One factor exacerbating gender gaps in employment is the cost of affording maternity and parental leave to women as primary caregivers. This column analyses the relationship between the costs of providing parental leave and labour demand for childbearing-age women. As evidenced by a series of reforms in Japan in the last two decades, reducing the burden of parental leave costs from firms to social insurance systems increases both labour demand and starting wages for such workers.

Persistent gender gaps in employment and wages exist in many OECD countries. These gaps appear most prominently around childbirth, a phenomenon referred to as the ‘child penalty’ (Bertrand et al. 2010, Kleven et al. 2019). For example, Bertrand et al. (2010) studied the careers of MBA graduates from the University of Chicago and found that 40% of women experience at least one career interruption within ten years after graduation, while only 10% of men experience career interruption. In addition, approximately 40% of women stop working or work part-time ten years after graduation, compared to just 5% of men. While some of this career interruption and reduction in hours reflects the personal choice of some women to spend more time at home with their young children, part of this is due to labour market institutions and a corporate environment that makes it difficult to stay employed during pregnancy and to return to full-time work after childbearing.

Maternity and parental leave programmes can make it easier for new mothers to spend more time with their newborn child while securing their job and providing financial support during leave. In many countries, governments have stepped in to mandate these benefits. However, providing these benefits is costly. Beyond the monetary costs of supporting women on leave, there are costs associated with staffing that the firm must bear. Thus, there may be incentives for firms to minimize or reduce these costs through hiring practices that may manifest in lower starting wages and reduced career opportunities for women.

These unintended consequences can be mitigated or exacerbated through the institutional details of leave programmes. In a recent paper (Asai 2019), I study a series of reforms that reduced the cost of employment when women took leave. I investigate how reducing these differential costs affect the starting wages and employment opportunities for women at these firms.

Employers' costs of leave

Depending on a country's institutions, there are different types of costs employers face when an employee takes maternity/parental leave. In the US, a firm typically directly provides leave benefits, so the firm is responsible for income replacement during the leave. In many other countries, maternity and parental leave is a mandatory benefit financed by the social insurance system, much like unemployment insurance (UI) in the US. This is also how California's state maternity leave system is financed. The firm is responsible for social insurance payments, borne equally by men and women, to finance the system, and a worker's income replacement functions similarly to UI while on leave.

In addition to these direct costs, there is an effect on firm output from losing a worker. These costs depend on whether the job can be easily replaced by hiring a temporary worker or whether co-workers can cover the roles. Another direct cost is a worker's payroll taxes. In many countries, firms are responsible for paying these costs even during the leave.

Often, not all workers are covered equally by this system. In many countries that have temporary and permanent contracts, only those with permanent contract types will be eligible.

Since women are the primary leave takers, these costs create gender differences in the cost of employing women.

Analysis based on social insurance payments during leave

I study a unique series of reforms that gradually lowered the costs to firms of employing female workers who go on maternity and parental leave. The particular context is Japan, a country with relatively generous mandatory leave policies of 13.5 months with income replacement financed via the social security system. However, for many years, firms still had to pay for the worker's payroll taxes during leave (namely, medical and pension contributions), amounting to 13% of pre-leave earnings. A series of reforms occurring in 2000, 2001, and 2014 gradually reduced these costs to zero.

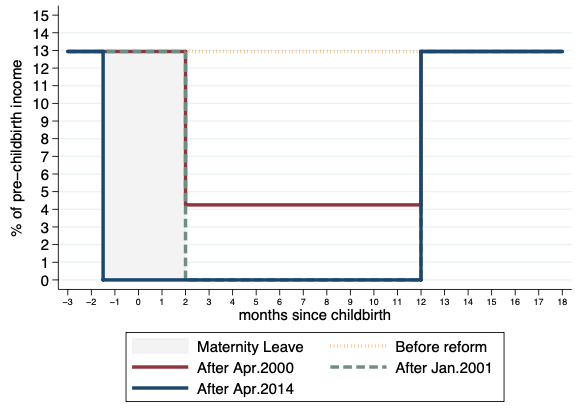

Figure 1 summarises these social insurance costs during leave over this period with an illustrative example of the costs faced by employers. All female workers who give birth are qualified to take 3.5 months of maternity leave. Female workers on permanent contracts are entitled to another ten months of parental leave. The horizontal line in the figure denotes months since childbirth, and the vertical line represents payroll taxes owed as a percentage of earnings. At the beginning of 2000, employers were responsible for paying for half of the social insurance payment during leave, which is 12.9% of worker's income (depicted as the dotted "Before reform" line).

In April 2000, the pension insurance payment during parental leave (8.7% during months 2-12 after childbirth) was eliminated, which is depicted as the solid red line in the figure. In January 2001, the payment of health insurance during parental leave was removed (4.25% during months 2-12 after childbirth), which is depicted by the dashed green line in the figure. Firms were still responsible for the social insurance payment during maternity leave (-1.5 to 2 months after childbirth) until April 2014, when the social insurance payment during maternity leave was completely eliminated (depicted as the solid blue line). Importantly, these reforms were not accompanied by an increase in the length of leave that could have the potential to change the labour supply response significantly.

Contributions of my study

There are several studies investigating the introduction or expansion of mandated benefits and the effects of their costs on employment and wages (Scott et al. 1989, Gruber and Krueger 1991, Gruber 1994, Baicker and Chandra 2006). These studies tend to find either little effect or a small decrease in the employment of those affected, while the effects on wages are mostly negative. Instead of an expansion of benefits and costs, my paper differs because I focus on an experiment that reduced costs, with no loss of benefits.

