While assessing the economic impact of COVID-19 is essential, it is challenging due to the extreme speed with which the crisis unfolded. This column uses three forward-looking uncertainty measures to quantify the enormous increase in economic uncertainty over the past weeks. Feeding these COVID-induced uncertainty shocks into a model of disaster effects predicts a year-on-year contraction in US real GDP of nearly 11% as of 2020 Q4. About 60% of the forecasted output contraction is estimated to be due to COVID-induced uncertainty.

The COVID-19 pandemic has triggered a massive spike in uncertainty. Major uncertainties surround almost every aspect: the infectiousness, prevalence, and lethality of the virus; the availability and deployment of antigen and antibody tests; the capacity of healthcare systems to meet an extraordinary challenge; how long it will take to develop and deploy safe, effective vaccines; the ultimate size of the mortality shock; the duration and effectiveness of social distancing, market lockdowns, and other mitigation and containment strategies; the near-term economic impact of the pandemic and policy responses; the speed of recovery as the pandemic recedes; whether ‘temporary’ government interventions and policies will persist; the extent to which pandemic-induced shifts in consumer spending patterns will persist; and the impact on business survival, new business formation, R&D, human capital investment, and other factors that affect productivity over the medium and long term (Note 1).

Our goal here is to assess near- and medium-term macroeconomic effects of these COVID-induced uncertainties. A necessary first step is to quantify uncertainty such that it presents a suitable input into a statistical model of macroeconomic outcomes. In this regard, there are some notable challenges:

- The COVID-19 crisis erupted and unfolded with tremendous speed. Take the US case as an example. In February 2020, the unemployment rate stood at 3.5%, equaling its lowest rate in the past 67 years. A mere six weeks later, the outlook has shifted profoundly: Nearly ten million Americans filed for unemployment benefits in the past two weeks (Chaney and Morath 2020). Millions more lost jobs but did not file. Because the outlook changed with such suddenness, methods based on backward-looking statistical analyses and historic data are unlikely to yield suitable measures of forward-looking uncertainty.

- A related challenge is the lack of close historic parallels to the current crisis. While the Spanish Flu pandemic a century ago offers a reasonable point of comparison in terms of mortality (Barro et al. 2020), it took place in a very different social, political and economic context. The scale of ongoing containment and mitigation policies is also unprecedented in the modern era.

- Timeliness of data is a critical practical challenge. To estimate the current and future macroeconomic effects of COVID-induced uncertainties, we need measures that are available in real time, or nearly so.

In short, we need timely, forward-looking measures of economic uncertainty. With these requirements in mind, we assess five types of uncertainty measures. Several of these measures figure prominently in the long literature on economic uncertainty and its consequences, and others are newer. See Bloom (2014) for an overview of this literature and Table 1 for a summary list of the measures we consider here.

Stock market volatility

Examples include the CBOW Volaitility Index (VIX), which reflects the forward-looking volatility implied by options on the S&P 500 index. Figure 1 shows that the COVID-19 shock increased the VIX by about 500% from 15 January 2020 to 31 March 2020. This forward-looking measure starts in 1990 and is available daily in real time. Realized volatility can be calculated on short look-back windows to quickly reflect abrupt changes in economic circumstances. The realised volatility of daily returns stretches back to the late 19th century.

Newspaper-based measures

Examples include the Economic Policy Uncertainty (EPU) Indices of Baker et al. (2016) (Note 2). The daily version of this index reflects the frequency of newspaper articles with one or more terms about "economics," "policy" and "uncertainty" in roughly 2,000 US newspapers. It is normalized to 100 from 1985 to 2010, so values above 100 reflect higher-than-average uncertainty. Figure 2 plots the monthly average of the daily EPU, which surges from around 100 in January 2020 to almost 400 in March 2020, the highest value on record. The monthly US EPU index which is based on a balanced panel of major US newspapers displays a similar pattern and also reaches its peak value in March 2020 (Note 3).

Newspaper-based measures of uncertainty are forward looking in that they reflect the real-time uncertainty perceived and expressed by journalists. They stretch back to 1900 for the US and are now available for dozens of countries at www.policyuncertainty.com. They also offer a ready ability to drill down into the sources of economic uncertainty and its movements over time, as contemporaneously perceived. For example, Baker et al. (2020) report that over 90% of newspaper articles about economic policy uncertainty in March 2020 mention ‘COVID’, ‘Coronavirus’, ‘pandemic’ or other terms related to infectious diseases.

