Introduction

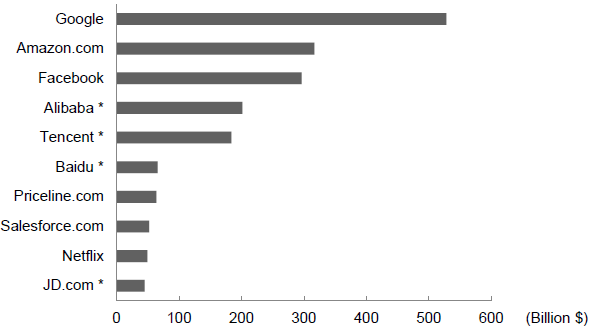

In China, the Internet industry has emerged as a new engine driving economic growth in recent years, and the "Internet Plus" action plan, which aims to amalgamate the Internet with conventional industries, has also become an important part of the government's industrial policy. Baidu, Alibaba, Tencent, and JD.com, leaders of China's Internet industry, have already grown into the world's top 10 companies, closing in on Google, Amazon.com, and Facebook in terms of market capitalization (Figure 1). Although many of the Internet companies in China were founded by Chinese and their management teams are also primarily Chinese, they are "foreign companies" in the sense that they are listed overseas, with the majority of their shares owned by foreign investors (Table 1).

| Rank | Company Name | Main Business | Year of IPO | Market | Market Capitalization (Billion $)Note |

|---|---|---|---|---|---|

| 1 | Alibaba | E-commerce | 2014 | NYSE | 240.0 |

| 2 | Tencent | Internet service | 2004 | Hong Kong | 247.8 |

| 3 | Baidu | Search engine | 2005 | NASDAQ | 60.8 |

| 4 | JD.com | E-commerce | 2014 | NASDAQ | 36.7 |

| 5 | Qihoo 360 | Anti-virus service | 2011 | NYSE | Delisted on July 18, 2016 |

| 6 | Sohu | Internet service | 2000 | NASDAQ | 1.5 |

| 7 | Net Ease | Internet service | 2000 | NASDAQ | 2.73 |

| 8 | CTrip | Travel and sightseeing | 2003 | NASDAQ | 1.90 |

| 9 | VIP | E-commerce | 2012 | NYSE | 9.3 |

| 10 | Suning | E-commerce | 2004 | Shenzhen | 15.9 |

| Note: As of August 18, 2016 Source: The top 10 Internet companies in China are compiled by the author based on the "China's top 100 Internet companies 2016" published on July 12, 2016 by the Internet Society of China, and the year of IPO, market, and market capitalization are prepared based on WIND. |

|||||

The Chinese government has imposed restrictions on ownership by foreigners in some areas including the Internet industry, with the aims of guaranteeing national security and protecting domestic industries. The fact that Internet companies are actually controlled by foreign investors seems to be contradictory to this policy, but these companies have circumvented restrictions on foreign ownership by adopting variable interest entity (VIE) structures. Under this structure, a company is divided into (1) a domestically-owned operating company that actually conducts business and (2) a holding company registered overseas that becomes a vehicle for fundraising and listing overseas, and the shareholders of the holding company that include foreign investors control the domestically-owned operating company through subsidiaries and a series of contractual arrangements, instead of ownership, and enjoy rights similar to those of the shareholders of the domestically-owned operating company.

In China, VIE structures have been widely used as vehicles for fundraising in the Internet industry as well as other areas such as education and publication where foreign ownership is prohibited or restricted. However, Chinese companies that are listed overseas are beginning to seek a return to the domestic market as progress has been made in reforming the securities market, including the listing system, and in easing restrictions on foreign ownership on the one hand, while regulations on the use of VIE structures are likely to be tightened, on the other.

The VIE structure designed to circumvent regulations

In China, companies are required to pass rigorous screening in terms of profit size in order to be listed on the domestic stock market (Note 1). The bar is high for venture companies that have not been established for long and have yet to secure stable income. With this as the backdrop, many companies have been aiming at listing overseas.

