The economic consequences of Covid-19 are often compared to a war, prompting fears of rising inflation and high bond yields. However, historically, pandemics and wars have had diverging effects. This column uses data extending to the 1300s to compare inflation and government bond yield behaviour in the aftermath of the world’s 12 largest wars and pandemics. It shows that both inflation and bond yields typically rise in wartime but remain relatively stable during pandemics. Although every such event is unique, history suggests high inflation and bond yields are not a natural consequence of pandemics.

In economic terms, the battle against the Covid-19 pandemic is often compared to a war – national resources have been commandeered in the battle against an ‘invisible enemy’, driving government debt levels sharply higher around the world (Baldwin and Weder di Mauro 2020). For financial markets, one worrying aspect of this analogy is that the aftermaths of major wars have often been associated with rising inflation, high bond yields, and financial disruption.

But how close does the ‘pandemic as war’ analogy hold in practice? In a recent paper, we used data extending back to the Black Death in the 1300s to compare how inflation and government bond yields have behaved in the aftermath of history's 12 largest wars and pandemics (Daly and Chankova 2021).

From Covid-19 to the Black Death: Very long-run data on inflation and bond yields

Our inflation and bond yield data come from two separate sources, both from economists at the Bank of England (Bank of England 2021, Schmelzing 2020), and our country sample consists of France, Germany, Italy, Netherlands, the UK, Spain, the US, and Japan (Note 1).

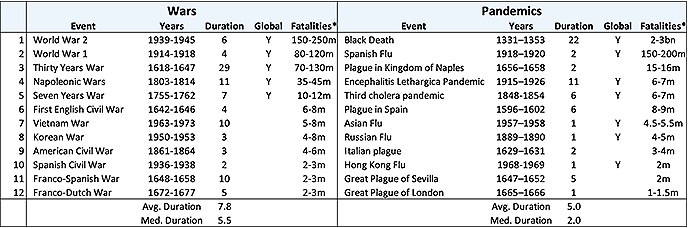

Our sample of wars and pandemics includes the 12 largest wars and pandemics measured by deaths, excluding regional wars and pandemics affecting countries/regions where we have no data (Table 1) (Note 2). Re-scaling fatalities to today's global population, the cut-off point for inclusion in the sample is around two million deaths for wars and around 1-1.5 million deaths for pandemics (compared with an estimated 2.7 million deaths globally to date from Covid-19) (Note 3).

Source: Goldman Sachs Global Investment Research, Cirillo and Taleb (2020).

