"It ought to be remembered that there is nothing more difficult to take in hand, more perilous to conduct, or more uncertain in its success, than to take the lead in the introduction of a new order of things. Because the innovator has for enemies all those who have done well under the old conditions, and lukewarm defenders in those who may do well under the new."

Niccolò Machiavelli (1505).

Policies that change the way governments work—known as structural reforms—range from reducing regulatory barriers to competition and opening to trade and financial flows to increasing labor market flexibility. They are motivated by objectives that include increasing productivity, investment, and employment, and making the economy more resilient to shocks (Ostry et al., 2008; Prati et al., 2013; Quinn and Toyoda, 2008). While there has been broad agreement on the economic benefits of structural reforms, the political impact is less settled. This is because reforms may generate gains for society as a whole only in the longer term, while inflicting short-term pains on some sectors. Those affected may be highly vocal and well organized. When this happens, politicians may hold back on reforms for fear they will be penalized at the ballot box.

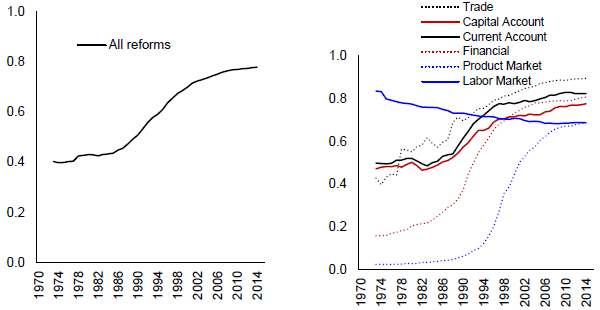

Economic reforms are often painful in the short term and hence unpopular, but does that mean reform-minded leaders always pay a price at the ballot box? Alesina, Furceri, Ostry, Papageorgiou and Quinn (2020) in their analysis of structural reforms and election outcomes in 66 countries suggest that this is not necessarily true. In this work we explore the electoral consequences of structural reforms through the prism of two new databases. One measures reforms in domestic finance, external finance, trade, product and labor markets, covering 90 advanced and developing economies, from 1973 to 2014. The other chronicles the timing and results of national elections.

The question is timely, because the economic policy agenda in both advanced and developing economies is increasingly focused on structural reforms, amid persistently weak medium-term growth and limited fiscal space in many countries.

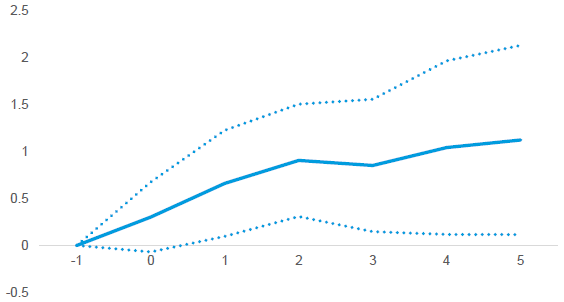

There is a pressing need and strong case for well-designed, appropriately timed, and carefully implemented structural reforms. This is especially true in emerging market economies and developing economies, where deregulation has stalled in recent years. A major push for structural reform would mean significant output gains in the medium term in both advanced and developing economies as confirmed by our own research (Figure 2).

The question which then remains is: granted reforms are economically significant, but at what political cost? Our new research suggests that electoral costs associated with structural reforms can be avoided, or at least substantially lessened, if political considerations are factored into policy design.

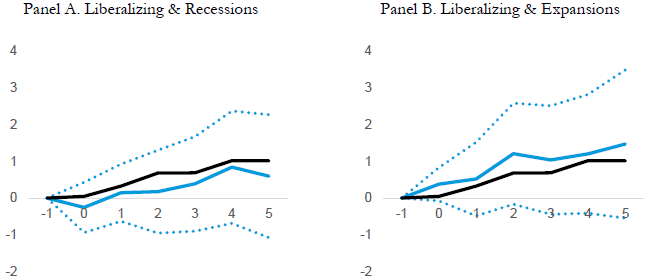

Our key finding is that reforms do not always mean political risk. Specifically, based on a panel of 66 democratic countries we show that while on average reforms are associated with electoral costs, specific effects depend not only on the type of reform, but also on when in the electoral cycle it is implemented. Reforms are shown to be benign or even favorable politically when implemented swiftly after elections so that governments can reap the rewards from the medium-term economic gains. Electoral risks are heightened when governments delay and enact reforms on the eve of an election, given that short-term dislocation effects are often caused by reforms.

Finally, not all reforms are equal from an electoral perspective. The data suggest that those that engender increased income inequality—notably financial sector deregulation (such as banking sector privatization and removing controls on credit and interest rates) and opening to financial flows under some conditions—can exact a higher cost at election time (see, e.g. de Han and Sturm, 2017; Furceri and Loungani, 2018; Ostry et al., 2018).

There are three key takeaways from our analysis. First, governments should act swiftly following an electoral victory to carry out reforms during their political honeymoon period. Second, reforms are best implemented when economic conditions are favorable. Third, policymakers should factor in any harm reforms may have on income distribution and take well-communicated upfront steps to offset such side effects.

These takeaways are consistent with evidence that the benefits of reforms take time to materialize—often beyond the electoral term—and with the notion that voters do not internalize the lag between the implementation of a reform and its economic effects. Voters seem to attribute the state of the economy at a point in time at least in part to reforms implemented around that time. The cost of liberalizing reforms during recessions is especially large when they occur in an election year. When reforms occur during expansions, voters do not punish and may even reward the incumbent.

Our findings are also consistent with voters facing a signal extraction problem regarding the competence of leaders. Growth benefits from reforms are years in the making, and voters appear not to anticipate these future benefits. In downturns, voters appear to struggle to correctly attribute how much of the downturn is due to the policymaker's policies and how much is due to the general state of the economy. Even when successful economically, reforms can have a clear contractionary impact on a subset of the population. Our results appear consistent with both voter myopia and rational behavior by concentrated interests harmed by reforms.