The Weak Price of Crude Oil

The U.S.-based WTI crude oil futures price (WTI crude oil price) is remaining constant at a low level due to fears of a global economic slowdown. This is because demand for crude oil has fallen, primarily in terms of export fuel, due to stagnant automobile sales connected to the continuing trade conflict between the United States and China and the increasingly prevalent view that an oversupply situation is likely in the global crude oil market.

In terms of the supply side, OPEC-Plus – made up of OPEC and non-OPEC major oil-producing countries, which endorsed its creation in July 2019 – has agreed to reduce production by 1.7 million barrels per day until March 2020. Because this agreement is based on a system of cooperation between Russia, which produces the second-largest volume of oil in the world, and Saudi Arabia, which produces the third-largest, its implementation is proceeding smoothly. The United States, however, which in 2018 again became the world's largest producer of oil for the first time in 45 years, has been increasing production at a faster rate than the reductions undertaken by OPEC-Plus. Although the volume of oil produced by the United States has increased by at least one million barrels compared to 2018 and is at its highest level in history (at over 12 million barrels per day), the number of active oil rigs, which influences future oil production, has been constant since late-2019. The production volume of shale oil, which drives U.S. oil production, has reached 9 million barrels per day, but its growth has rapidly weakened.

There is little possibility that the global crude oil supply will rapidly increase as it did in 2018 and markets are closely watching the demand side. The volume of crude oil imports by China, which has become the world's largest importer of crude oil, is stable at a high level (around 10 million barrels per day) and its volume of crude oil processing remains firm as well. However, based on its stagnating industrial production, fears are growing that actual demand is not keeping pace. Demand is relatively high in the United States, the country with the world's highest demand for oil, as well, but factors such as the sluggish ISM manufacturing index, an important economic indicator for the U.S., are causing concern.

The International Energy Agency (IEA) has repeatedly revised global crude oil demand downward recently and since future drops in demand are seen as indicative for the market, some are starting to suspect that the price of crude oil may soon fall to around $35 per barrel (Nihon Keizai Shimbun, October 31). The prevailing opinion is that the price of crude oil in 2020 will hover at a low level, affected by trends from late 2019, but will this truly be the case?

Saudi Arabia at the Center of Geopolitical Risk

The global crude oil market appears to have absorbed the news of attacks on Saudi Arabia's oil facilities, but the risk of another similar occurrence in the Middle East remains.

A crude oil production volume of 5.7 million barrels per day (6% of global crude oil supply volume) was lost in a drone strike against Saudi Arabian oil facilities in the early morning of September 14, 2019. This loss was the greatest in history, surpassing the crude oil production volume lost during the second oil crisis that began with the Iranian revolution (5.6 million barrels per day, then 9% of global crude oil supply volume).

The United States and some European countries claimed that Iran was involved in the drone strike against Saudi Arabia, but did not try to search for the actual perpetrator. Based on A) repeated drone attacks against Saudi Arabia since May 2019 by the Houthis, a Shiite rebel group in Yemen, and B) Iran supplying development technology for low-cost military drones, the training of drone pilot combatants within the country and their deployment to various locations in the Middle East, I believe that the Houthis played a central role in the strike.

While the Houthis have called for a ceasefire, a Saudi-led military coalition is continuing aerial bombardments of Sanaa and other areas supporting the Houthis, who in return continue to wage a ground campaign in southern Saudi Arabia.

Iranian media reported in mid-October that "an explosion has occurred at a Saudi Aramco refinery, killing 18 people, though the cause is unclear," and there is a possibility of further drone attacks by the Houthis. Since the Houthis have issued a warning that "unless aerial bombardments of Yemen by the Arab coalition forces cease entirely, further large-scale attacks will likely be resumed," oil production on the entire Arabian Peninsula (20% of global crude oil supply volume) continues to be at risk.

Fearing further deterioration of the situation in the Middle East, Prime Minister Khan of Pakistan visited Iran and Saudi Arabia in mid-October with the goal of defusing tensions, but directly prior to his visit an Iranian oil tanker was hit by two missiles off the coast of the Saudi Arabian city of Jeddah (which is close to a region controlled by the Houthis). The perpetrators have not been determined, however the Iranian side increasingly believes that this was an act of sabotage by Israel fearing rapprochement between Saudi Arabia and Iran.

Although the conflict in the Middle East is thus in the process of escalating from a blockade of the Strait of Hormuz to an international conflict in Yemen, the deterioration of the situation in Yemen puts the authority of Crown Prince Mohammad bin Salman in question Crown Prince Mohammad bin Salman.

Immediately after assuming the position of Minister of Defense in March 2015, bin Salman decided to intervene militarily in Yemen and since then has spent over $100 billion in military expenses. However, not only have there been no military gains, but Saudi Arabia's precious oil facilities have suffered from significant attacks.

