-regional trade agreement sentiments [1, 2].

Custom unions and FTAs may appear similar. The difference between the two is that in a customs union, the participating countries set a common customs tariff (a single external tariff applied by all members) against third countries, while in an FTA, they do not. This results in other differences: (i) under a customs union, the participating countries must engage in trade negotiations as a single entity (typically the EU), while in a FTA, the members may negotiate individually; (ii) in a customs union, free movement of goods is allowed among the member nations, although in an FTA, it is not; and (iii) under a customs union, a customs house is not required between member nations, yet in an FTA, it is required and its function may even be reinforced.

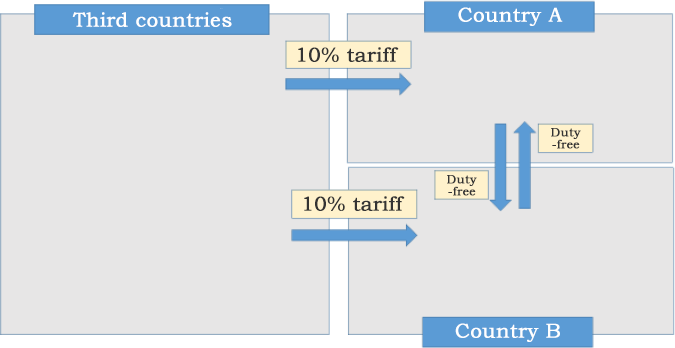

Figure 1 provides a simplified diagram of a customs union. Country A and Country B have formed a customs union. In this case, both Country A and Country B have mutually eliminated tariffs and have set a single external tariff toward the third countries (in this case, 10%). If, for example, the goods concerned is a finished vehicle, a 10% tariff will be imposed at the time the vehicle is imported into Country A and no tariff will be imposed when that vehicle is transported from Country A to Country B. Put another way, there is no need for Country B to impose tariffs on goods transported from Country A, because tariffs have already been imposed when the goods were imported into Country A. Consequently, no customs house for collecting customs duties is required between Countries A and B, and free movement of goods between the two countries becomes possible. If multiple countries comprising a customs union are allowed to take part in trade negotiations individually, it would destroy the principle of setting a common customs tariff toward third countries. Thus, in a complete customs union such as the EU, the European Commission, not the individual countries, becomes the negotiation agent.

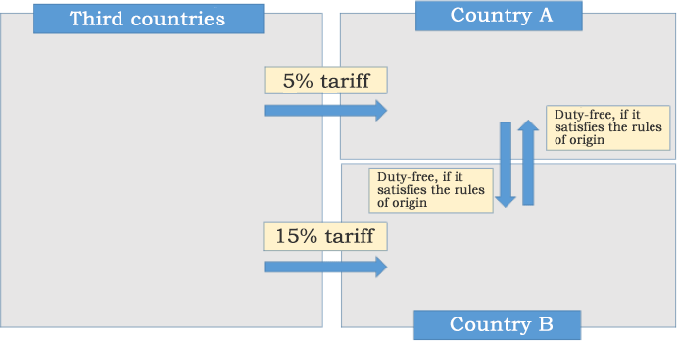

Figure 2 provides a simplified diagram of an FTA. In an FTA, both Countries A and B do not impose tariffs on each other, however, unlike a customs union, Country A imposes a 5% tariff on third countries, while Country B imposes 15%, and there is no common customs tariff. In this case, if a product imported to Country A under a 5% tariff is transported to County B, the product would be subject to the 5% tariff, not the 15% tariff of Country B, which would lead to goods flowing in via Country A under a 5% tariff. To avoid such a circumvention, an FTA usually sets the rules of origin to prove that the products are actually from Country A.

In other words, in Country B, not all the goods imported from Country A are duty-free but only those that have met the provisions of the rules of origin are. There are many variations to the rules of origin. For example, in Country B, only goods with over 40% of value added in Country A (or Country A + Country B) become subject to the FTA. Often when the effects of trade liberalization through FTAs are discussed, the explanations center mainly on the amounts of trade of the two countries. This, however, is a wrong approach. In reality, the only ones to benefit from an FTA are those goods which had originally been subject to tariffs, and that satisfy the rules of origin and thus become duty-free as a result of the FTA (there are exceptional cases where tariffs are still imposed but at a lower rate).

The costs associated with the rules of origin are far greater than what the general public would imagine. A business operator must check and see if his/her products satisfy the rules of origin, and if they do not, a decision must be made either to take measures such as switching the supplier of raw materials from other countries to his/her own country, or to give up using the FTA as a whole. Even if the products satisfy the rules of origin, various procedures including obtaining a certificate of origin and retaining his/her books must be carried out. The work load relating to customs also increases on the government side. According to an older study, the costs associated with observance of the rules of origin in NAFTA are estimated to account for 6% of the product's price [3]. Under an FTA, tax exemption is optional, but under MFN (if it is duty-free) or customs unions there is no option, and tax exemption is applied automatically.

2. Brexit

Should the UK decide to simply exit the customs union of EU, tariffs between the UK and the member countries of the EU will be reinstated. For instance in terms of vehicles, if a finished vehicle is exported from the UK to an EU member country, a 10% tariff will be imposed, and conversely, if a finished vehicle from an EU member country is exported to the UK, a 10% tariff will be imposed unless the UK alters its tariffs. By exiting the EU, the UK will be able to change its tariff from that of the EU. The UK, however, will probably be bound by the tariff rates, which had been incorporated into the EU's commitments to the WTO (referred to as the concession tax rates), and in such case, the UK will be able to easily lower the tariff but will have difficulty raising it.

In order for the UK to continue duty-free exports with the EU member countries, it will need to conclude an FTA, and it is generally understood that in such cases the goods to be exported from the UK will need to satisfy the rules of origin. However, the White Paper published by the British government is based on a different concept. Instead of setting the rules of origin, it proposes to conclude a "Facilitated Customs Arrangement" with the EU; for goods entering the UK from outside of the EU, either the EU's or the UK's tariff will be imposed depending on the final destination (if undecided, the higher of the two), thereby avoiding the problem of circumvention and allowing for the free flow of goods between the EU and the UK. In the case of most FTAs, tariffs had been set between the counterparties and then the rules of origin are discussed to be set to compensate for the elimination of such tariffs. However, the case of Brexit is different. There had been a free flow of goods to begin with, and now the counterparties are proposing to impose some restrictions on this flow. And thus, it is understandable that the UK proposes a scheme that is going against conventional wisdom, nevertheless, for the EU, it is probably an uncomfortable proposal, as the complexity of the scheme casts doubt on its feasibility.

3. Conclusion

Customs unions and FTAs may be similar but are actually more different than generally recognized. The distinction between the two may become more significant as the discussion on Brexit will proceed.