In China, housing prices have risen sharply in recent years, particularly in first-tier cities such as Beijing and Shanghai, showing the characteristics of a bubble. In response, the government has launched a series of measures in an attempt to control the rise, such as tighter restrictions on housing loans and qualifications for purchase. Consequently, the housing market is now entering a correction phase, and this looks likely to become a negative factor for the prospects of the Chinese economy and primary commodity prices in 2017.

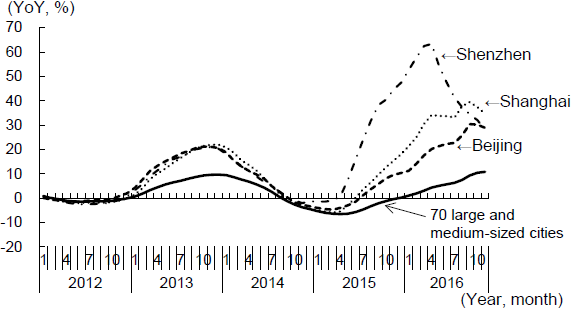

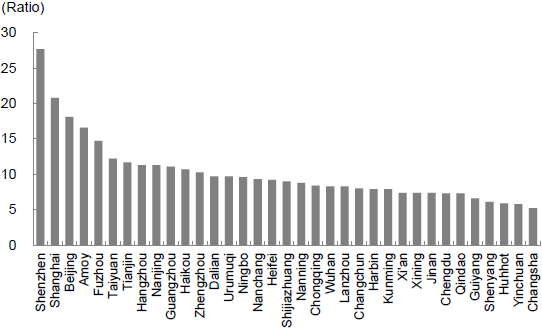

Since mid-2015, Chinese housing prices have soared in stark contrast to plunging stock prices. The pace of increase in housing prices has been particularly fast in the first-tier cities. At the peak, housing prices rose by 63.4% year on year in Shenzhen (April 2016), 39.5% in Shanghai (September 2016), and 30.4% in Beijing (September 2016) (Figure 1). Judging from the ratio of housing price to household income, Chinese housing prices have already reached the bubble stage. In 2015, the ratio of housing price to household annual income reached 27.7 in Shenzhen, 20.8 in Shanghai, and 18.1 in Beijing (Figure 2), far exceeding the level observed in Tokyo in the bubble period of the late 1980s.

To control the swelling of the housing bubble, restrictions on housing loans and the qualification for purchase have been strengthened in major cities including Beijing, Tianjin, Shenzhen, Guangzhou, and Shanghai since the beginning of 2016. One typical case is the policy adopted in Shenzhen on October 4, 2016 summarized below (Shenzhen municipal government, "Some Measures to Further Promote the Stable and Healthy Development of Shenzhen's Real Estate Market" on October 4, 2016).

Restrictions on housing loans

- The down payment is 30% or more when a household is buying a house for the first time, if the household does not own a house and if there is no record of a commercial housing loan or housing provident fund loan.

- The down payment is 50% or more when a household buys a house, if the household does not own a house and if there is a record of a commercial housing loan or housing provident fund loan.

- The down payment is 70% or more if a household that intends to buy a house already owns a house and is buying a second one.

Restrictions on the qualification for purchase

- Households with a household registration in Shenzhen are permitted to buy a maximum of two houses.

- Single adults (including divorced persons) with a household registration in Shenzhen are allowed to buy a maximum of one house.

- Residents without a household registration in Shenzhen who are able to submit a tax payment certificate or a certificate proving payment of social insurance in Shenzhen for five years or more are allowed to buy a maximum of one house.

- Other residents without household registrations in Shenzhen are prohibited from buying a house.

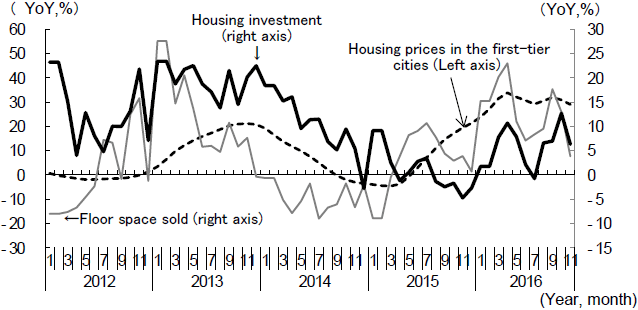

Thanks to these policies, the housing market is entering a correction phase. Growth (year on year) in the floor space sold and the housing prices in first-tier cities, which are effective leading indicators of housing investment, has slowed after peaking in April 2016. As a result, the growth rate of housing investment has begun to decelerate from its peak in October 2016 (Figure 3).

Housing investment in China accounts for approximately 10% of gross domestic product (GDP) and has a significant impact on the economy because it fluctuates markedly. The year-on-year rate of growth in housing investment rose from 0.4% in 2015 to 6.0% in January through November 2016, and its contribution to GDP growth also increased from 0.04% (0.4% × 10%) to 0.60% (6.0% × 10%). However, housing investment in China is expected to slow in 2017, and the economic growth rate is also likely to decline as a result.

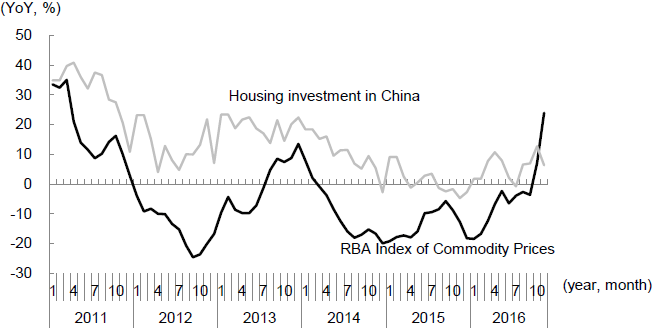

Fluctuations in housing investment in China have a significant impact on the international market conditions of primary commodities, mainly through demand for steel and related industries. Indeed, the Reserve Bank of Australia (RBA) Index of Commodity Prices, which has a strong tendency to move in tandem with housing investment in China, has shown a rapid recovery (Figure 4). In 2017, however, the expected deceleration of housing investment in China is likely to cap prices of iron ore and coal through weaker demand for steel.

The correction of the housing market will have an impact not only on the real economy in China and overseas, but also on the flow of funds. Because capital flow is restricted and investment options are limited for Chinese investors, there is a tendency for funds to flow into the housing market when stock prices are slumping and then return to the stock market when housing market conditions are unattractive. Should this pattern continue to hold, falling housing prices may trigger a rise in stock prices in the months ahead.

The original text in Japanese was posted on January 10, 2017.