Large Exchange Rate Appreciations

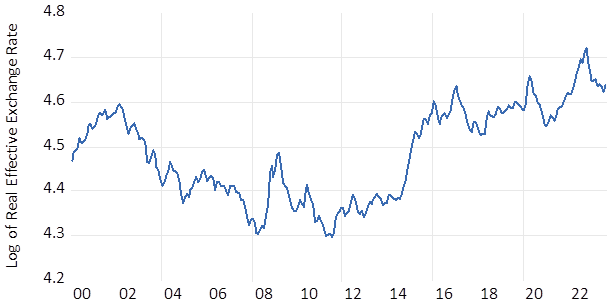

Exchange rates can appreciate substantially. The U.S. real effective exchange rate (REER) appreciated 34% between July 2011 and September 2023 (see Figure 1) (Note 1). The Swiss REER appreciated 36% between October 2007 and September 2011. The Japanese REER appreciated 38% between July 2007 and January 2012. The British REER appreciated 27% between January 2009 and August 2015.

Large appreciations erode the price competitiveness of exports and cause dislocation. The Swiss National Bank responded to the appreciation in September 2011 by setting a floor for the Swiss franc relative to the euro. The yen appreciation decimated the Japanese electronics industry. The pound appreciation crowded out the British manufacturing sector (see Krugman, 2016 and Mody, 2016).

Exchange Rate Elasticities and Product Complexity

How can countries protect themselves from the harmful effects of appreciations on exports? One way would be to produce goods that are less sensitive to exchange rates. Abiad et al. (2018) and Asia Development Bank (2018) noted that sophisticated goods are harder to produce. There will thus be fewer substitutes for these goods and customers will need to spend more time and effort to find replacements. When there are fewer substitutes, microeconomic theory teaches us that price elasticities will be lower. Thus exports of complex products may be less sensitive to exchange rates.

Abiad et al.(2018) and Asia Development Bank (2018) recommended measuring product complexity using the methods of Hidalgo and Hausmann (2009). Hidalgo and Hausmann employed the method of reflections to calculate a product’s complexity. This approach takes account of how ubiquitous a good is, as measured by the number of countries that have a revealed comparative advantage in exporting the good. This method also takes account of how diversified an economy is, as measured by the number of goods that the economy exports with revealed comparative advantage. Hidalgo and Hausmann used an iterative process involving product ubiquity and economy diversification to derive a product complexity index (PCI) for more than 1,200 products disaggregated at the Harmonized System (HS) 4-digit level.

Arbatli and Hong (2016) employed Hidalgo and Hausmann’s (2009) PCI to investigate whether more sophisticated exports from Singapore have lower exchange rate elasticities. They used annual data disaggregated at the HS 4-digit level over the 1989 to 2013 period. They also used a mean group estimator and found that products that are more complex are less responsive to exchange rates.

Sauré (2015) investigated how exchange rates impact Switzerland’s trade in pharmaceutical and non-pharmaceutical goods. Pharmaceutical goods are sophisticated and require extensive research and development. He employed annual panel data on Switzerland’s trade with 24 partners over the 1988–2007 period. He used Arellano-Bond estimation and reported that an appreciation of the Swiss franc had no impact on Switzerland’s trade balance in pharmaceutical goods but lowered Switzerland’s trade balance in non-pharmaceutical goods.

Baiardi et al. (2015) examined price elasticities for clothing. Clothing is a low-technology good produced by many countries. They used annual data over the 1992-2011 period on clothing exports from 12 countries disaggregated into 4-digit Standard Industrial Trade Classification categories. They measured relative prices as the ratio of the country’s export unit value for each 4-digit clothing category to the average export unit value for the other 11 exporters of the same good. They employed system generalized method of moments techniques and found that price increases decreased exports for 11 of the 12 countries. On average, a 10% increase in relative prices for these countries would reduce clothing exports by 7.5%.

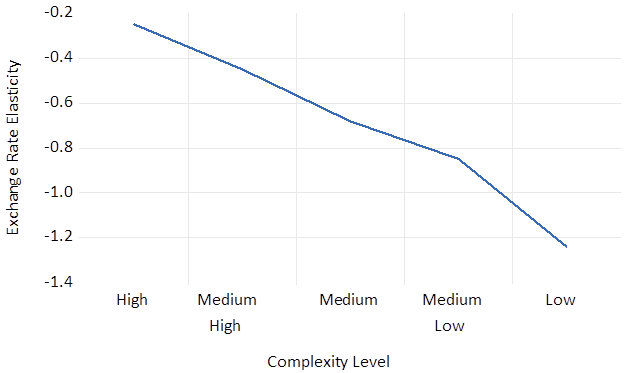

Previous research thus indicates that sophisticated exports such as pharmaceuticals are not affected by exchange rates and while basic products such as clothing are. In recent work (Thorbecke et al., 2021 and Chen et al., 2023), we investigated the relationship between product complexity as measured by Hidalgo and Hausmann’s (2009) method and exchange rate elasticities for China, the world’s leading exporter. We used Bénassy-Quéré et al.’s (2021) approach to estimate exchange rate elasticities. Thorbecke et al. examined China’s exports of 960 manufactured goods disaggregated at the HS 4-digit level to 190 partners over the 1995-2018 period. They reported that a 10% appreciation of the Chinese yuan causes a fall in exports of 2.5% for the most sophisticated exports, 4.5% for medium-high sophisticated exports, 6.8% for medium sophisticated exports, 8.5% for medium-low sophisticated exports, and 12.4% for the least sophisticated exports (see Figure 2). Chen et al. examined China’s exports of 1,242 goods disaggregated at the HS 4-digit level to 190 partners over the 1995-2018 period. They found that appreciations significantly reduced exports during the 1990s and early 2000s. However, as China has upgraded its production capabilities and exported more technologically advanced products, its exchange rate elasticities have fallen.

Source: Calculations by the authors.

Lessons for the U.S.

For the appreciations mentioned in the opening paragraph, exchange rates subsequently depreciated for Switzerland, Japan, and Britain. The U.S. REER, however, remains strong. Recent estimates suggest that a strong U.S. dollar keeps steady state U.S. exports lower and the steady state U.S. trade deficit higher.

The Atlas of Economic Complexity reported that the ranking of the U.S. economy in terms of complexity has fallen eight places between 2000 and 2021 while the ranking of the Chinese economy has risen 21 places over this period. According to the Atlas, Japan, South Korea, and Singapore ranked among the top five most complex economies in the world in 2021. Historically the success of East Asian economies at climbing the technology ladder and producing sophisticated goods was driven by factors such as entrepreneurs who face appropriate incentives, workers who are hardworking and well-educated, fiscal policy that is disciplined, national saving rates that are high, infrastructure that is world class, and exchange rates that are not too strong. The U.S., to increase the complexity of its exports and to better weather periods of strong exchange rates, should take a page out of Asia’s playbook. It should also avoid policy mixes such as expansionary fiscal policy and contractionary monetary policy that produce large dollar appreciations.

This article first appeared on Econbrowser on October 20, 2023. Reproduced with permission.