Wars result in higher inflation and bond yields, pandemics do not

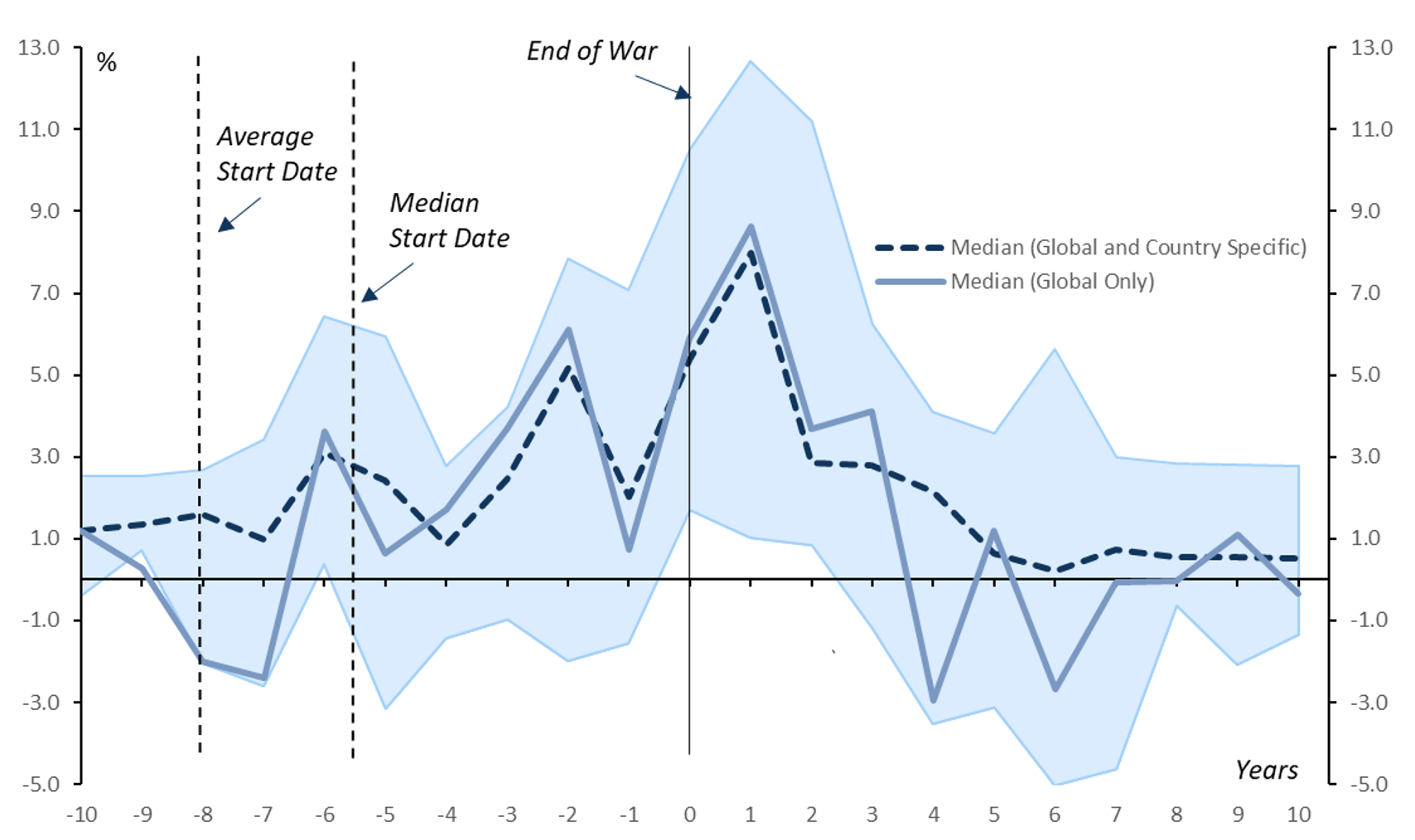

Figure 1 displays the median behaviour of inflation around major wars, together with its interquartile range (and also a median based only on global wars in our sample). Inflation has typically risen sharply both during and – especially – in the aftermath of major wars, with median inflation peaking at 8% one year after the war has ended.

Source: Goldman Sachs Global Investment Research, Bank of England (2021), Schmelzing (2020).

