The currency a firm chooses to invoice in reveals lessons on the prominence of that currency in the international sphere. This column presents survey data from Japanese overseas subsidiaries, highlighting how the use of Asian currencies has been growing steadily. The authors show that among Asian local currencies, Chinese renminbi and Thai baht are the most used currencies by Japanese subsidiaries. If these countries become increasingly important destination markets for regional countries, local currencies will be used more as trade invoice currency in Asia.

Since the collapse of the Bretton Woods system in 1971, Japanese firms' profits have fluctuated with volatile exchange rate movements. From the early 1970s to the mid-1990s, the yen appreciated steadily, especially after the Plaza Accord in 1985. Japanese exporting firms have had to cope with large fluctuations within a yen appreciation trend. They have adopted various defensive measures. The use of financial instruments such as forward transactions proved to be effective only in the short run. Invoicing exports in yen should protect Japanese exporters' income, but importers may not agree to the arrangement. Trade conflicts incentivised exporters to set up ‘assembler subsidiaries’ in foreign countries, and this proved to be an effective hedging operation against currency fluctuations. Japanese exporters have developed sophisticated currency risk management methods since the 2000s, when the overseas production ratio increased sharply. Some choose the currency of destination country as the invoice currency for intra-firm trade between head offices in Japan and overseas subsidiaries. Some use the US dollar as the invoice currency throughout the production chain: from Japan to Asian countries where production takes place, to final destinations in the US and Europe. In earlier studies, we focused on the case of Japanese firms, showing that currency risk management depends on the size of the firm, sales destinations of subsidiaries, and the global market power of exporters (Ito et al. 2012, 2016, 2018).

The shift to overseas production by Japanese firms accelerated during the period of appreciation of the yen to the record high, following the global financial crisis in 2008. The share of overseas manufacturing by manufacturing firms (based on all Japanese firms) peaked in 2017 at a record 25.4%, according to the Basic Survey on Overseas Business Activities 2018 (Ministry of Economy, Trade and Industry). Trade with Asian countries is extremely important for Japanese firms. Accordingly, the question of which currency overseas subsidiaries in Asia should use to conduct trade transactions has become important, particularly for exporting firms.

In 2017, we conducted the third Research Institute of Economy, Trade and Industry (RIETI) questionnaire survey with Japanese head offices (Ito et al. 2018b), which revealed new evidence that the share of local currency invoicing has increased markedly in Japanese exports to Asia. What caused such a rapid increase in local currency invoicing and decline in US dollar invoicing? To answer this question, we investigated large-scale firm-level questionnaire surveys conducted in 2018 on Japanese overseas subsidiaries in Asia about their choice of invoice currency.

Choice of invoice currency and foreign exchange risk management

There are various studies on the determinants of invoice currency. Most focus on trading volume, firm size, and export/import country's economic performance. There has been less focus on the relationship between invoice currency and foreign exchange risk management to date. Döhring (2008) conducted the first survey study and concluded that whether invoicing in a domestic currency and financial/operational hedging are substitutes or complements depends crucially on the size and geographical orientation of the exporting firm and on the structure of the destination market.

From the 2018 questionnaire, we obtained the following results: First, subsidiaries with large sales tended to choose the US dollar or local currency invoicing, while subsidiaries with small sales tended to choose the yen or local currency invoicing. Second, sales subsidiaries also tended to choose local currency invoicing. Third, overseas subsidiaries tended to choose the same invoice currency for both imports and exports. Fourth, local currency borrowing, a high share of local procurement, joint ventures with local firms, and profit management policies in the local currency also promoted local currency invoicing.

Asian local currencies are increasingly being used among Japanese overseas subsidiaries as Japan becomes more involved in Asian value chains. Why has the use of local currencies increased in transactions with Japanese overseas subsidiaries in Asia? Our research indicates that Japanese export firms often adopt a strategy of centralising exchange risk management at the headquarters (in Japan) to avoid exposing their overseas subsidiaries to exchange risks. Previously, this meant all transactions were invoiced in the US dollar. In recent years, however, China and other Asian countries have become more important as final consumption destinations. Asian production bases engaged in manufacturing not only import intermediary goods from Japan but have also started local procurement. In addition, intra-regional trade transactions in Asia have been expanding recently. These seem to be the reasons for the increased use of Asian local currencies.