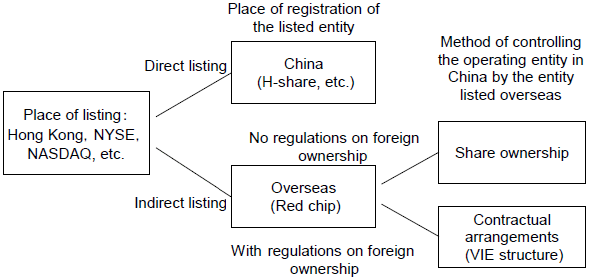

The listing of Chinese companies overseas can be classified into two types: one is to list a company registered in China directly in Hong Kong and New York, etc. (H-share, etc.), and the other is to list indirectly by transferring assets to a holding company established in a tax haven such as the Cayman Islands, which serves as a vehicle for listing (so-called red chip), (Figure 2). Direct listing is mainly used by state-owned enterprises, while companies adopting indirect listing include many private companies. Until 2012, the criteria of the so-called "456 requirements" (net assets of 400 million yuan or more, amount of funds raised of $50 million or more, and after-tax profit in the past year of 60 million yuan or more) set by the authorities had to be cleared for Chinese companies to be listed directly overseas, but these criteria can be circumvented by indirect listing.

Indirect listing can also be divided into two types in terms of the relationship between the entity listed overseas and the operating entity in China: control through share ownership or control through contractual arrangements. Because foreign ownership is restricted or prohibited in some fields, the holding company overseas, which is regarded as a foreign entity, is not allowed to control the operating company in China through share ownership. In response, the VIE structure has been designed to circumvent this regulation. Under this structure, foreign investors who provide funds to the operating companies in China control it through contractual arrangements instead of through holding its shares, which is prohibited. The holding company overseas, which is out of the reach of supervision by the Chinese authorities, serves as a platform for fundraising and eventually becomes the entity that is listed overseas.

The VIE structure is widely used, particularly by Internet companies.

Internet companies need large amounts and continuous flow of investment funds in the early years following their founding, but the capital market in China has not adequately met these needs. State-owned banks have extended loans mainly to state-owned enterprises with proven track records, and have been unwilling to provide funds to Internet companies whose risk and profitability are difficult to evaluate. Private investors also lack a long-term perspective, and missed the great opportunity of investing in the fast-growing Internet industry. As a result, Internet companies in China have to rely on foreign capital for funding from the early stages, while foreign investors have been investing aggressively in Internet companies in China in anticipation that the Chinese market will exert its huge potential.

However, foreign investment in the Internet sector is restricted through equity caps and complex licensing requirements. Specifically, according to the Catalogue for the Guidance of Foreign Investment Industries (amended in 2015), "Telecommunication companies: telecommunication increment service (foreign capital shall not exceed 50%, except for electronic commerce), basic telecom business (foreign capital shall not exceed 49%)" are classified as "Restricted foreign investment industries," while "News website, Internet publication service, network audiovisual service, Internet service location, Internet art management (except music)" are classified as "Prohibited foreign investment industries" with respect to Internet-related fields. In the 2011 edition before the amendment, "electronic commerce" was also subject to the restriction (foreign capital shall not exceed 50%), similar to the "telecommunication increment service." The VIE structure is used not only in the Internet industry, but also in education and publication, etc. as a means to circumvent restrictions on foreign ownership.

How the VIE structure actually works

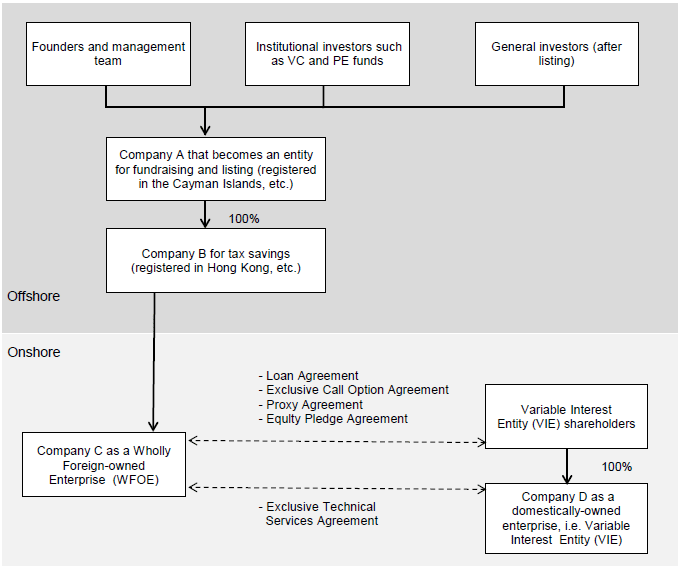

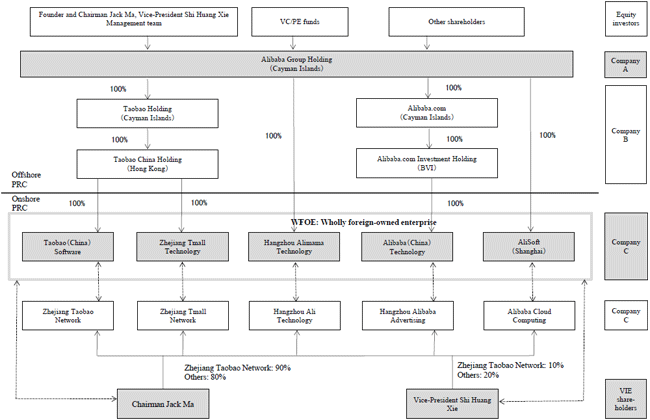

The VIE structure usually has the following hierarchical structure (Figure 3).