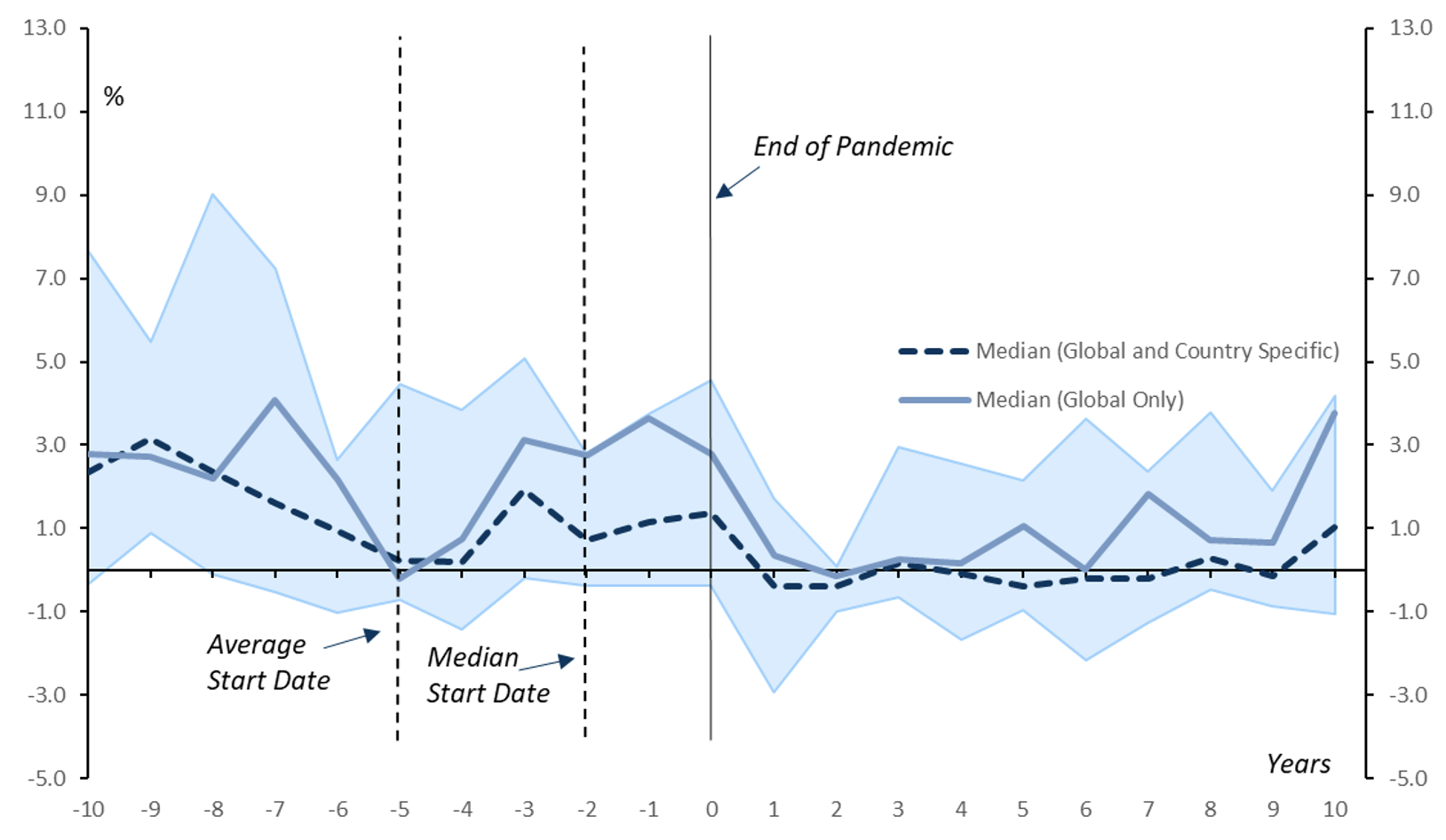

Figure 2 displays the same inflation data around the ends of pandemics. Inflation has typically remained weak during pandemics and declined in their aftermath, with median inflation falling below zero one year after the pandemic has ended and fluctuating close to zero for nine years after the pandemic has ended.

Source: Goldman Sachs Global Investment Research, Bank of England (2021), Schmelzing (2020).

