In response to sanctions imposed on Russia following the invasion of Ukraine, President Putin recently announced that ‘unfriendly’ countries would have to pay for Russian gas (and perhaps oil in the future) in roubles. This column discusses the possible reasons for the announcement and the potential economic and financial implications if Putin were to follow through on it.

On 23 March 2022, President Putin puzzled the world, and international economists, with the apparently strange announcement that ‘unfriendly’ countries would have to pay for Russian gas (and, perhaps, oil too in the near future) in Russian roubles. This move was a reaction to the sanctions these countries had agreed on quickly in response to the invasion of Ukraine by Russia on 24 February 2022. The sanctions included, notably, the exclusion from the SWIFT bank messaging system of selected Russian banks and the freezing of assets of the Bank of Russia, the country’s central bank, coupled with subsequent restrictions on the wealth and movement of some Russian oligarchs.

Why might Putin have made this announcement? At least three key possible reasons come to mind, all related to well-known theoretical and empirical work in international monetary economics:

- Market segmentation, arising from obstacles to the formation of a unique global market with a single price for a product (in this case, gas), allows monopolistically competitive firms (such as Gazprom in this case) to operate pricing-to-market strategies by choice of the currency of pricing in international transactions for each such segmented market.

- A shift of the exchange-rate risk from Gazprom as exporter to its importer counterparties in the ‘unfriendly’ countries, which could potentially result in rising energy costs if the rouble gains value in a medium-to-longer run.

- As a consequence, the move could boost demand for roubles in international forex markets, in particular by forcing the West to allow gas and oil buyers a way to purchase roubles under the current sanction regime, and thus – presumably – a way for Russia and its central bank to sell those roubles.

The combination of these three factors, and especially the final one, might potentially enhance the international role of the rouble.

In the remainder of this column, I shall try to explain, in turn, each of these three possible reasons behind Putin’s announcement.

Market segmentation allows price discrimination

Theoretically as well as empirically in international trade and finance, global market segmentation (to the extent it exists due to transportation and related costs of crossing oceans and national borders) in the goods (and services) market enables ‘pricing-to-market’ behaviour by monopolistically competitive firms – a term coined by Krugman (1987). Buyer’s (or consumer’s) or local currency pricing – as in the new open economy macroeconomics literature of the turn of the millennium (Note 1) – is a form of pricing-to-market, where exporters set prices in the currency of their respective local export market. For example, a Japanese exporter to France will set its price in euros and to the US in dollars. More precisely, pricing-to-market is third-degree price discrimination, allowing different markets to be charged different prices (or payment currencies) for the same exported product (Note 2).

By contrast, under the ‘traditional’ Mundell-Fleming-Dornbusch paradigm in international trade and macro models prior the late 1980s, as well as in the seminal new open macro papers by Obstfeld and Rogoff (1995) and Gali and Monacelli (2005), export prices were modelled as being set in the national currency of the exporter, seller, or producer (i.e. producer’s currency pricing). For example, an Italian exporter to Canada as well as to the UK or the US or any other country will set its price always in euros, irrespective of where it sells its products.

Choice of payment currency affects the allocation of exchange-rate risk

The currency choice matters since it determines whether the buyer or the seller bears the exchange-rate risk. Such uncertainty may either harm or benefit ex post the bearer of the exchange-rate risk ex ante, which is not always easy to predict – hence the importance of stipulating the currency of payment in trade contracts. Under producer’s currency pricing, the exchange-rate risk is borne by the buyer or importer (i.e. the West in the case of gas considered here), while under local currency pricing, the exchange-rate risk is borne by the seller or exporter (i.e. Russia).

In addition to producer’s currency pricing and local currency pricing, vehicle currency pricing and dollar currency pricing are also widely used and studied in the literature. Under vehicle currency pricing (e.g. Goldberg and Tille 2008), prices are set in a different currency to that of both the exporter and importer (the US dollar under dollar currency pricing; e.g. Boz et al. 2018, 2020, Egorov and Mukhin 2021). A firm that exports or imports will have a particular combination of invoicing practices and pricing currencies, where these four conventions will coexist. Their precise proportions, and hence the implied exchange-rate uncertainty for the trading parties, depend on the type of goods and services (due to international customs or practices), but are periodically renegotiated in trade contracts (which have a typical duration of about 3–6 months).