Neither have bin Salman's policies promoting a decoupling of the economy from oil under the banner of a "Vision 2030" led to substantial results. While Saudi Arabia has significantly scaled back its production of crude oil, since its price is not rising, the country's 2019 GDP growth is again expected to be negative.

In order to secure funds to prop up the domestic economic climate, bin Salman pushed through a domestic initial public offering (IPO) for Saudi Aramco, but this has likely resulted in frustration among the population, which was forced to purchase shares out of patriotic sentiment.

On the occasion of the new Japanese Emperor's ascension to the throne on October 22, a great number of heads of state from various countries visited Japan, but two heads of state canceled their visits on short notice. One was President Erdogan of Turkey and the other was Saudi Arabia's Crown Prince Mohammad bin Salman. It was revealed that President Erdogan met urgently with Russian President Putin over the situation in Syria. I know very little about the reason why Crown Prince Mohammad, who has close connections to the Imperial House of Japan, canceled his visit, but in light of the difficult circumstances domestically and internationally, it appears possible that he had no other choice.

An Unexpected Development in the Shale Oil Boom

Geopolitical risk surrounding the Middle East continues to grow and it is safe to say that it is thanks to shale oil that the crude oil market has been able to keep its cool.

The production scale of shale oil has come to play a role in preventing potential supply shocks resulting from geopolitical risks, but an unfortunate shift is occurring in this boom at an inopportune time. Because suppliers, eager to increase production, drilled down to shale layers with closely concentrated wells, the production volume from each well in many cases has dropped more quickly than expected. Another calamity is that shale companies are experiencing a shortage of capital and the view is spreading that even if crude oil prices continue around $60 per barrel, increases in production volume cannot be expected. There are also increasing predictions that production increases for shale oil in 2020 will flatten substantially compared to 2019 (OIL PRICE, November 3).

Now that the substantial production increase in shale oil is ceasing to function as a buffer in the global crude oil market, one must fear that if another incident occurred in the Middle East the price of crude oil, unlike last time, would jump by an order of magnitude.

Are We Sufficiently Prepared for an Impending Oil Crisis?

Crude oil prices tripled (to between $40 and $50 per barrel) when the second oil crisis broke out and also in the case of the recent attack, and some analyses claim that if damage had been protracted, the price of crude oil might have again tripled (to around $150 per barrel). How would the Japanese economy be impacted by a hypothetical tripling of crude oil prices?

The price of gasoline, directly connected to people's daily lives, would jump to 1.5 times its current level (since taxes and the like make up half of the price of gasoline, the rate of increase would theoretically be limited to one-half of that of the price of crude oil), and all petroleum products would necessarily become significantly more expensive.

Since Japan's degree of crude oil dependence is nearly 100%, stocks could already be negatively affected if the price of crude oil surpassed $70 per barrel. Most recently the average Nikkei-listed share price in February 2018 fell by more than 3,000 yen for various reasons that included an increase in crude oil prices to $70.

Even the United States, where dependence on imports has dramatically fallen with the large increase in shale oil production, would not be immune.

The U.S., which drives the global economy, experienced a sudden rise in the price of crude oil immediately preceding four of its last five recessions (in 1973, 1980, 1990, and 2008), so the entire global economy, including the United States, would definitely be greatly affected if crude oil prices shot up.

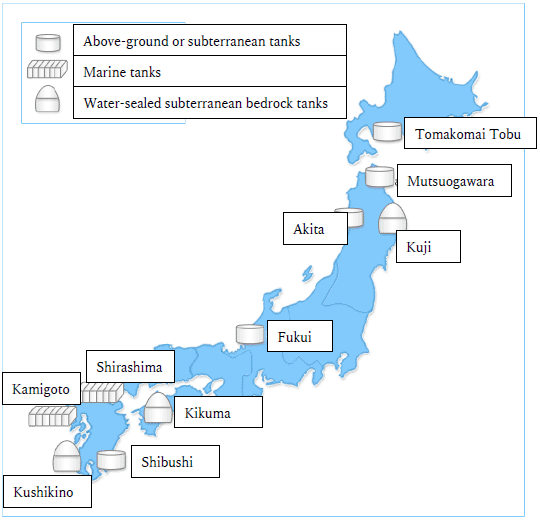

Directly after the attack against Saudi Arabia, the U.S. government began considering opening its strategic petroleum reserve (SPR) to prevent a sudden increase in the price of crude oil. Based on the lesson of two oil crises, Japan, too, has begun operating a national oil reserve system (which holds 360 million barrels, an import volume of 90 days (see Fig. 1)), but unlike the United States, it has never tapped into the reserve in over 30 years.

Implementing preparations to flexibly open its national petroleum reserve should be an urgent issue for Japan, which depends on the Arabian Peninsula for over 80% of its crude oil imports.