| Author Name | ITO Takatoshi (Columbia University / National Graduate Institute for Policy Studies) / KOIBUCHI Satoshi (Chuo University) / SATO Kiyotaka (Yokohama National University) / Shimizu Junko (Gakushuin University) / YOSHIMI Taiyo (Chuo University) |

|---|---|

| Research Project | Exchange Rates and International Currency |

| Download / Links |

This Non Technical Summary does not constitute part of the above-captioned Discussion Paper but has been prepared for the purpose of providing a bold outline of the paper, based on findings from the analysis for the paper and focusing primarily on their implications for policy. For details of the analysis, read the captioned Discussion Paper. Views expressed in this Non Technical Summary are solely those of the individual author(s), and do not necessarily represent the views of the Research Institute of Economy, Trade and Industry (RIETI).

Macroeconomy and Low Birthrate/Aging Population (FY2016-FY2019)

Exchange Rates and International Currency

Ito, et al. (2008, 2009, 2010, 2011, 2015, 2016) (Note 1) have analyzed Japanese firms' choice of invoice currency for transactions using interviews and questionnaire surveys. These studies pointed out that the high share of the U.S. dollar in Japanese firms' exports to Asia was caused by a scheme where Japanese firms operating in Asia export key parts from Japan to their Asian production subsidiaries, which assemble them into products, and then export them to third countries (especially in the Americas and Europe). Under the centralized management of exchange rate risks by their headquarters finance department, many Japanese major firms minimize exchange rate risks at the whole group level by using the U.S. dollar in all transactions with their overseas subsidiaries (intra-firm trade). In the early 1990s, the fact that many Asian countries were using the dollar peg system was another reason why they chose the U.S. dollar. Subsequently, Asian countries experienced the currency crisis, shifted to the managed float regime, saw China's yuan reform in 2005, and shifted to a more flexible exchange rate system from 2010 onward. As a result, the choice of the U.S. dollar is likely to cause exchange rate risks both at the headquarters in Japan and at overseas subsidiaries. The degree to which Japanese firms can avoid risks of significant exchange rate fluctuations depends on their overseas subsidiaries choice of invoice currency.

The two questionnaire surveys we conducted in 2010 and 2014 revealed the characteristics of the choice of invoice currency in different locations: Japanese overseas subsidiaries located in North America and Europe most frequently used the U.S. dollar and the euro respectively, while in Asia, the U.S. dollar and the Japanese yen had equally large shares. At "production" sites in Asia, the U.S. dollar is used more frequently in both exports and imports with Japan, and the 2014 survey confirmed the advancement of this trend, showing that the share of the yen decreased slightly while that of the U.S. dollar increased. The reason that overseas subsidiaries in Asia do not use local Asian currencies is, firstly, that Asian currencies tend to largely fluctuate vis-à-vis the Japanese yen. Our past two surveys were conducted after experiencing the yen as it appreciated to historically high values below 80 yen per U.S. dollar and then the sharp depreciation to above 120 yen in response to Abenomics. The second reason is the regulations on capital and exchange transactions imposed by the monetary authorities of Asian countries. Many Asian currencies cannot be freely used by non-residents. These regulations have been gradually eased in recent years, but transaction costs are still relatively high and hedging transactions have limited effectiveness.