Hence, Putin’s announcement on 23 March can be viewed, from the perspective of trade between Russia and the West, as a proposed change to who bears the exchange-rate risk in the trading of gas. If the Russian rouble depreciates in the medium-to-longer run, it will become cheaper for the West to finance its imports from Russia. But if the opposite trend is observed, or in some way encouraged to prevail – and the logic behind Putin’s decision might have been exactly this – then the West bears the risk of paying more and more when buying the roubles to pay for its gas imports.

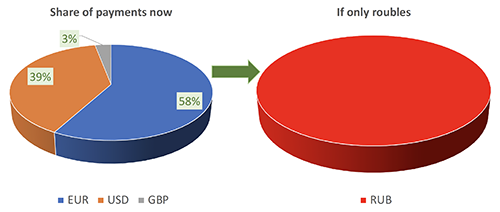

According to a Sky News article of 25 March 2022 (Note 3), “Russia is estimated to rake in up to $800m every day from its sales of gas to Europe. Of this, some 58% is paid for in euros, with 39% in US dollars and 3% in sterling”. This currency composition of the existing payment arrangements has, in effect, isolated the EU, the UK, and other foreign importers of Russian gas – and, ultimately, the consumers via the ‘pass-through’ from import to consumer prices along the pricing chain – from exchange-rate risk (that is, from any fluctuations in the exchange rate of the Russian rouble). This is because EU and UK importers pay in euros or sterling, the international currencies their respective central banks issue, or in US dollars. In other words, a German or Italian importer or consumer of Russian natural gas has so far been protected from/unaffected by fluctuations in the exchange rate of the euro against the rouble, as the payment is fixed in euros. This will change if a switch to buying gas in roubles is somehow enforced (see this transition in Figure 1). Such a transition, however, may induce EU countries to decrease their dependence on Russian energy sources even more than has been discussed recently.

Figure 1 Putin’s announcement of a transition in currency of payment for Russian gas of 23 March 2022

Why would switching to payment in roubles matter?

The exchange rate at which EU or UK importers and consumers would sell euros or pounds to buy roubles in international forex markets to pay for their imports of Russian gas will start to matter: an expensive rouble will be costly for everyone from the importing firm, to the industrial factory or transportation company, down to the household using, for example, Russian gas for heating. Under the proposed change in the pricing rule, long-run demand for – and hence, upward market pressure on the value of – the Russian rouble in international currency markets (Note 4) would appear ‘guaranteed’ by an underlying long-run demand for Russian gas and oil by the West.

This will be true as long as substitution towards other exporters of these core raw materials for every importing economy is not easy; and the same applies to substitution toward greener technologies that do not use gas or oil, or at least use significantly less. If such substitution options remain limited, the announced change to payment arrangements will presumably have long-run supportive effects on the value of the Russian rouble in international markets. This would be a possible scenario unless Russia becomes totally isolated under a trade and payments embargo, as suggested in recent calculations and calls from fellow economists – in Germany in particular (e.g. Bachmann et al. 2022) – in the hope of ensuring the quickest and most efficient (and safest for the world?) end to the war in Ukraine. But the ultimate decisions in market democracies are of course delegated to governments and parliaments; the role for us as economists is to provide quantified scenarios for feasible options that inform policymakers.

Moreover, what Putin’s economic advisers may have envisaged is that such a measure, if implemented, is likely to pave the way for the Russian rouble to eventually gain a more prominent position as a reserve or international currency. The ‘exorbitant privilege’ pertaining to the US dollar due to its central and nearly century-old role as the world’s major reserve and payment currency is a well-known concept among economists. Barry Eichengreen published a book in 2010 with this concept in its title. In their review of Eichengreen’s book, Richardson and Zhang (2013) explain that the concept is related to “the advantages that accrue to the United States because it possesses the dominant global currency, a situation which Charles de Gaulle’s finance minister Valery Giscard d’Estaing referred to as ‘exorbitant privilege.’ This privilege confers considerable benefits for US residents, banks, and firms.” Obviously, such longer-run effects and prospects are now desirable to, and pursued by, the Kremlin too.

Concluding comments

In this column, I have highlighted the likely key reasons behind Putin’s recent announcement to force the West to pay in roubles for its gas supplies from Russia, as well as the main economic and financial implications. Yet, it is also possible that the announcement was not really meant as a serious and credible economic proposal, but rather as just a random act of political theatre or an attempt to cloud the discussion of an embargo.

Author’s note: I am grateful to Richard Baldwin for constructive feedback on my initial draft. Any remaining potential errors or misinterpretations are my own responsibility

This article first appeared on www.VoxEU.org on March 29, 2022. Reproduced with permission.