Introduction

In recent years, high-tech companies creating new technologies, industries, businesses, and business models have emerged in China against the backdrop of technological innovation in information and communications technology and other sectors. On the other hand, China is lagging behind in capital market reform, and the current regulatory framework can no longer adapt to this new environment. As a result, leading companies in China's new-economy sector, such as Alibaba, Tencent, and Baidu, have listed their stocks in New York and other overseas markets as "red-chip companies." Many rapidly growing "unicorn companies" are also preparing for listing in overseas markets.

In this article, red-chip companies are defined as ones which are mainly doing business activities in mainland China but are registered abroad, while unicorn companies are defined as unlisted start-up companies (start-up companies are generally defined as companies which are less than 10 years old) which raise funds from the outside and whose market value is $1 billion or higher. As is clear from these definitions, there is a significant overlap between the red-chip and unicorn categories. Some companies that are usually known as red-chip ones are also unicorn companies, and vice versa.

To enable these companies to list their stocks in the domestic market, the Chinese government is seeking to improve the regulatory environment. As the first major step, on March 30, 2018, the State Council announced a document titled "Several Opinions on Launching Pilot Project for Innovative Enterprises' Issuance of Shares or Depositary Receipt in Domestic Market," which was compiled by the China Securities Regulatory Commission. This document lays down new rules for domestic listings (on the A-Share sections of the Shanghai and Shenzhen markets) of red-chip and unicorn companies already listed in overseas markets. It also opens the way for high-tech companies registered abroad to be listed in the domestic market by issuing China Depositary Receipts (CDRs), which are backed by shares and other securities issued abroad.

Going forward, following a pilot test involving a selected group of companies, the new rules are expected to be fully enforced after undergoing necessary revisions. This will be a strong push for Chinese high-tech companies listed abroad to return to the domestic market and for unlisted ones to seek domestic listings. This trend is also expected to improve the quality of the capital markets.

Strict listing requirements constraining domestic listing

In China, many high-tech companies fail to meet the requirements for listing in the domestic market with respect to (1) the restriction on share ownership by foreign investors and the variable interest entity (VIE) scheme, which is adopted as a measure to circumvent the restriction, (2) the number of years in business, (3) profitability, and (4) equality among shareholders in terms of voting rights.

(1) Restriction on share ownership by foreign investors and the VIE scheme adopted as a restriction evasion measure

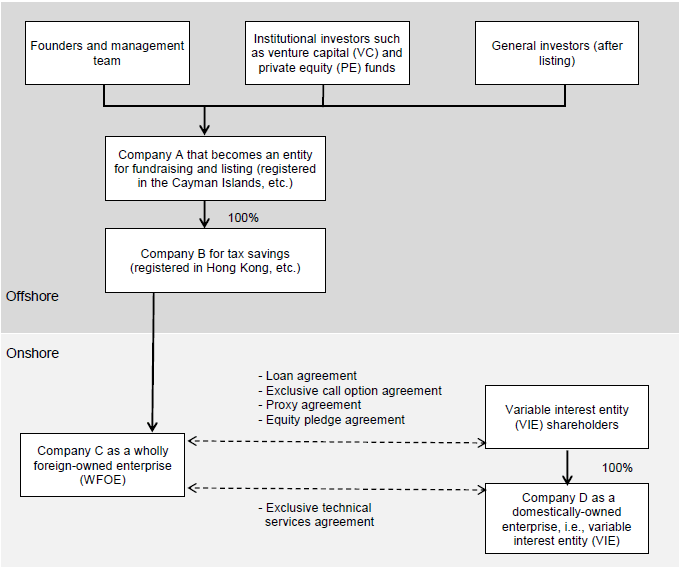

China has strictly restricted foreign investment for reasons such as the protection of domestic companies. In some industries, the foreign-owned share in a company's all outstanding shares must be less than 50%. As a measure to circumvent this restriction, many high-tech companies that have received foreign capital from early on after their founding have adopted the VIE scheme (Figure 1). Specifically, under this scheme, a company is divided into (1) a domestically-owned operating company that actually conducts business (Company D) and (2) a holding company registered abroad that becomes a vehicle for fundraising and overseas listing (Company A). Shareholders of the holding company, including foreign investors, control the domestically-owned operating company through subsidiaries (Company B and Company C) and a series of contractual arrangements, instead of share ownership, and enjoy rights similar to those of the shareholders of the domestically-owned operating company. In China, there is not a clear rule as to whether companies registered abroad and companies adopting the VIE scheme can be listed in the domestic market. However, as no such company has ever been listed in the domestic market, it has widely been understood that domestic listing is effectively prohibited.

Source: Created by the author.

