The arrival of the new Cold War between the United States and China has thrown the global economy into a period of change from the previous acceleration of globalization. Global trade volume became stagnant after the Global Financial Crisis in 2008, and recently, it has remained trapped in low growth after rebounding to the pre-COVID-19 level. Most of the tariff hikes implemented against China under the U.S. administration of then President Trump have been retained under the Biden administration, which has also strengthened trade controls that were implemented for national security reasons.

Although Japan’s overseas production ratio had continued to rise for many years, this has come to a halt in recent years. Regarding global supply chains (GSCs), the risk that supply disruptions present has been recognized anew due to Russia’s invasion of Ukraine.

This article will look back at the evolution of global trade and discuss frameworks for understanding the current situation in order to explore clues for discussion of future prospects.

◆◆◆

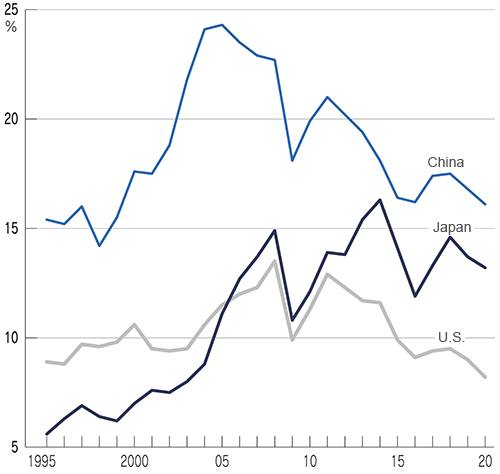

First, let us look back at how globalization has proceeded based on data on the value share of imported inputs in the value of exports (excluding the domestic value added from the value of exports) (see the figure below).

International fragmentation, which refers to the phenomenon of parts and raw materials frequently moving across national borders during the manufacturing process, has always been a mainstay of globalization, but in recent years, it has started to recede. In China, the input share of imports increased rapidly after the turn of the century against the backdrop of China’s participation in the international division of labor centering on processing and assembly, but later it started to decline, and has continued to do so. In the United States, the input share of imports was on an upward trajectory, but it has since declined to the level seen around the middle of the 1990s after the end of the U.S.-Soviet Cold War.

In Japan’s case, in 1995 the share was low--around 5%--because the value of its exports was mostly domestically-created value added. Later, as Japan’s dependence on imported intermediate goods grew, the input share of imports increased to 13-16%, a level close to the share in China, but since the Global Financial Crisis, the growth of that share has come to a halt.

Before discussing how to deal with the disruption of the global economy, it is imperative to gain an accurate understanding of the current situation. The Japanese economy’s dependence on trade rose at the beginning of the 21st century, but it has since leveled off. As China’s share of Japan’s overall trade has also started to decline in recent years, Japan’s dependence on China does not seem particularly conspicuous. However, examining statistical figures alone is insufficient for an appropriate analysis in this case. Below, I will mention three additional approaches.

The first approach is to identify the chokepoints that could cause disruptions in GSCs by calculating the rate of dependency on particular countries as supply sources for specific products. When using this approach, it is necessary to look at the state of dependency from the viewpoints of the possibility of technological substitution and spillover effects on other industries with respect to specific categories of goods. Presumably, the current drive to establish semiconductor manufacturing bases in Japan is considered to be important from these perspectives.

Second, it is also important to examine the input-output linkages between different industries, because some imported intermediate goods are used in the production of other intermediate goods. According to a study conducted by Professor Richard Baldwin of IMD Business School in Switzerland and others, based on ordinary import data, China is the largest supplier of intermediate goods for around 60% of all U.S. manufacturing industries, but if you examine the input-output linkages in more detail, China is the largest supplier for all industries except for the pharmaceutical industry.

Third, when discussing developed economies that have shifted to services industries and digitalization to a greater degree, it is important to pay close attention to items other than goods. Trade in services and cross-border data transfer are involved in trade in goods—particularly for transactions that are associated with the complicated international division of labor based on GSCs—through many processes, including order placement, delivery, settlement, development of products and associated software, advertising, and after-sales services.