- (1) Company A (registered in the Cayman Islands, etc.) is established by the founders and members of the management team of a company together with institutional investors such as VC and PE funds as an entity for fundraising. Through listing, it also accepts investments from general investors

- (2) Company B is a shell company that is a wholly-owned subsidiary of Company A established overseas such as in Hong Kong for tax savings, etc.

- (3) Company C is established by Company B as a wholly foreign-owned enterprise (WFOE).

- (4) Company D is a domestically-owned enterprise, or variable interest entity (VIE) that carries out business in China.

The number of companies in each layer is not necessarily one, but rather two or more companies may coexist in many cases. In addition, shell companies may stand between the layers.

In the VIE structure, Company A, which serves as the entity for listing overseas, does not have an equity relationship with Company D, which is a VIE, but is able to control it indirectly and reap its profits through a series of contractual arrangements between Company C (WFOE) and Company D (VIE), as well as between Company C and the shareholders of Company D (VIE shareholders).

Generally, the main contractual arrangements between WFOE and VIE shareholders and the VIE are as follows.

- Between WFOE and VIE shareholders

- (1) Loan Agreement

The WFOE extends interest-free loans to the VIE shareholders, and the VIE shareholders take a stake in the VIE by using the loans to fund its capital. - (2) Exclusive Call Option Agreement

The WFOE has a right to purchase shares of the VIE from the VIE shareholders. - (3) Proxy Agreement

The VIE shareholders delegate the exercise of their rights to the VIE to a person designated by the WFOE. - (4) Equity Pledge Agreement

The VIE shareholders offer the shares of the VIE to the WFOE as collateral for loans from the WFOE.

- (1) Loan Agreement

- Between WFOE and VIE

- (5) Exclusive Technical Services Agreement

In return for technical support from the WFOE, the VIE pays almost the entire amount of its pre-tax profit to the WFOE.

- (5) Exclusive Technical Services Agreement

Sina, which was listed on the NASDAQ in 2000, is a pioneer in adopting the VIE structure, and most of the Chinese Internet companies that are listed overseas, such as Alibaba, which was listed on the NYSE in September 2014, as well as Baidu, Tencent, and Sohu, have also adopted the VIE structure. They have raised funds and succeeded in listing overseas through this scheme (see the box for the VIE structure of Alibaba).

Risks involved in the VIE structure

Although the VIE structure has facilitated fundraising and helped develop many Chinese high-tech companies, it faces a variety of risks at the same time.

As pointed out in the report titled "The Risks of China's Internet Companies on U.S. Stock Exchanges" submitted by the U.S.-China Economic and Security Review Commission to the U.S. Congress, though listing VIEs on U.S. exchanges is legal in the United States, they can be considered illegal in China where rule of law remains rudimentary. (Rosier, Kevin, "The Risks of China's Internet Companies on U.S. Stock Exchanges," U.S.-China Economic and Security Review Commission Staff Report, June 18, 2014, addendum added: September 12, 2014). Because the Chinese government has not announced specific laws regarding the VIE structure, it has long existed in a gray area between what is legal and what is illegal. The supervisory authorities in the United States are concerned that "U.S. shareholders face major risks from the complexity and purpose of the VIE structure" and obligate companies that will apply for listing, using the VIE structure, to explain the risks in their prospectus.