(2) Number of years in business

In order to be the main board of the domestic market, companies are required to have been in business for three years or longer, and in the case of listing on the Growth Enterprise Market (GEM) board, the minimum required number of years in business is two. However, many promising startup companies do not meet this requirement, so they cannot be listed at an early date.

(3) Profitability

In order to be listed on the main board, companies are required to have earned net profits of 30 million yuan or more in each of the most recent three years, and in the case of listing on the GEM board, the required profit threshold is net profits of 20 million yuan in each of the most recent two years or annual operating income of 50 million yuan in the most recent year. Most unicorn companies do not meet this requirement. Meanwhile, the markets in the United States and Hong Kong have not set any particular profitability criterion as a listing requirement, as they place emphasis on the growth potential of startup companies.

(4) Equality among shareholders in terms of voting rights

Concerning voting rights related to joint stock companies, China's Company Law lays down the principle that one vote should be granted for each share owned. However, in some cases, companies registered abroad issue class shares which give shareholders different rights compared with common shares. For example, a type of class shares known as multiple voting rights shares, to which multiple (e.g., 10) votes per share are attached, is issued in order to enable company founders and managers to ensure stable management by defending their companies against hostile takeover bids. The dual capitalization structure comprised of common and class shares has been adopted by many Internet-related companies, including not only U.S. companies like Google and Facebook but also companies doing business mainly in China but registered abroad, such as Alibaba, Tencent, and Baidu. However, in China, listing of companies which have issued class shares is not permitted (Note 1).

Announcement of policy measures to encourage high-tech companies to be listed in the domestic market

On March 30, 2018, the State Council of China announced a document titled "Several Opinions on Launching Pilot Project for Innovative Enterprises' Issuance of Shares or Depositary Receipt in Domestic Market" (hereinafter referred to as the "Opinions"). The Opinions include references to the following policy measures and rules:

(1) Permission for red-chip companies registered abroad to issue shares in China.

(2) The introduction of a new security product called CDRs and the basic policy concerning its issuance and listing

(3) Easing of the requirements for listing in the domestic stock market (A-Share section) to allow the listing of start-up companies expected to turn profitable

(4) Rules concerning the listing of stocks of high-tech companies which adopts the VIE scheme or have issued shares with multiple voting rights

Before fully implementing these policy measures, China will conduct a pilot test involving a selected group of companies based on the following policy.

1) Selection of candidates for the pilot test from among red-chip and unicorn companies

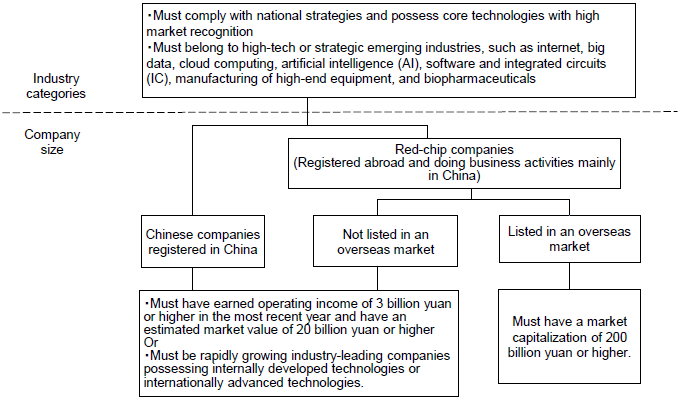

The companies to be involved in the pilot test will be selected mainly on the basis of the industry category and company size. First, candidate companies are required to comply with national strategies and possess core technologies with high market recognition. They must also belong to high-tech or strategic emerging industries, such as internet, big data, cloud computing, artificial intelligence (AI), software and integrated circuits (IC), manufacturing of high-end equipment, and biopharmaceuticals (Figure 2).

Moreover, in the case of companies already registered and listed abroad, their market capitalization must be 200 billion yuan or higher. Currently, there are only five companies that meet these requirements—Tencent (listed on the main board of Hong Kong exchange), Alibaba (listed on the New York Stock Exchange), Baidu (listed on NASDAQ), JD.com (listed on NASDAQ), and NetEase (listed on NASDAQ) (all five companies are registered in the Cayman Islands).

To be selected for the pilot test, unlisted companies, regardless of whether they are registered in China or abroad, are required to (1) have earned operating income of three billion yuan or higher in the most recent year and have an estimated market value of 20 billion yuan or higher, or must be (2) rapidly growing industry-leading companies possessing internally developed technologies or internationally advanced technologies. According to the 2017 Chinese Unicorn Enterprise Development Report, compiled mainly by the Ministry of Science and Technology's Torch High Technology Industry Development Center, 30 companies meet the minimum estimated market value requirement of 20 billion yuan (approximately $3.1 billion) (Table 1).

