There is no consensus in the literature on how policy uncertainty affects international trade and foreign direct investment in services. This column examines the impact on trade margins of five regional trade agreements between Japan and its partner countries that entered into force between 1995–2018s. Results show that policy uncertainty regarding national treatment reduces the intensive margin of FDI in services, while policy uncertainty relating to most-favoured nation status reduces the extensive margin of FDI in services.

In the trade literature, policy uncertainty typically measures gaps between the actual trade regime and binding commitments under international trade agreements – for example, the gap between applied and bound levels of tariffs (Handley 2014). Against this backdrop, the role of regional trade agreements (RTAs) in reducing policy uncertainty has received attention in studies on trade in services. RTAs create a gap between the actual trade regime and commitments, allowing for a more restrictive regime in the future. The gap is created because some sensitive sectors – such as the communication, advertising and education sectors – are exempt from liberalisation in many RTAs. Two approaches preserve flexibility for introducing such exemptions, inspired by either the General Agreements on Trade in Services (GATS) or the North American Free Trade Agreement (NAFTA) (Roy et al. 2007). RTAs following the GATS-inspired approach use positive lists, whereby the relevant liberalisations are applied only to listed sectors subject to the inscribed exemptions. RTAs following the NAFTA-inspired approach use negative lists, whereby the relevant liberalisations apply to all services sectors unless they are exempted from certain commitments and obligations by a host country. Thus, this approach provides more comprehensive commitments than the GATS-inspired approach.

Lamprecht and Miroudot (2020) recently took a further step by focusing on the GATS-inspired approach to scheduling the commitments in services chapters of RTAs, quantifying the value of binding service trade regimes. Relative to Lamprecht and Miroudot (2020), we focus on the NAFTA-inspired approach to scheduling the commitments in services chapters of RTAs, and aim to quantify reservations for liberalisation commitments, such as market access, national treatment, and most-favoured nation (MFN) commitments.

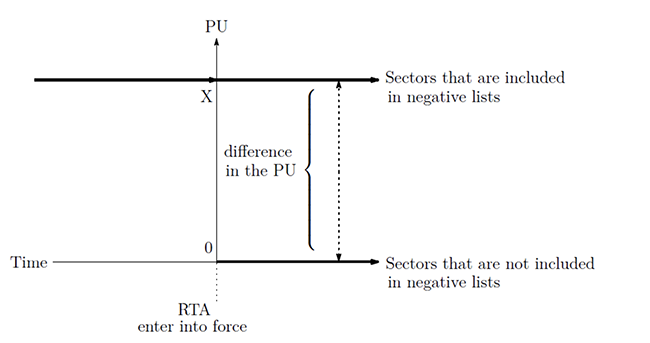

In a recent paper (Inada and Jinji 2023), we build on an earlier paper (Inada and Jinji 2020) in which we examined the effect of NAFTA-inspired investment chapters of RTAs and international investment agreements on FDI, and adapted the methodology to NAFTA-inspired service chapters of RTAs. This empirical methodology is shown in Figure 1. The figure shows the difference in the change in policy uncertainty change between the sectors included in negative lists and those not included in negative lists before and after an RTA enters into force. Before the RTA enters into force, all foreign affiliates face the same degree of policy uncertainty. The bold arrow to the right indicates the time before and after the RTA takes effect. We set the mean initial policy uncertainty level before an RTA’s entry into force at X. After the RTA enters into force, affiliates in the sectors that are not included in the negative lists drop to zero, whereas affiliates in the sectors included in the negative lists can retain policy uncertainty at level X. This sectoral variation enables us to measure the effects of retained policy uncertainty in affected sectors by comparing the affected and non-affected sectors before and after the entry into force of RTAs in the difference-in-differences (DID) design.

Our study evaluates how the service chapters in RTAs with a NAFTA-inspired approach affect the intensive margins (i.e. the ownership ratio of parent firms) and extensive margins (i.e. affiliate entry and exit) of FDI in services. We focus on five RTAs between Japan and its partner countries that entered into force between 1995–2018 (Note 1). Our DID estimates revealed that a reduction in policy uncertainty relating to MFN reservations increases the probability of affiliate entry, and that a reduction in policy uncertainty relating to national treatment reservations increases the ownership ratio of parent firms. Moreover, the results showed that a reduction in policy uncertainty relating to MFN reservations increases rather than decreases the probability of affiliate exit.

In relation to the magnitude of the effects, we found that when a sector is included in the negative list for MFN reservations, the probability of affiliate entry falls by 13.0% and that the probability of affiliate exit declines by 7.7%. These findings imply that a reduction in policy uncertainty regarding the MFN status of foreign investors in the host country due to the entry into force of an RTA increases the probability of affiliate entry by 13.0% and the probability of affiliate exit by 7.7%. Since the new entry of firms is stimulated by the reduction in policy uncertainty, the sector may become more competitive, resulting in a higher exit probability for incumbent affiliates. These magnitudes are consistent with – but larger than – our estimates in Inada and Jinji (2020). Subsequently, we found that when a sector is included in the negative list for national treatment reservations, the ownership ratio of parent firms falls by 19.4%. This result was not detected in our earlier paper. Taken together, these results suggest that the policy uncertainty relating to national treatment reduces the intensive margin of FDI in services, while policy uncertainty relating to MFN reduces the extensive margin of FDI in services. However, the coefficients for market access reservations are insignificant, which is an unexpected finding.

An important policy implication of our findings is that different reservations affect different aspects of FDI in host countries. Specifically, policy uncertainty in the domestic competitive environment against other foreign investors (i.e. regarding MFN) may be important to the extensive margin of FDI in services; while policy uncertainty in the domestic competitive environment against domestic rivals (i.e. regarding national treatment) may be important to the intensive margin of FDI in services. Our study implies that reducing such policy uncertainty will attract more FDI, which makes it vital to sign an RTA with a well-designed approach to scheduling binding commitments.

Editor’s note: The main research on which this column is based (Inada and Jinji) first appeared as a Discussion Paper of the Research Institute of Economy, Trade and Industry (RIETI) of Japan.

This article first appeared on VoxEU on May 17, 2023. Reproduced with permission.