Structural reforms can have adverse effects in the short run if implemented under weak macroeconomic conditions. This column argues that prioritising reform measures that bring short-term benefits even in a bad conjuncture, and packaging them to benefit from reform complementarities across product and labour markets, remains the most promising growth strategy, especially in the post-Global Crisis context.

Despite the consensus that structural reforms boost employment and productivity in the medium to long run, relatively little is known about the adjustment path to the new equilibrium as supply and demand respond to reforms. A natural concern is that some reforms have adverse short-run impacts on GDP, especially if conducted under weak macroeconomic conditions. Such concern is reinforced if the availability and effectiveness of monetary and fiscal policies to alleviate the adverse impacts of reforms are limited (e.g. Eggertsson et al. 2014). Our recent paper surveys the literature assessing the impacts of structural reforms, and discusses several conflicting channels through which reforms affect the real economy in the near term (Caldera Sánchez et al. 2016). We argue that even during unfavourable cyclical conditions with limited support from monetary or fiscal policies, smart packaging and prioritisation of structural reforms can lift growth in the short run.

How the impact of structural reform changes under different macro conditions

Some of the most important channels through which reforms affect demand include changes in wealth or permanent income that bring forward future reform-driven income gains in current consumption and investment; changes in disposable income and cash-flow that affect spending decisions of households and firms that are liquidity or cash-flow constrained; changes in households' and firms' perception of income and profit uncertainty that influence precautionary savings; and changes in the real interest rate that affect household consumption through inter-temporal substitution effects. Given that the relative strength of these channels is likely to vary according to macroeconomic conditions, similar reforms can have different short-run implications on the economy.

When the economy is near its potential, and confidence among consumers and investors is high, gains from growth-enhancing reforms are likely to exceed potential transitional costs even in the short run, as demand increases in the anticipation of the future benefits. For instance, the macroeconomic model simulation by Cacciatore et al. (2012) predicts that labour market reforms that lower firing costs lead to an increase in unemployment in the initial year after the reform, but this effect is quickly reversed in subsequent years. Other reforms encouraging labour market participation, such as reducing the labour tax wedge or tightening eligibility of unemployment benefits, are also found to quickly lead to increased output and employment (Bouis et al. 2012).

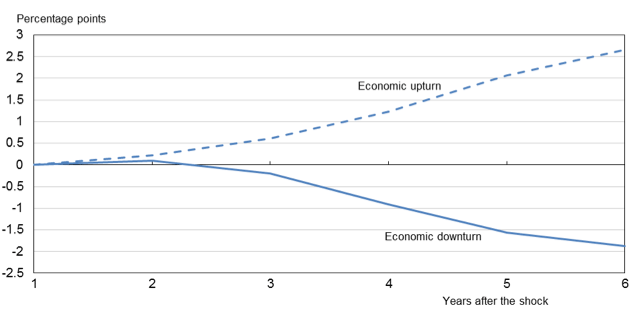

When the economy is in a downturn, the short-term impact of reforms may be less favourable or even entail short-term reductions in demand. For example, consider reforms that aim to improve work incentives by strengthening the conditionality of income support in the case of a lay-offs. Such reforms would raise employment by facilitating the return to work, and thereby increase household income and thus consumption. However, they also increase uncertainty regarding disposable income, discouraging consumption. During an economic upturn, employment gains can be quick, so that output increases within 2-3 years after reforms. But during a downturn when the unemployed are less likely to find jobs, the gains in output and employment can turn negative (see Figure 1). Other reforms that seek to restore competitiveness through lower relative costs and prices can also depress demand if conducted during downturns. This is because during recessions, labour and goods demand respond little to the lower wages and product prices resulting from reforms, while workers or firms see their income and profit eroded in the short term.

Source: Bouis et al. (2012).

Ideally, governments can deploy expansionary fiscal policies or monetary policies to support demand while implementing such reforms. Looser monetary policy can boost external demand through a currency depreciation, bringing forward the benefits of reforms. For instance, our review of specific reform episodes shows that Canada's labour market reforms around the mid-1990s benefitted from strong demand from the US, which supported the gains in employment following the reforms. But, in some cases, macro policies may also be constrained, as has been the case for several countries in the past few years.

Even with limited support from fiscal and monetary policies or external demand, the negative short-run impacts on demand can be alleviated with a smart packaging or sequencing of reforms. First, reforms of labour and product markets can be conducted in tandem, so that the lower prices from stronger competition limit the impact of labour market reforms on real wages. Second, addressing dysfunctions in the financial sector as early as possible can improve access to credit and allow households and firms to capitalise on the future benefits of reforms and expand consumption and investment today. Third, reducing policy uncertainty through well-communicated, credible reform strategies can prevent the deterioration of confidence among business and consumers.

Furthermore, many supply-side reforms can directly boost demand, even during difficult macroeconomic conditions. For instance, public infrastructure investment that effectively increases the growth potential in the medium term can stimulate private investment by increasing the expected return. Tax reforms that lower the tax burden on labour income can lead to a relatively quick increase in consumption, especially by credit-constrained households. Also, reducing regulatory barriers to entry in service sectors with large pent-up demand and relatively low entry costs (like professional services or taxis) can boost business expansion and employment quite quickly (Note 1). Similarly, reducing barriers to geographic or job mobility can increase the speed of employment gains in difficult times. Strengthening active labour market policies and alleviating skill shortages and mismatches can unleash business activities that were previously constrained by skills bottlenecks. Finally, reforms that contribute to the long-term sustainability of public finance and to the cost-effectiveness of healthcare or pension systems can reduce uncertainties on households' future income, thereby boosting consumption today (Note 2).

Conclusion

There is a shared recognition among policymakers that expansionary monetary policies alone cannot restore world economic growth. Decisive policy actions to strengthen fundamentals and revive productivity growth are needed (Note 3). However, the pace of structural reforms seems to be slowing lately, albeit with considerable heterogeneity across countries (OECD 2016). It is possible that, as strong pressure from financial markets in the wake of the Global Crisis fades, policymakers will become more concerned about the short-run costs of structural reforms. Yet, our research indicates that prioritising reform measures that bring short-term benefits even in a bad conjuncture, and packaging them to benefit from reform complementarities across product and labour markets, remains the most promising growth strategy, especially in the current macroeconomic context.

Authors' note: The opinions expressed and arguments employed are those of the authors and do not represent the official views of the OECD or of its member countries.

This article first appeared on www.VoxEU.org on September 4, 2016. Reproduced with permission.