| Author Name | Willem THORBECKE (Senior Fellow, RIETI) |

|---|---|

| Download / Links |

This Non Technical Summary does not constitute part of the above-captioned Discussion Paper but has been prepared for the purpose of providing a bold outline of the paper, based on findings from the analysis for the paper and focusing primarily on their implications for policy. For details of the analysis, read the captioned Discussion Paper. Views expressed in this Non Technical Summary are solely those of the individual author(s), and do not necessarily represent the views of the Research Institute of Economy, Trade and Industry (RIETI).

Japan has taken several steps to limit the spread of COVID-19. In March Prime Minister Abe requested that Japanese schools close. In April the Japanese government imposed a voluntary lockdown. This included asking people to work from home, requesting that non-essential businesses close, and demanding that crowds not assemble at concerts and ballgames. The government also imposed restrictions on travel from abroad. The pandemic and the government's attempts to control it may cause GDP to fall by 20 percent in the second quarter of 2020.

This paper goes beyond aggregate GDP numbers to investigate how different parts of the Japanese economy have been affected. To do this it examines the response of Japanese stock prices. In theory stock prices equal the expected present value of future cash flows. They thus shed light on how investors expect industries to be affected.

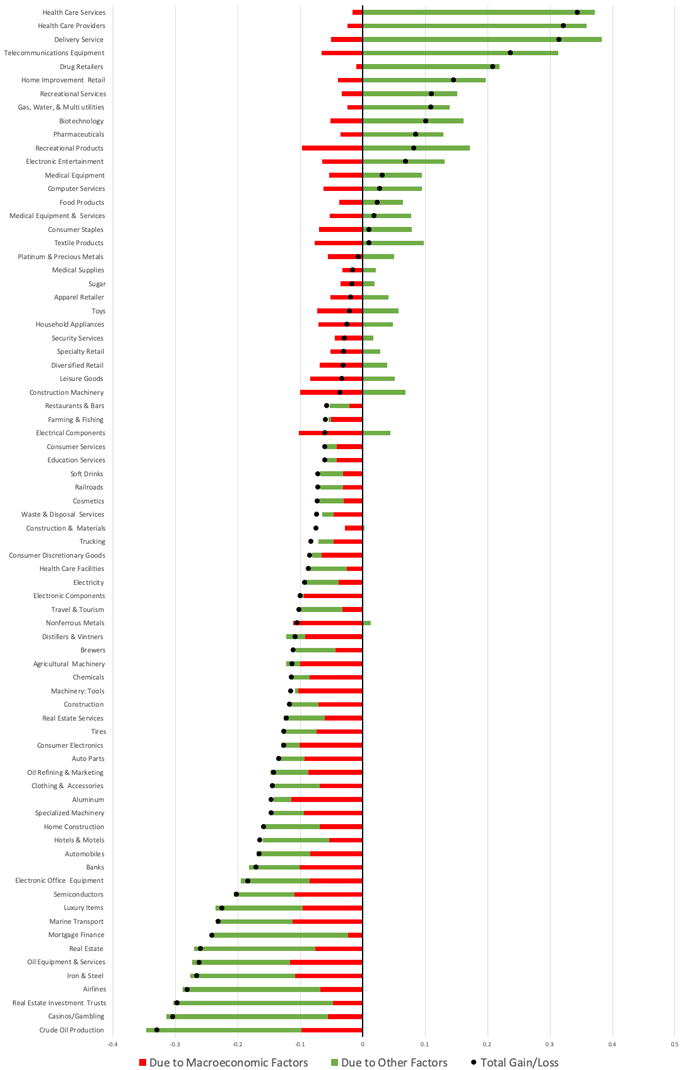

Japanese stocks began falling on 24 February 2020. This paper compounds returns across sectors between 24 February 2020 and the end of May 2020. It also uses regression analysis to divide sectoral returns into the portion explained by four macroeconomic factors (the Japanese stock market return, the world stock market return, the yen/dollar exchange rate, and the price of Dubai crude oil) and by other factors (e.g., travel restrictions and the voluntary lockdown).

Figure 1 presents the results. Sectors related to real estate have done especially badly. The value for real estate investment trusts (REITs) is 0.7021, the value for mortgage finance is 0.7398, the value for real estate is 0.7578, and the value for home construction is 0.8412. To understand these numbers, the value of 0.7021 for REITs indicates that 1 yen invested in real estate investment trusts on 24 February 2020 would only be worth 0.7021 yen on 29 May 2020. The figure indicates that real estate has suffered not primarily because of the macroeconomic environment but rather because of other factors. The state of emergency has hindered real estate transactions.

Sectors related to travel and leisure have also suffered. The value for casinos and gambling is 0.6951, the value for airlines in 0.7190, the value for hotels & motels is 0.8346, and the value for travel & tourism is 0.8977. Figure 1 indicates that these losses are not driven primarily by macroeconomic factors. Rather they reflect restrictions on travel that have plagued the industry and also the postponement of the 2020 Tokyo Olympics.

The oil sector has also performed poorly. The return to one yen invested in crude oil production is 0.6697 and the return to one yen invested in oil equipment & services is 0.7375. Figure 1 indicates that while macroeconomic factors such as low oil prices have contributed to these losses, more of the contribution has come from other factors. Lockdowns and travel bans have decimated the oil industry.

The automobile sector and related industries have also suffered. The value for automobiles in Figure 1 is 0.8335, for automobile parts 0.8652, for iron & steel 0.7333, and for tires 0.8738. For automobiles both the macroeconomic variables and other factors have contributed equally to the losses. On the macroeconomic front exports have collapsed. A key other factor is the fact that many dealers remained shut during the emergency.

The electronic office equipment sector has also lagged. Its value is 0.8152. This reflects the fact that many offices have been closed.

The machinery sector has also suffered losses. One yen invested in specialized machinery stocks would be worth 0.853, one yen invested in tool stocks would be worth 0.8842, and one yen invested in agricultural machinery would be worth 0.8869. Figure 1 indicates that these losses were driven by macroeconomic factors. The slowdowns in Japan and the rest of the world have frozen demand for machinery.

On the other hand, sectors related to peoples' health have done well. The value for pharmaceuticals is 1.0845, the value for biotechnology is 1.1004, the value for drug retailers is 1.2076, the value for health care providers is 1.321, and for health care services is 1.3436. Figure 1 indicates that these gains are not driven by macroeconomic variables but entirely by other factors. The COVID-19 Crisis has been a boon for health-related sectors.

Businesses that provide entertainment and distractions at home have done better than predicted. The value for telecommunications equipment (including smartphones) is 1.236, the value for recreational services is 1.1097, the value for recreational products is 1.082, and the value for electronic entertainment is 1.0681. These gains are not driven by macroeconomic variables but entirely by other factors. As people have huddled at home, the demand for such entertainment products has soared.

Delivery services have also done well. Its value is 1.3146. Again these gains were not driven by macroeconomic factors but entirely by other factors. These services have provided a critical lifeline for those forced to stay home.

The evidence also indicates that the return on the Japanese stock market is the primary macroeconomic driver of poor sectoral performance. If the Japanese economy and by extension the Japanese stock market recovers, then those sectors harmed by macroeconomic factors could recover. Nurturing the Japanese economy is thus crucial to helping Japanese firms rebound from this devastating crisis.

[ Click to enlarge ]