| Author Name | Willem THORBECKE (Senior Fellow, RIETI) |

|---|---|

| Research Project | East Asian Production Networks, Trade, Exchange Rates, and Global Imbalances |

| Download / Links |

This Non Technical Summary does not constitute part of the above-captioned Discussion Paper but has been prepared for the purpose of providing a bold outline of the paper, based on findings from the analysis for the paper and focusing primarily on their implications for policy. For details of the analysis, read the captioned Discussion Paper. Views expressed in this Non Technical Summary are solely those of the individual author(s), and do not necessarily represent the views of the Research Institute of Economy, Trade and Industry (RIETI).

Macroeconomy and Low Birthrate/Aging Population (FY2016-FY2019)

East Asian Production Networks, Trade, Exchange Rates, and Global Imbalances

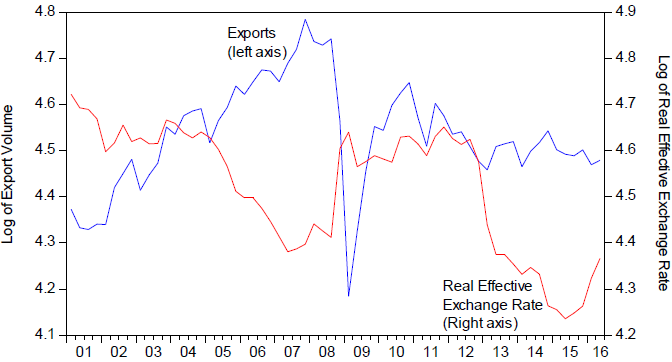

The Japanese real effective exchange rate depreciated logarithmically by 30% between the fourth quarter of 2003 and the second quarter of 2007. The volume of exports increased by 25% over this period. The yen then appreciated by almost 30% over the subsequent seven quarters as the Global Financial Crisis (GFC) took hold. The volume of exports tumbled. Following the implementation of Prime Minister Shinzo Abe's stimulus packages in the third quarter of 2012, the yen depreciated by more than 30%. However, as Figure 1 shows, the volume of Japanese exports has not increased. Why has the yen depreciation beginning in 2012 not been associated with an increase in exports?

Investigating the effect of exchange rates on Japanese exports is tricky, since more than 25% of Japanese exports are parts and components (p&c) and other intermediate goods. A depreciation in a downstream country importing p&c from Japan (equivalently, an appreciation of the yen) may increase the downstream country's exports of final goods to the rest of the world and thus its imports of Japanese p&c that are used to produce exports. Therefore, a depreciation in the importing country and an appreciation of the yen may be associated with an increase in Japanese p&c exports. This effect can cloud estimates of exchange rate elasticities.

To circumvent this problem, this paper investigates exports of final goods. Since Japan is an upstream country in global value chains, much of the value added of Japanese final goods exports comes from Japan. Examining how the yen affects final goods exports—rather than examining how the yen affects total exports—should provide a cleaner test of how exchange rates affect Japanese exports. In every year prior to 1990, Japan's leading export category has been motor vehicles. In 2014, more than 16% of the value of Japanese exports were in this category. This paper thus investigates how exchange rates affect the Japanese automobile industry.

The results indicate that exchange rate elasticities are greater than unity for Japanese automobile exports. To investigate why the yen depreciation beginning in 2012 Q3 did not lead to a resurgence of automobile exports, the paper employs out-of-sample forecasts using actual values of the exchange rate and other variables. The evidence indicates that exports did not rebound because Japanese automakers relocated production out of Japan after the GFC. In addition, evidence from exchange rate pass-through equations shows that exporters since 2012 have allowed the yen depreciation to affect profit margins rather than the volume of exports. Finally, evidence from regressing stock returns on exchange rates indicates that the profitability of Japanese automakers was more exposed to a strong yen in 2016 than at any time over the last 12 years.

A couple of policy implications flow from these findings. First, the world economy faces the risk of protectionism in the United States and other countries. Japan should make clear that its flagship industry, automobiles, has already relocated much of its production to the United States and other countries. Second, the results in the paper indicate that even exports of Japanese automobiles—goods that are valued for their quality and reliability—are sensitive to exchange rates. To avoid price competition, Japan should foster industries that are even more advanced than automobiles. To succeed in producing and exporting high-technology, research-intensive goods, Japan needs to invest in the health and education of its people beginning at a young age.