Sato, Shimizu, Shrestha and Zhang (2013), Chinn (2013) and others reported that a depreciation of the yen causes Japanese exports to increase. However, following the implementation of Prime Minister Shinzo Abe's stimulus packages in the third quarter of 2012, the yen has depreciated by more than 30% while Japanese exports have not increased.

Investigating the effect of exchange rates on Japanese exports is tricky, since more than 25% of Japanese exports are parts and components (p&c) and other intermediate goods. A depreciation in a downstream country importing p&c from Japan (equivalently, an appreciation of the yen) may increase its exports of final goods to the rest of the world and thus its imports of Japanese p&c that are used to produce exports. Therefore, a depreciation in the importing country and an appreciation of the yen may be associated with an increase in Japanese p&c exports. This effect can cloud estimates of exchange rate elasticities.

One way to circumvent this problem is to investigate exports of final goods. Since Japan is an upstream country in global value chains, much of the value added of Japanese final goods exports comes from Japan. Examining how the yen affects final goods exports should provide a cleaner test of how exchange rates affect Japanese exports rather than examining how the yen affect total exports.

In every year since 1990, Japan's leading export category at the International Standard Industrial Classification (ISIC) 4-digit level has been motor vehicles. In 2014, more than 16% of the value of Japanese exports were in this category. I thus investigated how exchange rates affect the Japanese automobile industry.

I used the Mark and Sul (2003) weighted dynamic ordinary least squares technique to find trade elasticities for Japanese automobile exports to 30 countries. The estimated model provides a better fit when individual specific time trends are included along with individual specific fixed effects.

The results indicate that the yen exchange rate exerts important effects on automobile exports over the 1992-2015 period, with elasticities exceeding unity. Gross domestic product (GDP) elasticities are also large, ranging from 1.8 to 2.4.

The Japanese real effective exchange rate depreciated by more than 35% following the implementation of Prime Minister Abe's stimulus packages in the third quarter of 2012. The results imply that this should increase auto exports by about 35%. However, the volume of automobile exports has not increased.

To investigate why, I re-estimated the model up to 2013 and employed actual out-of-sample observations of the independent variables in 2014 and 2015 to forecast exports in these years. The results indicate that actual exports in 2014 and 2015 fell far short of predicted values, and that between 71% and 75% of the shortfall was for exports to North America. I then documented that, while more Japanese cars are sold in the North American Free Trade Agreement (NAFTA) region now than before the Global Financial Crisis, the share of Japanese cars produced in the NAFTA region rose 12 percentage points from 62% to 74% between 2006 and 2014. The fact that Japanese producers have moved production to North America helps to explain why exports from Japan have not recovered in the wake of the yen depreciation that began in 2012Q3 (Note 1).

For those cars exported from Japan, how have export prices reacted to fluctuations in the yen? At one extreme, exporters could adopt a pricing-to-market (PTM) strategy. This implies that an appreciation of the yen would cause a one-for-one drop in yen export prices and squeeze firms' profit margins. At the other extreme, exporters could pass through the entire exchange rate change into foreign currency export prices. This would maintain profit margins but reduce export volumes.

I investigated the degree of pass through using a single equation model where export prices depend on firms' marginal costs and on their markups over marginal cost. Specifically, I regressed the first difference of export prices on current and lagged values of the first differences of the exchange rate, foreign prices, domestic costs, and economic activity in the destination markets. I measured the exchange rate (1) as the nominal effective exchange rate calculated by the Bank of Japan, (2) as the nominal yen/dollar exchange rate, and (3) as the ratio of Japanese yen export prices for the transport equipment industry to export prices measured in the invoice currencies.

The results in all three cases indicate that an appreciation of the yen would lower Japanese yen export prices. The findings imply that a 10% appreciation of the yen would lower yen export prices for transport equipment by between 5.9% and 9.4%. These findings imply that Japanese transport equipment exporters only pass through a small share of exchange rate appreciations into foreign currency prices.

The effect is largest when the exchange rate is measured as the ratio of Japanese yen export prices to contract currency export prices. Shimizu and Sato (2015) noted that this is a good measure to include in pass-through equations. If this is true, then the results imply that yen appreciations cause large declines in export prices for transport equipment. This PTM behavior implies severe pressure on exporters' margins in the face of large appreciations.

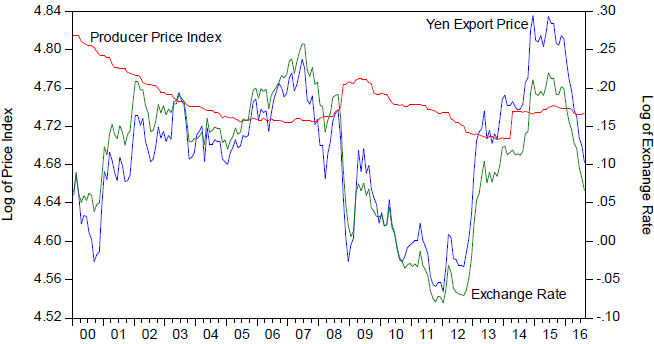

The figure sheds light on this issue. It shows Japanese yen export prices for transport equipment compared to the domestic producer price index for transport equipment. The domestic producer price index proxies for producers' costs. The figure shows that there was a huge drop in yen prices relative to yen costs, and also shows that the export price index moves very closely with the exchange rate. This indicates that yen appreciations erode profit margins for transport equipment exporters. Results from rolling regressions also indicate that, as the yen depreciated beginning in 2012, auto exporters increased their profit margins by allowing export prices to rise.

To further investigate the effect of exchange rates on firm profitability, I looked at how exchange rate changes affect stock returns. I regressed daily industry stock returns for the automobile and auto parts industries on daily changes in the yen/dollar exchange rate and daily changes in the Tokyo Stock Price Index (TOPIX) over the September 26, 2001 to September 23, 2016 period. The results indicate that a 1% appreciation of the yen would reduce automobile stock returns by 0.39% and auto parts stocks by 0.30%. The yen appreciated logarithmically by 47% between the end of June 2007 and the end of September 2011. These results imply that this appreciation caused auto stocks to fall by 18.5% and auto parts stocks by 14%. Thus, the automobile sector is significantly exposed to an appreciation of the yen.

Rolling regression results indicate that Japanese automakers are more exposed to the value of the exchange rate now than they have been at any time since 2004. The results also show that Japanese auto parts makers at present are as exposed to exchange rates as automobile producers are.

Why does an appreciation of the yen still cause such large drops in Japanese auto stock returns even in 2016? One reason could be that, as the yen appreciates, the yen value of profits repatriated from countries such as the United States falls. A second reason could be that yen appreciation decreases the yen value of Japanese automakers' plant and equipment that are located outside of Japan. A third reason could be that a strong yen matters for exports. A fourth reason could be that firms follow a PTM strategy, and this causes the profitability to be closely related to exchange rates. Future research should investigate why automobile stock returns at present are more exposed to the strong yen than at any time over the last 12 years. The answers to these questions could help Japanese automakers prepare for the risk on a strong yen in the future.