The stagnation of global trade has been a problem for trade in goods, while trade in services has continued to expand. Trade in services, including intellectual property trade and cross-border data transfer, have now come to play the leading role in globalization in place of trade in goods.

While Japan has been recording deficits in trade in goods with China, it is earning surpluses in trade in services with China, including intellectual property trade, despite chronic deficits on a worldwide basis. It is essential to assess the relationship of interdependence from multiple angles, including trade in services, for which data availability is limited compared with trade in goods.

◆◆◆

At a time when the global economy is on a path toward division, the response centers on mitigating the risks from depending on a few particular countries by procuring goods from multiple supply source countries (de-risking). As bringing production bases back to home soil (reshoring) does not provide a solution in the case of most types of goods, few countries have taken significant action in reshoring on the whole. In Japan’s case in particular, reshoring could put the country at a higher risk given that a megaquake has been predicted with a high probability at some time in the coming decades.

Sourcing goods from multiple countries undermines economies of scale and increases the need to monitor groups of subcontracting suppliers that are linked to primary outsourcers through data transfers and data sharing in order to avoid human rights infringements and diversion of technology to military use. Against that backdrop, the restrictions on cross-border data transfers and the forced technology transfer policies that China and other countries are applying are of particular concern.

Now that Japan has chronic trade deficits in goods while earning foreign income from intellectual property trade and direct investments, it must play an active role in strengthening international rules concerning intellectual property, data and services. If flows of data and technology are disrupted, both production in the short term and innovation in the long term would suffer negative impacts.

However, not all countries engage in behavior that is consistent with the principle of the rule of law or that is based on mechanisms of market economies. Countries that make up the so-called Global South, which are wedged between the United States and China amid the geopolitical conflict of these superpowers, are a diverse group facing a great variety of challenges. It is important for developed countries, including the G7, to encourage those countries to participate in GSCs by offering reliable support in resolving the specific challenges confronting each of them. The estimation of the impact that the division will have on the global economy will be significantly affected by whether the group of developing countries is treated as part of the U.S.-led bloc or the China-led bloc.

Even with stronger trade controls on some advanced sensitive technologies, the international division of labor in the production of most general-purpose goods will continue with the participation of many countries based on the principle of comparative advantage.

China’s changes in its fundamental policy stance toward market economies and globalization starting with Xi’s regime, and wage increases in China brought the curtain down on the era when countries promoted transferring production overseas in pursuit of low-wage labor which began at the end of the twentieth century Cold War. Companies have shifted away from the approach of selecting production locations based on a comparative examination of low wages and geographical proximity, which is important from the viewpoint of the cost of transporting goods, and are now focusing on reorganizing and rebuilding GSCs. Under this approach, GSC-operating companies disperse simple work processes and production of general-purpose goods across wide ranges of low-cost countries, while deepening division of precise labor within countries with stable legal systems that provide high levels of predictability and transparency.

The accelerated momentum of globalization triggered by the end of the twentieth century Cold War and China’s accession to the World Trade Organization (WTO) has subsided, and it has become difficult everywhere to minimize cost by producing goods in optimal locations. Even so, the importance of pursuing economic efficiency remains unchanged. The future of the global economy depends on courageous companies that are pursuing efficiency improvements under the increasingly severe geopolitical constraints and on policy efforts by allies and like-minded countries that support them, including the strengthening of the international order.

Japanese companies dealt with the yen’s appreciation, which deteriorated export competition conditions for domestic production, by transferring manufacturing operations to developing countries in Asia (offshoring). Meanwhile, they found solutions to the threats posed by the integration of the European market and the North American Free Trade Agreement (NAFTA), where in both cases there were fears of the creation of closed regional fortresses, by establishing production footholds in the United Kingdom in the case of the European market integration and in Mexico in the case of NAFTA. Through a bold realignment of GSCs facilitated by trade in services and data flows, we will be able to find a new way forward for global trade, although that is predicated on the assumption that the U.S.-China conflict will be kept from escalating beyond the cold war stage.

>> Original text in Japanese

* Translated by RIETI.

December 20, 2023 Nihon Keizai Shimbun