Baker et al. (2019) develop a newspaper-based Equity Market Volatility (EMV) tracker that closely mirrors movements in the VIX. Their index lends itself to a quantitative exploration of news developments that drive stock market volatility, again as contemporaneously perceived by journalists. Applying their approach to infectious diseases, we find that COVID-19 is the dominant topic in newspaper articles about stock market volatility since the last week in February. In comparison, Ebola, SARS, H1N1, and other infectious disease outbreaks since 1985 made only minor contributions to stock market volatility.

Business expectation surveys

Examples include the US monthly panel Survey of Business Uncertainty and the UK monthly Decision Maker Panel (Note 4). These surveys elicit five-point probability distributions (mass points and associated probabilities) over each firm's own future sales growth rates over a one-year horizon. By calculating each firm's subjective standard deviation about its own future growth rate forecast in a given month, and aggregating over all firms in that same month, we obtain an aggregate measure of subjective uncertainty about future sales growth rates.

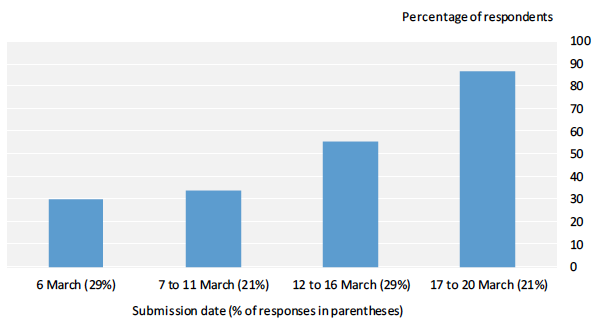

Figure 3 plots these survey-based time-series measures of sales growth rate uncertainty for the US and the UK. Both countries exhibit a pronounced spike in uncertainty in March 2020, well above any previous peak in their (short) histories. Nevertheless, we regard these March values as too low in the sense that they mostly reflect survey responses given in the first half of the month. Indeed, both surveys show a rapid deterioration in the outlook over the two weeks in which they were conducted. Figure 4 draws on data from the Decision Maker Panel to depict how COVID-induced uncertainty rose rapidly over this period in March 2020.

Percent of UK firms reporting Covid-19 as the top source of uncertainty, as of survey submission date in March 2020

These business expectation surveys are valuable for measuring firms' perceptions in real time. They yield actionable data within 5 to 20 days of when the survey first goes to field. They can also be modified to add additional questions, like business expectations over the likely duration of the COVID crisis. Their main downside is the cost of building the sample and fielding the survey each month, and the need to accumulate some historic data as a point of reference. Once in place, however, these surveys are highly flexible and allow for rapid deployment of special questions that target current developments and policy issues. Both the US and UK surveys will be back to the field in April with special forward-looking questions about the impact of COVID-related developments.

Forecaster disagreement

Examples include the dispersion of point forecasts about macroeconomic outcomes among participants in the Survey of Professional Forecasters (SPF) (Note 5). The typical disagreement measure is the standard deviation of point forecasts across the 50 odd forecasters that provide regular forecasts. There is a long history of using such disagreement measures to proxy for uncertainty, and also a long history of disagreement about their suitability for that purpose. For our present purpose, there is a practical issue: Currently, the most recent SPF data are from 14 February 2020, before the COVID crisis erupted in the US and many other countries. More broadly, the quarterly frequency of the SPF and the resulting lag in data availability is too long in periods of rapid change like the current crisis.

Statistical forecast uncertainty

Examples include the conditional volatility implied by a Generalized Auto-Regressive Conditional Heteroscedasticity (GARCH) model fit to US industrial production or forecast uncertainty implied by a large-scale time-series model, as in Jurado et al. (2015) (Note 6). These approaches can be used to generate time-varying measures of realized volatility and forecast uncertainty for GDP growth, industrial production, employment, trade, and other standard measures. These statistical measures of uncertainty capture recurring relationships in the time-series data – for example, the strong propensity of the volatility of many economic time series to rise in recessions – but their backward-looking character makes them less useful in the wake of abrupt shifts and once-in-a-century shocks. Long lags in the availability of key data inputs into statistical models of this type are another serious limitation for real-time uncertainty measurement, especially in the wake of sudden and unusual shocks. These lags amount to 90 days or so for many key economic series. As of this writing on 4 April, even Friday's BLS Employment Situation Report is dated, because it does not reflect the 10+ million newly lost jobs that we noted above.