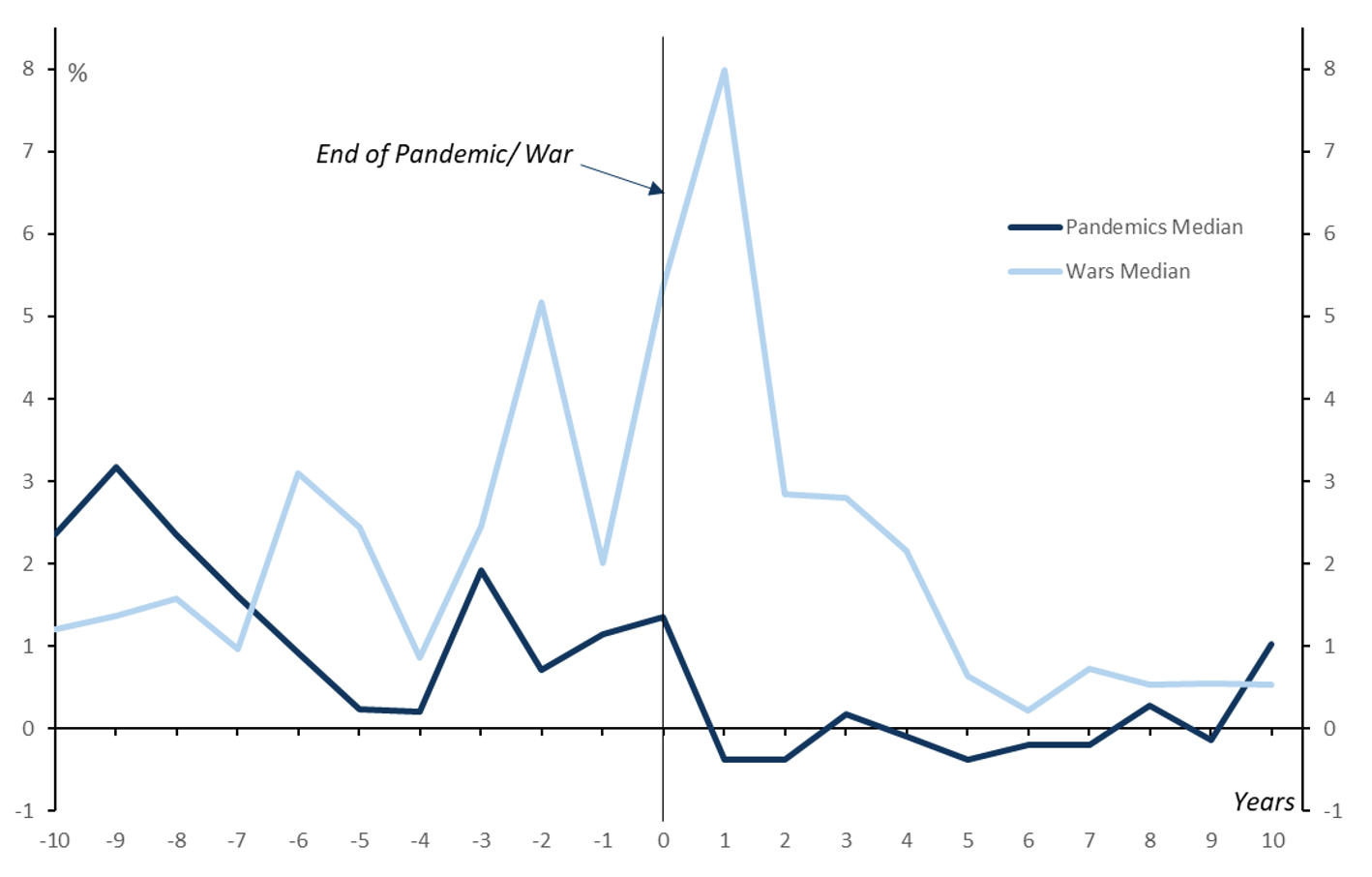

The contrast between the behaviour of inflation following wars and following pandemics is particularly clear in Figure 3, which plots median inflation rates across the 12 wars and pandemics.

Source: Goldman Sachs Global Investment Research, Bank of England (2021), Schmelzing (2020).