| Ranking | Company name | Estimated market value ($ billion) |

Industry | Year of foundation | Head office location |

|---|---|---|---|---|---|

| 1 | Ant Financial | 75.0 | Internet finance | 2014 | Hangzhou |

| 2 | Didi Chuxing | 56.0 | Car dispatch service | 2012 | Beijing |

| 3 | Xiaomi | 46.0 | Smartphone manufacturing and sales | 2010 | Beijing |

| 4 | Alibaba Cloud | 39.0 | Cloud service | 2009 | Hangzhou |

| 5 | Meituan-Dianping | 30.0 | E-commerce | 2010 | Beijing |

| 6 | Contemporary Amperex Technology | 20.0 | New energy vehicles | 2011 | Ningde |

| 6 | Bytedance | 20.0 | New media | 2012 | Beijing |

| 6 | Cainiao Network | 20.0 | Logistics | 2013 | Shenzhen |

| 9 | Lufax | 18.5 | Internet finance | 2011 | Shanghai |

| 10 | Jiedaibao | 10.77 | Internet finance | 2014 | Beijing |

| 11 | WeBank | 9.23 | Internet finance | 2015 | Shenzhen |

| 12 | Pingan Medical Insurance | 8.8 | Internet finance | 2016 | Shanghai |

| 13 | Koubei | 8.0 | E-commerce | 2015 | Hangzhou |

| 13 | Shanghai OneConnect Technology | 8.0 | Internet finance | 2015 | Shanghai |

| 15 | Jingdong Finance | 7.69 | Internet finance | 2013 | Beijing |

| 16 | Ele.me | 5.5 | E-commerce | 2008 | Shanghai |

| 17 | Ping An Good Doctor | 5.4 | Healthcare and medical care | 2014 | Shanghai |

| 18 | Weltmeister Motor Technology | 5.0 | New energy vehicles | 2011 | Shanghai |

| 18 | United Imaging Healthcare | 5.0 | Healthcare and medical care | 2011 | Shanghai |

| 18 | NIO | 5.0 | New energy and automobiles | 2014 | Shanghai |

| 21 | iQiyi | 4.59 | Entertainment | 2010 | Beijing |

| 22 | BAIC BJEV | 4.3 | New energy vehicles | 2009 | Beijing |

| 23 | UBTECH | 4.0 | Artificial intelligence | 2012 | Shenzhen |

| 23 | JBH | 4.0 | Internet finance | 2014 | Shenzhen |

| 25 | Shenzhou Zhuanche | 3.55 | Car dispatch service | 2015 | Beijing |

| 26 | Tencent Cloud | 3.3 | Cloud service | 2010 | Shenzhen |

| 27 | e-Shang | 3.2 | Logistics | 2011 | Shanghai |

| 27 | Guazi (Chehaoduo; CARS) | 3.2 | E-commerce | 2011 | Beijing |

| 27 | Maoyan | 3.2 | Entertainment | 2012 | Beijing |

| 30 | Shanghai Henlius Biotech | 3.18 | Healthcare and medical care | 2010 | Shanghai |

| Notes: 1. 20 billion yuan is equivalent to approximately $3.1 billion. 2. Subsequently, iQiyi was listed on NASDAQ (March 2018) and Ping An Good Doctor was listed on the main board of the Hong Kong exchange (May 2018). Xiaomi and Meituan-Dianping have already filed applications for listing on the Hong Kong exchange. Source: Created by the author based on the 2017 Chinese Unicorn Enterprise Development Report (March 23, 2018), compiled mainly by the Ministry of Science and Technology's Torch High Technology Industry Development Center. |

|||||

2) Two options: Public offering of shares and listing of CDRs

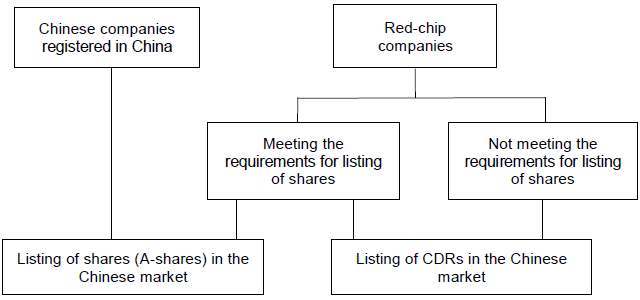

For companies selected for the pilot test in China, the Opinions indicated two options for domestic listing (Figure 3). Unicorn companies registered in China may be listed on the A-Share section of the domestic market. Meanwhile, red-chip companies registered abroad (including unlisted unicorn companies) may be listed on the A-Share section of the domestic market if they meet the listing requirements. If they do not meet the listing requirements, listing may be permitted in the form of listing of CDRs.

