| Author Name | Willem THORBECKE (Senior Fellow, RIETI) |

|---|---|

| Download / Links |

This Non Technical Summary does not constitute part of the above-captioned Discussion Paper but has been prepared for the purpose of providing a bold outline of the paper, based on findings from the analysis for the paper and focusing primarily on their implications for policy. For details of the analysis, read the captioned Discussion Paper. Views expressed in this Non Technical Summary are solely those of the individual author(s), and do not necessarily represent the views of the Research Institute of Economy, Trade and Industry (RIETI).

Coronavirus news roiled financial markets in early 2020. The Italian stock market fell 45 percent between 1 January and 12 March 2020. The French stock market fell 36 percent at this time. The German stock market fell by 33 percent. The U.S. stock market fell by 27 percent. The Japanese stock market fell by 25 percent.

In March, government policies throughout the world halted the fall in stock prices. For instance, the Federal Reserve lowered the overnight federal funds interest rate target by 150 basis points, provided forward guidance that interest rates would remain low, practiced quantitative easing (QE) by buying Treasury and mortgage-backed securities, extended loans to Treasury security primary dealers, encouraged lending by banks, and took other steps to keep credit flowing. The U.S. Congress passed the Coronavirus Aid, Relief, and Economic Security Act (CARES). It provided loans for small businesses to pay wages, expanded unemployment benefits, paid $1,200 per adult and $500 per child for individuals earning up to $75,000 (or $150,000 for taxpayers filing jointly), and channeled funds to the health care system and to state and local governments. Hartley and Rebucci (2020), Ramelli and Wagner (2020), Chen et al. (2020) and others reported that these steps contributed to a recovery in stock, bond, and other financial markets.

The European Central Bank (ECB) announced on 12 March 2020 several steps to help the economy address the pandemic. These included increasing QE purchases in 2020 by €120bn, providing subsidized loans to banks to stimulate small business lending, and offering loans to banks at rates below the yields that banks received from deposits at the ECB. These policies increased liquidity to the banking sector. Ortmans and Tripier (2020) found that these interventions by the ECB broke the link between news of Covid-19 cases and turmoil in European stock and bond markets.

Ortmans and Tripier (2020) reported that before the ECB's intervention an increase of ten Covid-19 cases per million people raised 10-year sovereign yields in 15 Eurozone countries relative to 10-year German sovereign yields by 0.021 percentage points (ppt) immediately and by 0.24 ppt after five business days. They also found before the ECB's actions in March that 10 new cases per million people led to an 11 percent drop in Eurozone stock prices within 5 business days of the news.

This paper investigates why news of Covid-19 cases roiled financial markets before government interventions in March 2020. To do this it investigates in depth how coronavirus news affected French stock returns. These are several reasons why coronavirus news could affect stock returns. Investors might have expected health concerns or legal shutdown requirements to restrict spending on items requiring close contact, such as hotels, transportation, and restaurant meals. Concerns that international trade would be hindered and supply chains disrupted could have harmed firms dependent on global value chains. Increased government borrowing to offset the health and economic costs of the crisis could raise sovereign yields and harm banks that hold government bonds. At an extreme, explosive increases in sovereign yield spreads relative to German bond yields could raise the risk of a breakup of the single currency.

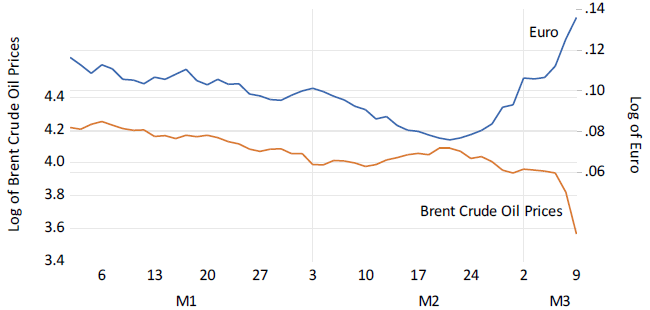

The coronavirus crisis also unleashed two disinflationary shocks in Europe. First, it caused the euro to appreciate as investors withdrew funds from investments in other currencies and flocked to the safety of the euro and as they expected the Federal Reserve to lower interest rates more than the ECB would. Second, it contributed to a drop in oil prices, as investors foresaw a drop in spending on transportation and as oil producing countries struggled to address the shock. Figure 1 shows the evolution of the euro and Brent crude oil prices as the crisis hit Europe. The euro appreciated by 6 percent between 21 February and 9 March 2020. Since a one-standard deviation shock to the euro equals 0.59 percent, a 6 percent change represents a large appreciation. Brent crude oil prices also fell 53 percent over this period. News of the coronavirus crisis could have affected stock prices by impacting the euro and crude oil prices.

To investigate why news of the number of coronavirus cases affected financial markets before the ECB's intervention on 12 March 2020, this paper examines the exposures of 174 French assets to the euro, Brent crude oil prices, and several other macro variables over the previous 20 years. It then compares assets' exposures to macro variables with their exposure to Covid-19 cases in 2020. The results indicate that there is a close relationship between stocks harmed by appreciations of the euro and by falls in oil prices, and stocks harmed by increases in the number of coronavirus cases. These results indicate that increases in coronavirus cases lowered returns on assets exposed to oil price decreases and euro appreciations. Also, there is some evidence that stocks that gain from expansionary ECB policy also gain from increases in the number of cases. This suggests that investors expected an increase in the number of cases to trigger expansionary policy.

Finally, there is no evidence that banks in general were harmed by increases in the number of cases. Banks that had extended loans to the oil industry were harmed by increases in the number of cases, but other banks were not. This indicates that the sovereign/bank "doom loop," whereby reductions in the value of banks' holding of sovereign bonds pressure governments to borrow more to bail out banks, was not driving the response of French stock prices to coronavirus cases in early 2020. These findings indicate that the Covid-19 crisis unleashed disinflationary shocks to the euro and oil prices that harmed financial markets and that the ECB succeeded in offsetting the impact of these shocks on the French stock market.

- Reference(s)

-

- Chen, Jaikai, Haoyang Liu, David Rubio, Asani Sarkar, and Zhaogang Song. 2020. MBS Market Dysfunction in the Time of COVID-19. Liberty Street Economics Weblog, 17 July. Available online: https://libertystreeteconomics.newyorkfed.org/2020/07/mbs-market-dysfunctions-in-the-time-of-covid-19.html

- Hartley, Jonathan S., and Alessandro Rebucci. 2020. An Event Study of COVID-19 Central Bank Quantitative Easing in Advanced and Emerging Economies (No. w27339). Cambridge: National Bureau of Economic Research. Available online: https://www.nber.org/papers/w27339

- Ortmans, Aymeric, and Fabien Tripier. 2020. COVID-Induced Sovereign Risk in the Euro Area:

When Did the ECB Stop the Contagion? (No. 2020-11). Paris: CEPII. Available online:

http://www.cepii.fr/PDF_PUB/wp/2020/wp2020-11.pdf - Ramelli, Stefano, and Alexander F. Wagner. 2020. Feverish stock price reactions to COVID-19. Review of Corporate Finance Studies, forthcoming.