Growing use of local currency invoicing in Asia

Based on our empirical analysis, we confirm that the subsidiaries' invoice currency choice was strongly influenced by their preference for using the same currency not only in import and export, but also in local sales, local procurement, and borrowing. We noticed in our interviews with Japanese headquarters that Japanese manufacturing exporters try to use the same currency for all their transactions to manage their foreign exchange exposure. In Ito et al. (2021), we reconfirmed this tendency based on questionnaire survey data.

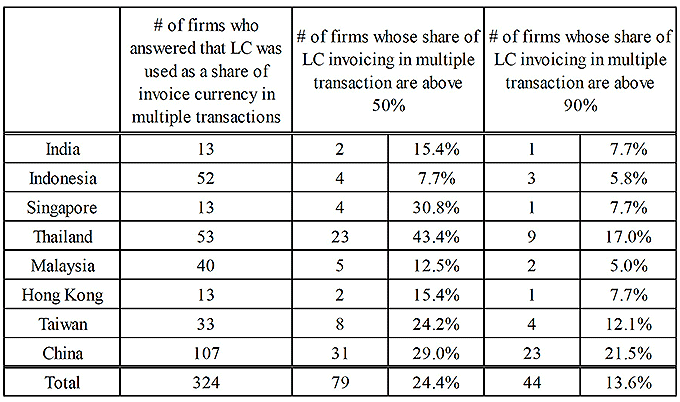

We also confirmed that the US dollar is still widely used as an invoice currency in Asian subsidiaries. It is because Japanese head offices tend to choose the US dollar invoicing to manage exchange rate risk in their intra-firm transactions. But we detect a sign of future change. In our Asian samples, the use of Asian local currency as invoice currency has been increasing. The following table shows the number of firms who answered the invoice currency share in their multiple transactions (for example, import and export with Japanese head office, local sales and procurement, and export to other countries).

The second column shows the number of firms whose share of local currency invoicing in multiple transactions is above 50%. Among the sample countries, China has the largest number of firms who meet this criterion (31), followed by Thailand (23). In terms of the share of firms who answered the invoice currency share in multiple transactions, Thailand has the highest share (43.4%), followed by Singapore (30.8%). The third column shows the number of firms whose share of local currency invoicing in multiple transactions is above 90%. In this case, China has the largest number of firms (23) and the highest share (21.5%). This means that more than 20% of overseas subsidiaries in China use the renminbi for almost all transactions. These results indicate that some of Asian subsidiaries, particularly in China, have already started to choose their own currencies in their multiple transactions to offset foreign exchange exposure in the same way as the US dollar.

The rise of the renminbi and Asian currencies

The rise of the Chinese renminbi and Asian currencies in the choice of invoice currency is partly a result of institutional movements: regulations on exchange transactions in the renminbi and other local Asian currencies have been eased, and the exchange rate regime has shifted to a more flexible managed float regime. Furthermore, the stability of the exchange rates of Asian currencies against the Japanese yen has helped.

In addition, the growing and deepening regional production network in Asia is likely to promote local currency transactions, especially if subsidiaries are jointly owned by local firms, have a large share of local procurement, or hold local currency debt. A recent deepening of the Asian local bond markets has also played an important role for foreign firms to raise their working capital locally. These results suggest that the role of the U.S. dollar will be gradually diminished if Asian countries further advance their local production abilities and financial and capital liberalisation. Regarding the usage of the Japanese yen, intermediate goods with a large global share imported from Japan tended to be invoiced in the Japanese yen. The future of the usage of Japanese yen in invoicing will depend on the competitiveness of Japanese goods and the Japanese markets becoming the destination of exports of Asian producers and Japanese subsidiaries in Asia.

Editor's note: The main research on which this column is based first appeared as a Discussion Paper of the Research Institute of Economy, Trade and Industry (RIETI) of Japan. This study is conducted as a part of the Project "Exchange Rate and International Currency" undertaken at the Research Institute of Economy, Trade and Industry (RIETI). This study utilizes the questionnaire survey data from the "Questionnaire Survey on the Choice of Invoice Currency by Japanese Overseas Subsidiaries" conducted in 2018 by RIETI. The author is grateful for helpful comments and suggestions by research members, and Discussion Paper seminar participants at RIETI.

This article first appeared on www.VoxEU.org on July 23, 2021. Reproduced with permission.