One key advantage of investigating these Japanese reforms is that I am able to separate the effects of changes in costs from endogenous responses by workers and firms to the list of available benefits. In the US case, employers can switch the type of plan or quality of the insurance programme. In addition, high-ability workers are likely to self-select into better health/pension insurance programmes. In the Japanese case, health and pension insurance programmes are universal, so all persons are enrolled in the same plan, and all patients are free to choose any of the medical providers. The insurance rate is determined by the national agencies and does not vary by the frequency of usage nor demographic backgrounds of the employees, and hospital fees are highly regulated.

Effects on wages and employment

To analyse the effects of social insurance on wages and employment, I combine two main ingredients: the probability a working woman of a particular age who is eligible for leave giving birth; and the costs of employment during maternity/parental leave, which vary based on the series of reforms discussed above. I compare outcomes of woman of childbearing age with older women and men of the same age.

Note that while the leave benefit is technically offered to both mothers and fathers, in practice, almost no fathers take leave. Thus, from the perspective of the firm, there is no differential cost due to leave between older women and men of any age. All of the differential costs come from younger women of child-bearing age. Accordingly, we expect that outcomes of women of child-bearing age would be affected after the reform, relative to men and older women.

I define the ‘risk’ faced by the firm from hiring a woman of child-bearing age as the probability that a working woman eligible for leave has a child and thus goes on leave, for each age group, based on data from birth registers. The risk varies across men and women (specifically, the risk of leave is approximately zero for men), and varies among women only based on their ages.

Next, I define the employment costs of leave to the firm. As discussed above, before 1999, firms were required to pay approximately 13% of earnings in payroll taxes during the 13.5 months of mandated leave. In 2000, these costs were reduced to 4.3% for the last ten months of leave, and thus the average cost fell to 6.5% over the 13.5 months of leave. In 2014, the costs fell to zero. To put this in perspective, the average monthly earnings for permanent workers in 1999 was approximately 197,200 yen, or about US $1,972 per month. In 1999, over the course of 13.5 months of leave, the firm needed to pay approximately 197,200 * 0.12925 * 13.5 = 344,000 yen (approximately $3,440). To facilitate interpretation, I define the independent variable ‘cost’ as the yen cost, in hundreds of thousands, for the average woman's leave, i.e. 3.44 in 1999, (0.12925 * 3.5 +0.0425 * 10) * 1.972 = 1.73 in 2000, 0.12925 * 3.5 * 1.972 = 0.892 from 2001, and 0 by 2014. Therefore, a unit change in this variable is 100,000 yen (approximately $1,000).

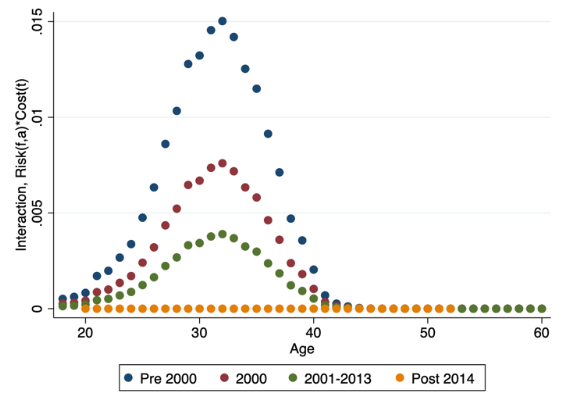

The key object of interest is the interaction, cost*risk, which varies across men and women, women of different ages, and over time. The interaction is the expected leave costs of that worker over the next year. In Figure 2, I plot the values of this interaction for female workers of different ages across years. The risk of a worker going on leave is low for the youngest and oldest female workers, and reaches its peak in the early 30s. The costs were highest before 2000, and gradually fall over the period until they reach zero by 2014.

I next investigate how this interaction affects employment opportunities for women. In particular, in Japan, like in many European countries, ‘good’ jobs are those that have a permanent employment contract. I also examine wage outcomes. These variables are available in Japan's rich firm-worker matched data.

My approach is to run a regression of these outcomes on cost, risk and cost*risk. The coefficient on cost*risk is my key object of interest, and expresses how reductions in costs change for those with higher risk compared to no risk at all (i.e. men and older women). My research design is also able to control for establishment effects, age trends, and trends in outcome measures that are common to everyone across years.

I find large effects on employment and earnings of at-risk groups from reducing employment costs during leave. In particular, I find that a 100,000 yen decrease in costs increased permanent employment by about 2% and increased starting pay by 3%.

My results are more pronounced at large firms compared with small firms. This may be because large firms may have more discrete tasks that are easily substitutable across workers (i.e. men versus women, older women versus younger women).

Conclusions

I examine the relationship between the costs of leave and labour demand for female workers of child-bearing age. I find that a decrease in costs increased permanent employment and the starting wage of female workers. The result implies that the higher costs of female employment may have discouraged firms from hiring female workers, holding back progress in the gender wage and employment gaps that these policies were directly designed to promote. These findings have relevance for other countries implementing mandatory benefits financed through social insurance where some workers have higher probabilities of using the benefits. Generous leave policies should be accompanied by policy that minimises firms' monetary costs of supporting women on leave.

This article first appeared on www.VoxEU.org on September 5, 2019. Reproduced with permission.