For example, the listing prospectus of Alibaba clearly states the following regarding the risks involved in the VIE structure: "If the Chinese government has determined that the VIE-related agreements of the Company run counter to its regulations on foreign capital, or if the relevant laws or interpretations thereof are changed, the Company could face punishment or the abandonment of profits from the VIE." "Although the structure of the Company conforms with existing practice and is used by many industry peers in China, the PRC regulatory authorities and PRC courts may in the future take a view that is contrary to the opinion of our PRC legal counsel. It is uncertain whether any new PRC laws, rules or regulations relating to variable interest entity structures will be adopted or if adopted, what they would provide. If we or any of our variable interest entities are found to be in violation of any existing or future PRC laws, rules or regulations, or fail to obtain or maintain any of the required permits or approvals, the relevant PRC regulatory, authorities would have broad discretion to take action in dealing with such violations or failures, including revoking the business and operating licenses of our PRC subsidiaries or the variable interest entities, requiring us to discontinue or restrict our operations, restricting our right to collect revenue, blocking one or more of our websites, requiring us to restructure our operations or taking other regulatory or enforcement actions against us." (Note 2)

In addition, as pointed out in the listing prospectus of Alibaba, the controlling power of investors over the management of the VIE is not as strong in the VIE structure as it is in direct investment. In the VIE structure, the overseas listed company and its shareholders do not invest in directly the operating company in China and attempt to control the VIE through WFOE based on agreements concluded with the VIE and the VIE shareholders. However, if the VIE or its shareholders break the agreements, the overseas listed company and its shareholders could be hard hit.

The risk of breaking an agreement that is involved in the VIE structure was exposed in the Alipay incident that took place in 2011. Alipay, which Alibaba had placed under its control via the VIE agreement through its subsidiary, was sold to another company under the control of Jack Ma, the chairman of the Alibaba Group, for a low price without a resolution of the Group's board of directors. Although Ma explained that this was an unavoidable measure for obtaining the operating license of the third-party payment business from the authorities, Yahoo! and SoftBank (now the SoftBank Group), the major shareholders of Alibaba Group, objected. As a result of consultations, they reached the resolution that Alipay would continue paying part of its profits to Alibaba until its listing and return part of the profits when it was listed to Alibaba. However, concerns over the VIE structure remain unresolved among investors.

Toward a return to the domestic market

As risks involved in the VIE structure come to the surface, the Chinese authorities are also attempting to tighten the regulations on it. Given the sluggish share prices of Chinese companies listed on overseas markets compared with those listed in China, the easing of regulations on the foreign ownership, the rise of Chinese venture capital, and the advancement of reforms in the domestic capital market, the number of Chinese companies aiming for listing on the domestic market by delisting their stock overseas is increasing, particularly in the field of the Internet.

One of the factors that have led Internet companies listed overseas to return to the domestic market is the growing risk that the authorities could tighten their regulation over the VIE structure. On January 19, 2015, the Ministry of Commerce of China (MOFCOM) announced the Foreign Investment Law of the People's Republic of China (Draft for Comments). Article 149 (Legal liabilities for circumventing compliance with this Law) of the Law stipulates, "Where a foreign investor or foreign-invested enterprise circumvents this Law by agency holding, trust, multi-level reinvestment, leasing, contracting, financing arrangements, agreement-based control, overseas transactions or any other means, and invests in a field specified in the list of prohibited investments, or invests in a field specified in the list of restricted investments without first obtaining a license, or violates the information-reporting obligations prescribed herein, the foreign investor or foreign-invested enterprise shall be subject to punishment." The official explanation of the draft for comments also clearly states that the draft for comments regards the VIE structure as a type of foreign investment, and that the Foreign Investment Law will apply to investments using the VIE structure after it comes into effect. Although this Law is still in the stage of draft for comments and and subject to changes, there is no doubt that the regulations for the VIE structure will be tightened.

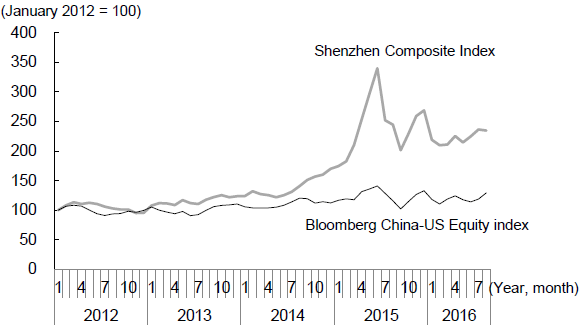

In addition, in terms of the evaluation of share prices, the domestic market is becoming increasingly more favorable than the overseas markets. In fact, the price-earnings ratio (PER) of Chinese startup companies is generally much higher in the domestic market than in the overseas markets. As shown by the comparison between changes in the Shenzhen Composite Index and the Bloomberg China-US Equity Index (consisting of Chinese stocks listed in the United States), the share prices of Chinese startup companies are sluggish in the overseas market but are rising significantly in the domestic market, albeit with significant fluctuations (Figure 4).