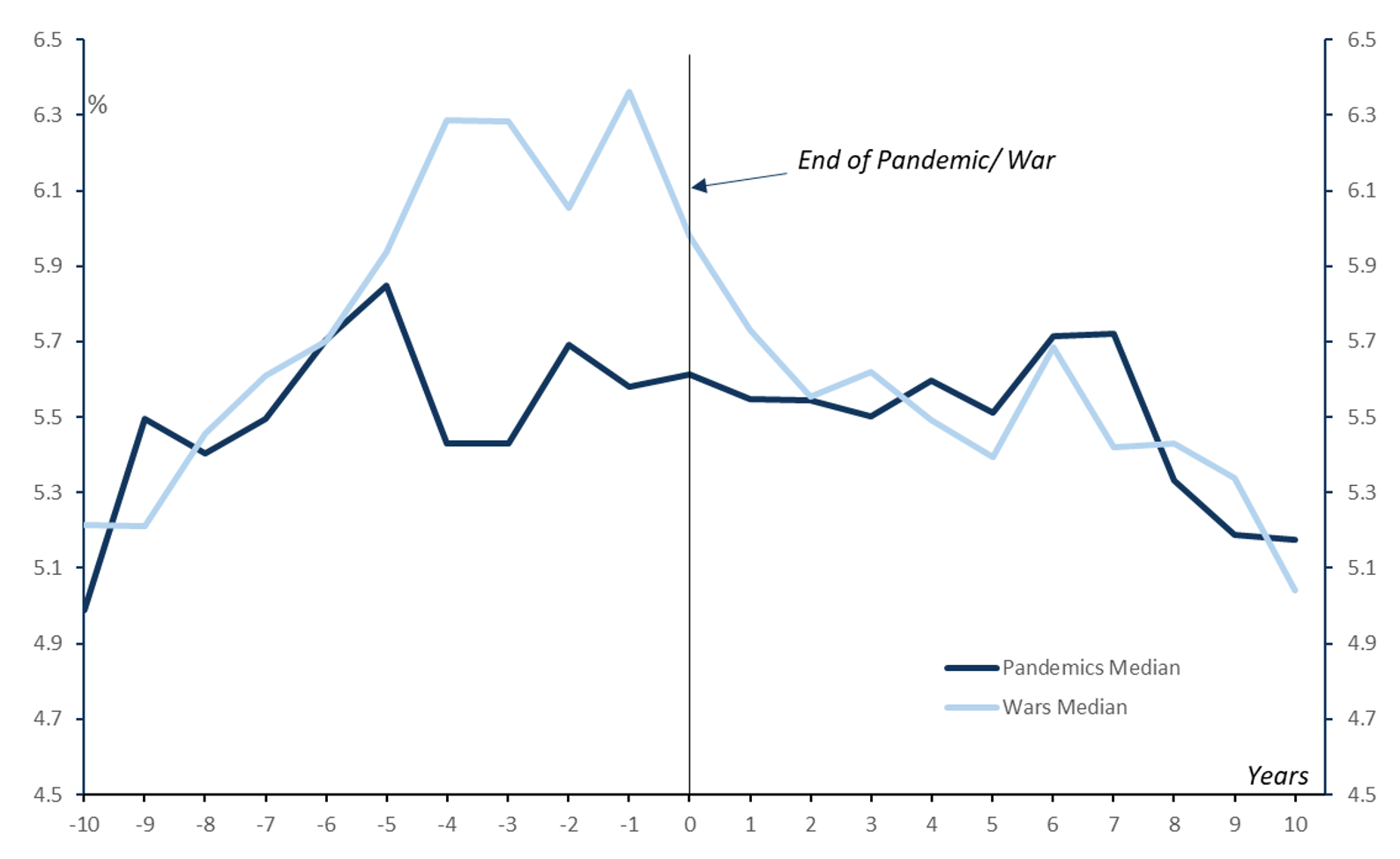

In Figure 4, we set out the same comparison for nominal government bond yields (Note 4). Bond yields have typically risen during wars, with median bond yields increasing by around one percentage point to a peak of 6.4% in the final year of the war. By contrast, during pandemics, median bond yields remained stable at around 5.5%, before declining in the years following the pandemic.

Source: Goldman Sachs Global Investment Research, Bank of England (2021), Schmelzing (2020).

Lessons from the past: From the world wars to the Black Death

Averaging across a number of wars and pandemics can obscure important details. It is therefore instructive to also explore some key episodes in a little more detail, to see how the contrasts between wars and pandemics have played out:

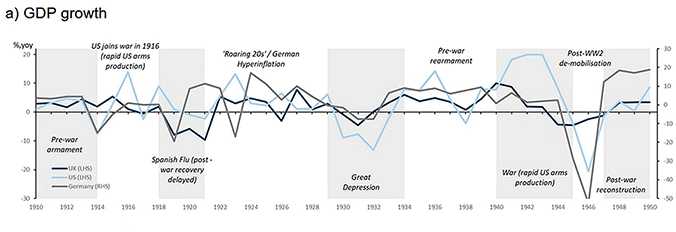

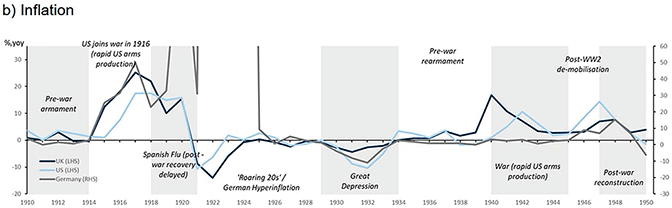

- WWI (1914-18): The years leading up to the outbreak of war were characterised by relatively rapid growth, partly fuelled by a rapid military expansion by European powers (Figure 5). Inflation accelerated sharply across Europe from 1914 onwards, as the UK, Germany, and France were forced to abandon the gold standard, rising to a peak of 50% year-on-year in Germany and 25% year-on-year in the UK in 1917. The US did not join the war until 1916 and growth and inflation both accelerated sharply in that year, with GDP rising 14% year-on-year and inflation reaching 17% year-on-year in 1917.

