Despite the growing labor shortage, the rise in service prices in Japan remain moderate. However, even if prices remain the same or rise only modestly, there is a good possibility that the "true" prices of services are rising sharply, probably at a much greater pace than indicated by statistics. This trend will likely intensify in 2018 if the Japanese economy continues to expand.

Economic expansion and a growing labor shortage

The Japanese economy has been on a growth path for five years since the end of 2012, and a growing number of companies are pointing to the tightening of the labor market. The unemployment rate has dropped to 2.7%, the lowest since 1993, while the jobs-to-applicants ratio has improved to 1.56, the highest since 1974. The Bank of Japan (BOJ)'s latest Tankan survey (Short-Term Economic Survey of Enterprises in Japan) showed that Japanese employers are facing the worst labor shortage since 1992. The diffusion index (DI) for employment conditions in all industries, calculated by subtracting the percentage of companies with a labor shortage from the percentage of those with a labor surplus, stood at -31. Labor shortage is particularly acute in non-manufacturing industries such as lodging, restaurant and catering, and transportation services (Note 1).

Estimates by the Cabinet Office and the BOJ show that aggregate demand already exceeds supply at the macroeconomic level. The government's economic outlook, approved by the Cabinet in December, predicts 1.8% real growth in gross domestic product (GDP) in FY2018. The figure, which exceeds potential growth rates estimated by many economic institutions, suggests that Japan's demand surplus will expand in the coming months. It is easily predictable that Japanese employers will face severer labor shortfalls if the economy continues to expand.

However, despite the tightening labor market, the pace of rising prices has been moderate. Japan's inflation rate as measured by the core consumer price index (CPI) remains below 1%, some distance away from the 2% target. The breakdown of the CPI basket into goods and services shows that the prices of services have been hovering at the same level, with the annual inflation rate stuck at near zero. Although some restaurant chains (e.g., Torikizoku, Hiday Hidaka, and Skylark) and parcel delivery service providers (e.g., Yamato Transport Co., Ltd. and Sagawa Express Co., Ltd.) have raised their prices (Note 2), their impacts were not big enough to lift the CPI for services at the aggregate level. To begin with, the prices of services are sticky by nature, meaning that prices are slow to change—whether upward or downward—even when there are changes in costs or demand. Whether Japan can put a complete end to its prolonged deflation hinges on how the trend in the prices of services will develop (Note 3).

Lower quality of services due to a shortage of hands

As Japan's labor market continues to tighten, many people are probably aware of the dwindling quality of services, for instance, experiencing a lengthy wait in supermarket checkout lines or in having their ordered drinks and foods served in restaurants. In this regard, I would like to share some findings from a survey I conducted recently (Note 4). Specifically, I provided a list of 32 kinds of services for personal consumption and asked respondents to choose those in which they find a deterioration in service quality due to a shortage of hands.

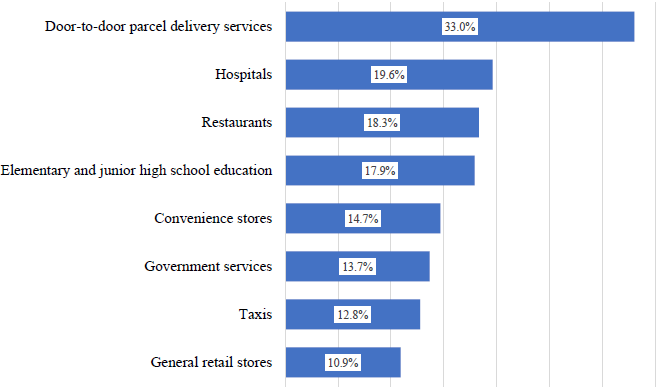

The most chosen was door-to-door parcel delivery services, followed by hospitals, restaurants, elementary and junior high school education, convenience stores, government services, and taxis (see Figure 1). All of those services are labor intensive and thus strongly impacted by labor shortages. Needless to say, the listed services are diverse, including those frequently used by consumers in general as well as those used only occasionally by certain types of people. Therefore, we cannot conclude that the quality of certain services is declining more sharply simply because more respondents chose them. However, we can say for sure that many consumers are beginning to feel the deterioration in the quality of various services.

A decline in the quality of goods and services translates into an increase in the true prices even when price tags remain unchanged. In the case of goods, manufacturers often keep prices unchanged even when the costs of raw materials rise sharply, reducing the volume per price or switching to cheaper materials instead. In effect, this constitutes an increase in prices. Likewise, lower quality services for the same price means a price hike.

However, as the CPI does not reflect such changes in the quality of services, rising prices remain hidden from statistics in a phenomenon referred to as hidden inflation. Generally speaking, the growth rate for service prices measured in statistics tends to be overstated when the economy is bad and the labor market is loose, and understated when the economy is good and the labor market is tight. Since services account for slightly more than 50% of the CPI basket, an annual drop of 1% in the quality of services means that true CPI growth is 0.5 percentage points higher than the statistics indicate. Seen from a different angle, in times of labor shortages, there is a good possibility for inflation-adjusted economic growth and productivity growth being overstated.

Diversity of consumers and service quality

Although we cannot estimate the percentage drop in the quality of services from the aforementioned survey results, let me provide some findings concerning consumers' willingness-to-pay (WTP) for service quality, citing some specific examples for reference. In door-to-door parcel delivery services, consumers are willing to pay 17% more on average or a median premium of 10% for ensuring the delivery of parcels within the specified time slot, compared to the amount they pay when allowing a one-hour margin of error for such time-specified delivery services. Meanwhile, a comparison of sit-down restaurants and self-service buffets shows that customers are willing to pay 15% more on average or a median premium of 10% for the former, i.e., for having their food served by a waiter, when other conditions such as the menu and quality of food are identical. These findings suggest that differences in service quality are significant when measured in terms of price differences.

However, in both door-to-door delivery services and restaurants, the level of WTP for the higher quality of services is quite heterogeneous among individuals, ranging from 5% indicated by respondents belonging to the bottom 10% or those who are least willing to pay to 30% those in the top 10% who are most willing to pay. Differences in individual characteristics such as the level of income, age, and the availability of time are contributing factors, but differences in unobservable individual characteristics have a greater impact.

Although it is often said that the quality of services in Japan is excessively high, compared to those in overseas, we need to pay attention to the fact that there are significant heterogeneity among Japanese consumers. Returning to the case of door-to-door parcel delivery services, roughly 80% of survey respondents find it appropriate that service providers differentiate prices depending on additional services such as time-specified delivery. Japan is facing a growing labor shortage. Against this backdrop, service business managers should seek to differentiate their services corresponding to the varying levels of WTP of diverse consumers and set prices as appropriate for the quality of respective services, instead of bothering about whether the quality of services is excessive or appropriate, and whether or not to lower the quality of services across the board.