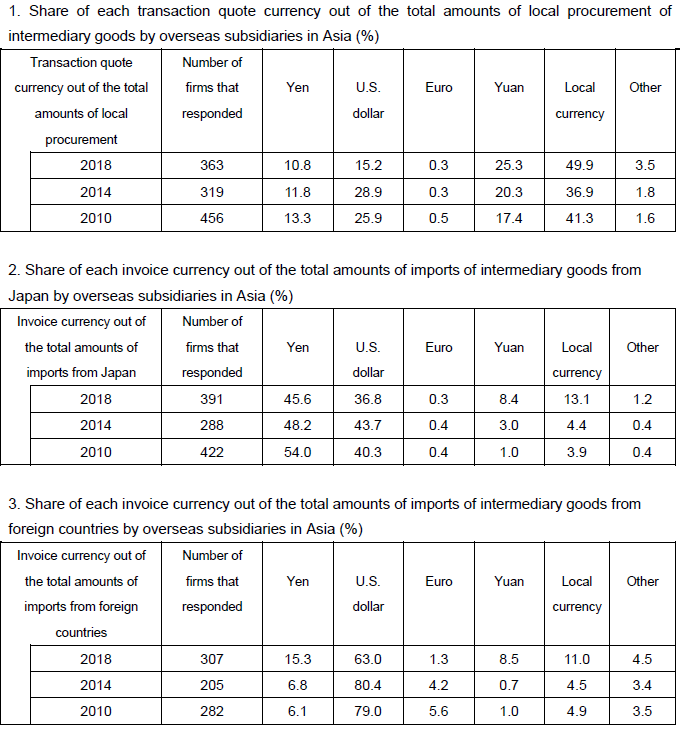

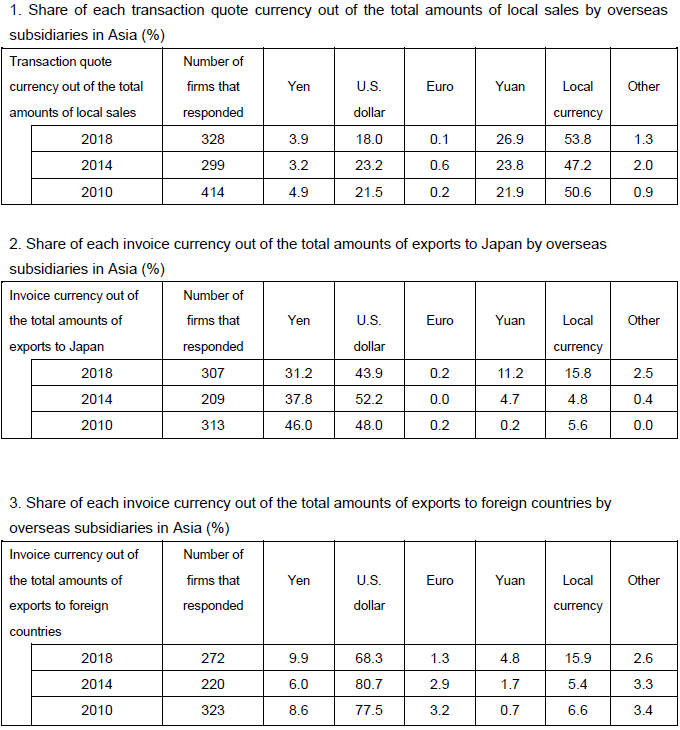

The purpose of this third survey was to clarify problems associated with the choice of invoice currency and the management of exchange risks by overseas subsidiaries in the current circumstances where overseas production networks are expanding and deepening while the U.S.-China trade conflict is emerging. We conducted a questionnaire survey targeting 21,801 overseas subsidiaries in January and February 2019. One of the most notable changes we have found from the survey is that the use of local Asian currencies, including the yuan, by overseas subsidiaries in Asia, has increased. The tables below summarize the results of our three surveys on how production sites in Asia choose invoice currency in imports and procurement as well as in exports and sales. It shows an increase in transactions using the yuan and local Asian currencies. Especially in transactions between overseas subsidiaries in Asia and foreign countries, the use of Asian currencies increased remarkably from 2014 to 2018, while the use of the U.S. dollar and the yen decreased. Focusing on the use of the yen, it has increased slightly in transactions with foreign countries (except Japan) although it has decreased in transactions (both imports and exports) with Japan.

Why has the use of the yuan and local Asian currencies increased in transactions with Japanese overseas subsidiaries in Asia? Japanese export firms often adopt the strategy of centralizing exchange risk management in their headquarters (Japan) to avoid exposing their overseas subsidiaries to exchange risks, and have tended to choose the dollar as the invoice currency in transactions in Asia. In recent years, however, Chinese and other Asian markets have become more important as final demand destinations. Sales sites prefer trading in local currencies. And Asian production sites engaging in manufacturing not only import intermediary goods from Japan but have also started local procurement. This is probably why the use of local currencies has increased in both sales and procurement. The use of local Asian currencies has become more advantageous than the U.S. dollar in terms of overseas subsidiaries' exchange risk management. This trend has also been enhanced by institutional movements: regulations on exchange transactions in the yuan and other local Asian currencies were eased; and the exchange system shifted from U.S dollar peg system to a flexible managed float regime which focuses more on markets. Furthermore, the stability of exchange rates of Asian currencies against the dollar and yen has helped.

This survey has confirmed that, as seen in the FY2017 survey targeting head offices, yen-denominated transactions have decreased in volume. This may suggest a slowdown in the "yen internationalization" advocated in the 1980s. In other words, yen internationalization is not supported by corporate behavior. It also needs to be noted that, even within Asia, situations are different between China and other ASEAN countries. Transactions using the yuan are increasing in China, Hong Kong, and Taiwan, while the use of ASEAN currencies such as the Thai baht and the Singapore dollar is increasing in transactions between local subsidiaries in ASEAN countries. The focus in the future will be placed on whether the yuan zone will expand in Asia, whether transactions of ASEAN currencies will increase, and whether emphasis will be put on rates against the dollar or against the yen. In order to lower transaction costs of Asian currencies against the yen, we need to take policy steps to increase the use of Asian currencies, including the establishment of direct transaction markets between pairs of countries.

- Footnote(s)

-

- ^ Reference documents are all published as RIETI Discussion Papers.