- The ‘Spanish Flu’ (1918-1920) is estimated to have killed around 40-50 million people worldwide, or 2-2.5% of the world's population, around twice the number that died during WWI. While growth and inflation both weakened during the pandemic (Figure 5), it is difficult to determine from time series data alone whether this was due to the war ending or the pandemic. To distinguish between these effects, Barro et al. (2020) use cross-sectional data on war and flu deaths. On this basis, they estimate that the Spanish Flu reduced real GDP per capita by 6% on average and that, in contrast to the highly inflationary effects of WWI, the pandemic had a ‘negligible’ impact on the price level.

- WWII: In common with WWI, the years leading up to WWII were also characterised by relatively strong growth which, in Europe, was partly fuelled by rapid military expansion. Inflation accelerated sharply in the UK in 1939-40, as war was initially declared, and later in the US, as it subsequently joined the war (Figure 5). During the war years, GDP growth was exceptionally strong in the US (boosted by a significant increase in arms production and without the cost of war damage) but weaker in Europe (where governments strained to maintain arms production amid widespread war damage). Inflation remained high throughout the war years and through the initial post-war period, before declining in 1949-1950.

[Click to enlarge]

[Click to enlarge]

Source: Goldman Sachs Global Investment Research, Bank of England (2021), Schmelzing (2020), Maddison.

- Napoleonic Wars: As tensions rose between England and France ahead of the Napoleonic Wars, the UK government tripled government spending over a five-year period (1792-97), partly funding this increase through a depletion of the Bank of England's gold reserves (Broadbent 2020). Fears over the impending war resulted in a private sector switch from Bank paper into gold, causing the government to suspend gold convertibility. The price level subsequently rose by 59% over the following three years, although it stabilised thereafter and gold convertibility was subsequently restored in 1821.

- The Black Death: The bubonic plague reached England in late 1348 and, over the subsequent three years, resulted in a 30-45% reduction in the country's population. As Jordà et al. (2020) discuss, the sharp reduction in labour was the primary cause of the Peasants' Rebellion, a doubling of real wages, and a significant reduction in rates of return on land.

Why wars are different from pandemics: Wars result in overheating and the destruction of physical capital

The contrast between the performance of inflation and bond yields during wars and pandemics makes intuitive sense, in our view, for two reasons:

- Wars drive aggregate demand up, while pandemics drive aggregate demand down: In wars, there is a long history of using debt-financed spending to fund increased war-related expenditure (before and during wars) and reconstruction efforts (in the aftermath), driving aggregate demand higher relative to war-damaged supply. In pandemics, by contrast, any increase in government spending is used to fill the gap left by absent private sector demand, with very different implications for the overall balance between aggregate demand and supply (Note 5).

- Wars destroy physical capital, driving investment and interest rates higher: Wars are often associated with the widespread destruction of physical capital, a development that increases the demand for investment and pushes interest rates higher. By contrast, pandemics do not result in any loss of physical capital and, if there is widespread loss of life, can result in an increase in the capital-labour ratio. Standard economic theory suggests that a higher capital-labour ratio should lower equilibrium interest rates, while raising real wages (Note 6).

Higher inflation is not a natural consequence of pandemics

Every war and pandemic is different, and we should be cautious of drawing lessons from events that occurred in the long-distant past and in very different circumstances. One feature of the current pandemic that is clearly distinctive to past episodes is the size of the government response. Equally, however, one can argue that an unusually large government response was necessitated by an unusually large collapse in private sector demand (Note 7).

What is clear is that history provides no evidence that higher inflation or higher bond yields are a natural consequence of major pandemics.

None of this precludes the possibility that higher inflation might result as a policy choice in the face of elevated debt levels. Higher inflation can bring welcome relief to debtors, including the government, by eroding the real value of their obligations. Faced with the choice of reducing debt through austerity or inflation, it is possible that policymakers might ‘choose’ higher inflation to help limit the need for tax rises and/or government expenditure reductions.

However, such a policy would require the cooperation of central banks to keep interest rates low, even as inflation is rising. And, in a world of independent central banks, even this route towards higher global inflation appears less likely than it did during past crises.

This article first appeared on www.VoxEU.org on April 15, 2021. Reproduced with permission.