The regulations on foreign ownership are also being eased. In particular, the Ministry of Industry and Information Technology issued a Circular on the Liberation of Foreign Shareholding Restrictions for Online Data Processing and Transaction Processing Businesses (e-commerce operations) on June 19, 2015. This has enabled foreign companies to make a 100% investment in the field of e-commerce and foreign companies to be listed directly in China without taking the trouble of going through the VIE structure. If the regulations on the foreign ownership are eased further and the fields open to foreign capital expand more, the VIE structure will lose its reason to exist.

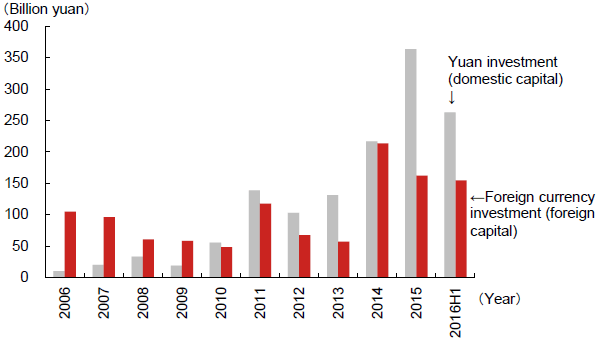

In addition, the main source of venture capital such as angels, VC, and PE to support startup companies in China had long been foreign currency investment (foreign capital), but has been replaced by yuan investment (domestic capital) in recent years (Figure 5). In fact, their sizes have reversed since 2010. When Chinese companies are delisted overseas and return to the domestic market, domestic investors will also replace foreign investors to become major shareholders of these Chinese companies.

—Yuan investment vs. foreign currency investment—

Finally, reforms in the domestic capital market are accelerating. In particular, an "opinion to further boost mass entrepreneurship and innovation" issued by the State Council on June 16, 2015 clearly states that "the government will study the possibility of listing Internet companies and high-tech companies yet to make profits on the GEM board and removing institutional impediments hindering the listing of venture companies with a special equity structure (such as VIE) in China." In addition, factors such as the further development of the National Equities Exchange and Quotations (the so-called "new third board"), which is a form of over-the-counter market for small companies in their startup period, a shift from the approval system to the registration system of listing, and the easing of listing requirements will also encourage Chinese companies listed overseas to return to the domestic market.

Box: The VIE structure of Alibaba

In terms of the structure of the VIE structure described in Figure 3, in the case of Alibaba, Alibaba Group Holding registered in the Cayman Islands corresponds to the listing entity (Company A), Taobao Holding (Cayman Islands), Taobao China Holding (Hong Kong), Alibaba.com (Cayman Islands), and Alibaba.com Investment Holding (BVI) are equivalent to the shell company (Company B) established for tax saving, etc., Taobao (China) Software, Zhejiang Tmall Technology, Hangzhou Alimama Technology, Alibaba (China) Technology, and Ali Software are WFOEs (Company C), and Zhejiang Taobao Network, Zhejiang Tmall Network, Hangzhou Alibaba Technology, Hangzhou Ali Advertising, and Alibaba Cloud Computing correspond to VIEs (Company D) that carry out business (Figure). Although Alibaba Group Holding (Company A), the listing entity, is not supposed to have a stake in these VIEs (Company D) according to Chinese laws, through the VIE-related agreements, it is able to enjoy almost the same rights as those shareholders who own the VIEs.

[Click to enlarge]

Alibaba, which was established in 1999, was listed on the New York Stock Exchange in September 2014 as the world's largest-ever IPO, and raised $25.0 billion. Before that, Alibaba had raised funds from many foreign investors including SoftBank (now SoftBank Group Corp.) in Japan and Yahoo! Inc. in the United States. Shareholders of Alibaba Group Holding before listing consisted of SoftBank with 34.3% and Yahoo! with 22.5%, with a much higher stake than Jack Ma, the founder and the executive chairman, who held 8.9%, and Joseph Tsai, the vice-chairman, who held 3.6% (the listing prospectus submitted by Alibaba Group to the U.S. Securities Exchange Commission, August 12, 2014). This shareholder composition centered on foreign investors is in contrast to the shareholder composition of the VIEs, which are held 100% by Ma and Vice-President Shi Huang Xie, who are Chinese nationals, combined.

The listing prospectus of Alibaba states, "Although not currently allowed under PRC law, if and when permitted by law, we may conduct a public offering and listing of our shares on a stock exchange in China in the future." However, the biggest obstacle to listing in China is precisely the fact that foreign investors control the VIEs in the field where they are prohibited from investing foreign capital through the VIE structure.

The original text in Japanese was posted on September 14, 2016.