To illustrate the use of forward-looking measures to project the near-term macroeconomic consequences of COVID-19, we borrow an empirical model of disaster effects developed by Baker et al. (2020) (Note 7). They use natural disasters, political coups, revolutions, and terrorist attacks across many countries to estimate the causal impact of disaster shocks on country-level output growth, working through first-moment and uncertainty channels. Their empirical model (BBT) is a vector autoregression model that uses disasters as instruments for shocks. They fit their model to quarterly data from 1987 to 2017 for 38 countries.

Armed with their estimated model and data on US real GDP, we proceed as follows: We calibrate the first-moment aspect of the COVID-19 shock based on the 28% fall in the S&P 500 stock market index from 24 February to 31 March 2020. We also calibrate the uncertainty aspect of the COVID-19 shock based on the rise in implied stock market volatility over the same period. Baker et al. (2020) provide evidence that COVID-19 developments drove the stock market collapse and the rise in its volatility over this period. We feed these calibrated shocks into the estimated BBT model as of 2020 Q2, while setting other contemporaneous shocks and all shocks in prior periods to zero.

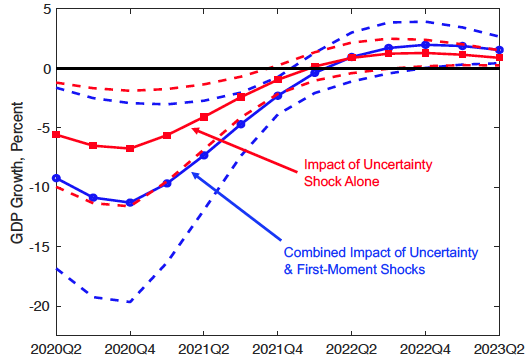

Figure 5 displays the resulting dynamic response for year-on-year U.S. real GDP growth from the second quarter of 2020 onwards. According to point estimates in the BBT model, output falls about 9% in 2020Q2 relative to 2019Q2 (this quarterly contraction corresponds to about 36% on an annualized basis). The point estimates imply a peak year-on-year output contraction of 11% in 2020Q4, followed by another five quarters of falling output on a year-on-year basis. The 90% confidence interval for the peak output response extends to a nearly 20% year-on-year contraction. As also shown in Figure 5, about 60% of the projected output contraction is caused by COVID-induced uncertainty (Note 8).

In short, our illustrative exercise predicts that the COVID-19 disaster will cause a large output contraction, more than half of which is due to COVID-induced economic uncertainty. There are, however, reasons to think that the actual effects may be even larger than suggested by our illustrative exercise. First, we set the 2020Q1 shock values to zero, but the COVID-19 disaster began to affect the US economy and its financial markets already in the last six weeks of the quarter, and especially in the last three weeks. Second, there are potentially important mechanisms at work in the wake of the COVID-19 disaster that played no or lesser roles in the disaster episodes to which BBT fit their model. For example, the COVID-19 crisis is leading to massive cuts in business expenditures on innovation, training and general management improvements, which we expect to lower productivity into 2021 and beyond. The irreversible nature of these investments in intangible forms of capital makes them particularly sensitive to uncertainty (e.g. Barrero et al. 2017). Moreover, R&D expenditures and other forms of innovative activity are probably more important in the US (for the US and global economies) than in most other countries that comprise the BBT sample. Finally, widespread school closures and an enormous shift to work-at-home practices in reaction to the COVID-19 pandemic seem likely to retard productivity in the near and long term.

Conclusions

To summarise, the COVID-19 pandemic has created an enormous uncertainty shock – larger than the one associated with the Global Crisis of 2008-09 and more similar in magnitude to the rise in uncertainty during the Great Depression of 1929-1933. We can track and characterise this massive increase in uncertainty in near real time using stock market volatility measures, newspaper-based measures of economic uncertainty, and by aggregating over responses to survey questions about perceived business-level uncertainty. Using stock market measures to calibrate the first- and second-moment aspects of the COVID-19 shock, and feeding them into an estimated empirical model of disaster effects, the implied contraction in US real GDP is 9% in 2020Q2 on a year-over-year basis and a peak year-on-year contraction of 11% two quarters later. Our illustrative exercise implies that more than half of the contraction is caused by COVID-induced uncertainty. To be sure, the confidence intervals around our GDP growth projections are wide. And, as we discuss, there are reasons to think that our illustrative exercise understates the likely output effect of the COVID-19 pandemic.

This article first appeared on www.VoxEU.org on April 13, 2020. Reproduced with permission.