3) Listing of shares

In principle, companies selected for the pilot test must meet the requirements prescribed by laws and regulations such as the Securities Law, the Administrative Measures for Initial Public Offerings and Listing of Stocks, and the Administrative Measures for Initial Public Offerings and Listing on the Growth Enterprise Market. However, those companies are eligible for exemption from the requirements concerning net profit and some other matters as special cases when they apply for listing (the "Decision on Revising the Administrative Measures for Initial Public Offerings and Listing of Stocks" and the "Decision on Revising the Administrative Measures for Initial Public Offerings and Listing on the Growth Enterprise Market," issued by the China Securities Regulatory Commission on June 6, 2018). Red-chip companies may follow the company laws of the countries and regions where they are registered with respect to the shareholder mix, corporate governance, and management rules, but must comply with China's domestic laws with respect to the protection of investors' rights. In the case of companies adopting the VIE scheme, the China Securities Regulatory Commission, together with other relevant organizations, decides whether or not to permit listing in consideration of the specific situations of individual companies. The China Securities Regulatory Commission has made clear that under the current Securities Law, companies registered abroad may issue shares in China (from a reply given by Chang Depeng, a spokesperson of the China Securities Regulatory Commission, to a question concerning developments related to the pilot test for the issuance of shares and depositary receipts; March 30, 2018).

4) Listing of CDR

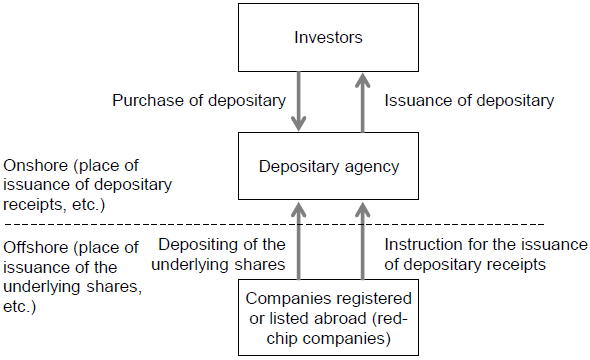

The CDR is a depositary receipt issued in China by the depositary agency on commission from Chinese companies registered abroad. The CDR is modeled on the American Depositary Receipt (ADR), which has been created in order to enable U.S. investors to make dollar-denominated investments in foreign companies (Figure 4). Foreign companies issue ADRs using shares issued outside the United States and deposited with the depositary agency as collateral. ADRs thus issued can be traded in the U.S. market after being listed there, just as ordinary U.S. shares are. Likewise, red-chip companies selected for the pilot test can issue yuan-denominated CDRs using shares deposited with the depositary agency as collateral. CDRs thus issued are listed on exchanges in China. Investors are free to trade in CDRs, and CDR holders can exercise shareholders' rights, such as the right to receive dividends, through the depositary agency.

According to the Opinions, when red-chip companies selected for the pilot test issue CDRs in China, they must meet the basic requirements for the issuance of shares prescribed by the Securities Law. In addition, although they may follow the laws of countries and regions where they are registered with respect to the shareholder mix, corporate governance, and management rules, they must comply with China's domestic laws with respect to the protection of investors' rights.

Moreover, red-chip companies seeking to issue CDRs must explicitly disclose information related to special circumstances, including the presence of class shares with multiple voting rights and the adoption of the VIE scheme, in easily visible sections of prospectus and other disclosure documents. The Administrative Measures on the Issuance and Transaction of Depositary Receipts (trial enforcement), which include detailed rules on the issuance of and trading in CDRs, were announced by the China Securities Regulatory Commission on June 6, 2018, and were put into force on the same day.

Compared with listing of shares, listing of CDRs is a low hurdle for many red-chip companies to clear in that applicant companies are not subject to the Administrative Measures for Initial Public Offerings and Listing of Stocks or the Administrative Measures for Initial Public Offerings and Listing on the Growth Enterprise Market and that the rules concerning class shares and the VIE scheme are less strict.

Contributions to the growth of unicorn companies and the new economy

The recently announced policy measures to encourage Chinese high-tech companies to be listed in the domestic market are expected to be fully implemented after undergoing some revisions following the pilot test stage. More high-tech companies, including those registered or listed abroad, are likely to use the introduction of the new measures as an opportunity to return to the domestic market.

The price earnings ratio (PER) of Chinese high-tech companies registered in China is much higher than the PER of red-chip companies in the same sector that are listed abroad. Other things being equal, domestic listings may be more favorable for high-tech companies than overseas listings. The recent reform will also make it easier for unicorn companies to raise funds through listing on the domestic market. This is expected to spur the growth of unicorn companies and, by extension, the development of the new economy.

As industry has become more and more sophisticated in the Chinese economy, the new economy's share in the entire economy has grown, but new economy-related companies' share in the A-Share section of the Chinese market has remained small. If more and more unicorn companies leading the new economy come to be listed in the domestic market, Chinese investors will be given an additional, attractive option while building their portfolios. This will lead to an improvement in the quality of China's capital markets.