"'Making Japan a Trade and Investment Center; Attracting 470 Foreign Firms by FY2018'

On November 25, 2015, the Japanese government decided on the policy outline, which included domestic countermeasures against the Trans-Pacific Strategic Economic Partnership Agreement (TPP)....The policy outline states that the government will attract more than 470 foreign firms to Japan by FY2018 and promote the invitation of the research and development division of global firms with the Japan External Trade Organization (JETRO) as the central player."(Front page of the morning edition of the Nihon Keizai Shimbun on November 26, 2015).

The government has begun taking steps toward the expansion of foreign direct investment (FDI) in Japan. As reported above by the Nihon Keizai Shimbun, the government has set a target of attracting 470 foreign firms by FY2018. According to the 2014 Economic Census for Business Activity published on November 30, 2015, the number of firms with a ratio of foreign capital of 33.4% or more was 6,650 as of 2014. As 470 is just 7.1% of this number, this is a major goal. In this article, I will discuss the current status of Japan's inward FDI and the challenges in achieving the target.

1. Current status of FDI in Japan

First, the current status of Japan's inward FDI compared with that of other developed countries is extremely low. Indeed, this situation has continued for more than 30 years. Edward Graham, formerly of the Peterson Institute for International Economics, demonstrated in a study that although Japan's gross domestic product (GDP) made up 10% of the world's GDP in the 1980s, Japan' inward FDI accounted for less than 1.5% of FDI worldwide (Graham, 1996).

This low level of Japan's inward FDI has been pointed out often by the media in recent years as well. For example, the Nihon Keizai Shimbun on May 6, 2013 reported that the ratio of inward FDI to GDP was 23.2% in the United States and 20.0% in Germany, but only 3.9% in Japan, which is also far behind that of South Korea (11.8%) and China (10.1%).

2. Why is Japan's inward FDI stagnant?

What are the factors that hamper Japan's inward FDI in Japan? No studies has answered this question yet. Although a variety of studies have been conducted in the past on such factors, the obstacles have yet to be pinned down. For example, although exchange rates and labor costs can be considered as factors that have an impact on direct investment, a study by Satomi Kimino and her colleagues at Aston University demonstrated that they are not relevant in the case of Japan's inward FDI (Kimino, Saal, and Driffield, 2007).

Here, some point out the language differences as an obstacle. In fact, according to the Survey of Trends in Business Activities of Foreign Affiliates by the Ministry of Economy, Trade and Industry published in October 2015, the percentage of foreign-affiliated firms that cited "Business communication difficulties in English" as an obstacle was 52.9%. However, a study by Hitoshi Sato of the Institute of Developing Economies, Japan External Trade Organization (IDE-JETRO) and his colleague confirmed that even if language differences are taken into consideration, direct investment by the United States in Japan is still significantly lower than in other regions (Sato and Oki, 2012). In other words, although improvements in the English ability of Japanese people may be necessary to expand inward FDI, it is highly doubtful that this alone would be sufficient.

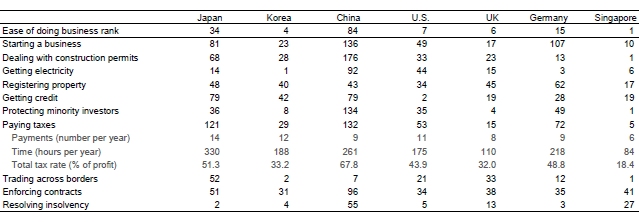

A heavy tax burden in Japan is cited as another possible factor. Table 1 shows the "Ease of doing business" ranking published by the World Bank. Japan's overall rank in 2015 is 34th among 189 countries. Japan is ranked higher than China (84th) but falls far behind South Korea (4th), United Kingdom (6th), United States (7th), and Germany (15th).

[Click to enlarge]

Source: Created by the author based on World Bank (2015).

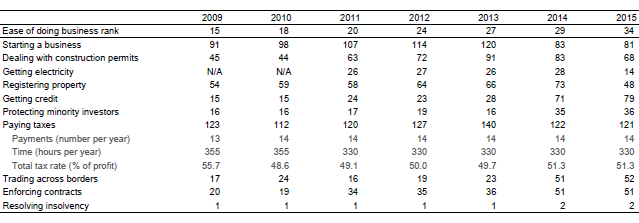

Looking at each item in Table 1, we see that Japan ranks remarkably low in tax burden. Japan's values in all indicators--number of payments, time (time required for preparing documents), and total tax rate--are higher than those in other countries. Table 2 summarizes the chronological changes in the Japan's rankings. What is interesting is that even though the "Time (hours per year)" for "Paying taxes" declined from 355 hours to 330 hours from 2010 to 2011, the ranking of "Paying taxes" dropped from 112th to 120th. What does this result mean?

[Click to enlarge]

Source: Complied by the author based on World Bank (various years).

To understand the details, it is necessary to closely examine the method of calculating the rankings, but if the survey method does not change, it is conceivable that the environment has changed not only in Japan but also in other countries. The fact that the overall ranking of Japan fell from 15th in 2009 to 34th in 2015 suggests that the investment environment in other countries has improved to a greater extent than in Japan.

The Nihon Keizai Shimbun on December 3, 2015 reported the policy of the ruling parties to reduce the effective corporation tax rate from 32.11% at present to 29.97% in FY2016. This policy can be highly valued in the sense that it will improve the investment environment for firms in Japan. However, given that other countries have also improved their investment environments, a profound effect cannot be expected if the improvement in Japan is not sufficient by international standards, even though it has improved. Accordingly, it is difficult to see how a lowering of the corporation tax rate will result in a surge in inward FDI.

3. What is required to increase inward FDI?

Of course, the "Ease of doing business" ranking published by the World Bank does not necessarily show all aspects of the investment environment in Japan. In addition, more rigorous quantitative analysis is necessary in order to take various factors other than tax burden into account. Nonetheless, we cannot ignore the fact Japan ranks consistently low in tax burden. Not only reducing the tax rate, but also simplifying and shortening documents and procedures for tax payments are also worth considering in order to increase inward FDI.

In addition, although the government has set the new entry of foreign firms into Japan as a goal, it is also an important point of view whether existing foreign-affiliated firms will take root and be able to expand their business in Japan. In association with this, it may also be effective to shift our focus to not only Japanese firms but also foreign-affiliated firms and overseas firms that have advanced into Japan when a local government attracts firms, for example. (Note1) In this respect, cooperation with JETRO, which is a gateway to inward FDI, will be effective. Of course it will be necessary to improve the English ability of Japanese people in mid- to long-term perspectives.

Improving the investment environment for foreign firms may lead to that for Japanese firms. In other words, Japan's efforts to expand its inward FDI may expand its domestic investment by Japanese firms. Regardless, to achieve the targets of the Japanese government that were stated at the beginning, 2016 will be an important year. We have to pay attention to trends in Japan's inward FDI in 2016.